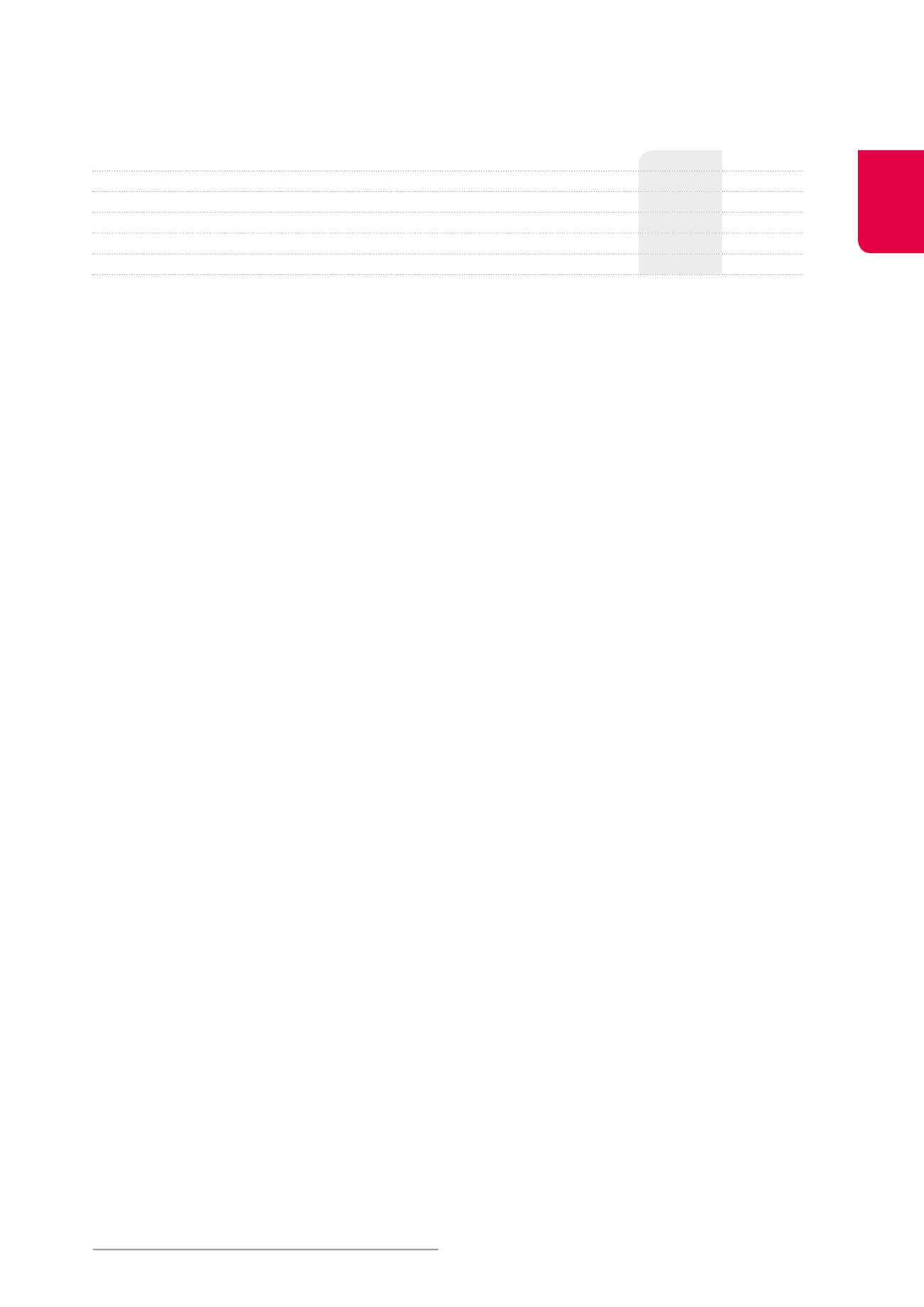

NUMBER OF SHARES

31.12.2014

31.12.2013

Number of ordinary shares issued (including treasury shares)

17,339,423 16,954,002

Number of preference shares issued and not converted

686,485

688,682

Number of ordinary shares entitled to share in the result of the period

17,285,009 16,905,085

Number of preference shares entitled to share in the result of the period

686,485

688,682

Total number of shares entitled to share in the result of the period

17,971,494 17,593,767

Comments on the consolidated income statement –

Analytical form

The

net rental income

amounts to €195.8 million at 31.12.2014, a

level comparable to that at 31.12.2013 (€195.2 million). The item

“Writeback of lease payments sold and discounted” comes from

€25.3 million at 31.12.2013 to €15.9 million at 31.12.2014, mainly as

a result of the sale of the shares of Galaxy Properties, owner of

the North Galaxy office building, on 12.05.2014. The

property result

amounts to €208.1 million at 31.12.2014, compared to €216.9 million

at 31.12.2013, i.e. a decrease of 4.1%.

Direct and indirect operating costs represent 0.85% of the average

value of the assets under management at 31.12.2014, compared

to 0.83% at 31.12.2013. The

operating result (before result on the

portfolio)

stands at €177.7 million at 31.12.2014, versus €185.6 million

one year before.

The

financial result (excluding IAS 39 impact)

amounts to

€-51.4 million at 31.12.2014, compared to €-61.2 million at 31.12.2013.

The average cost of debt, including bank margins

1

, decreased from

3.9% at 31.12.2013 to 3.4% at 31.12.2014, namely as a result of the

cancellation of FLOOR options on 12.05.2014. The average debt level

also decreased (€1,593.4 million at 31.12.2014, versus €1,685.8 mil-

lion at 31.12.2013).

The item “

Revaluation of derivative financial instruments

” stands

at €-136.1 million at 31.12.2014. It includes the costs related to the

restructuring of the interest rate hedging instruments for €-57 mil-

lion.

.

This manily consists in the recycling under the income state-

ment of discontinued hedging instruments. Their negative value

had already been taken into account as negative reserves under

equity. This restructuring is related to certain hedging instruments

for the period 2014-2017, for a notional amount of €600 million. It

resulted in an immediate outlay of €57 million, which will be com-

pensated by significantly lower interest charges during the next

four years.

On the other hand, it includes the effect of the decreasing inter-

est rates on the instruments which were not restructured for

€-71 million.

The net current result - Group share

amounts to €-15.7 million

at 31.12.2014, compared to €104.9 million at 31.12.2013. Per share,

these figures stand at €-0.87 at 31.12.2014 and €5.96 at 31.12.2013.

Excluding the IAS 39 impact, the net current result - Group share

amounts to €125.0 million at 31.12.2014, compared to €123.6 million

at 31.12.2013. Per share, these figures stand at €6.70 at 31.12.2014

and €6.78 at 31.12.2013.

Within the result on the portfolio,

the realised gains or losses

on disposals of investment properties and other non-financial

assets

amount to €-22.4 million at 31.12.2014 and mainly comprise

the €24 million loss realised on the sale of the North Galaxy office

building. This loss results mainly from the difference between the

price received by Cofinimmo for the shares of Galaxy Properties

SA/NV, company which owns the building, and their book value,

and, incidentally, from the cancellation of the writeback of lease

payments sold and discounted booked since 01.01.2014.

The

change in the fair value of investment properties

comes from

€-26.3 million at 31.12.2013 to €-5.5 million at 31.12.2014. The value

decrease of the office buildings to be renovated in the short term

is compensated namely by a value increase of the Livingstone II

office building, following the announcement of the letting to the

European Commission, and by a value increase of the health-

care assets in Belgium and France, resulting mainly from lease

indexations. On a like-for-like basis, the fair value of the investment

properties slightly decreased since 31.12.2013 (-0.2%).

The

net result – Group share

amounts to €-52.7 million at

31.12.2014, compared to €58.7 million at 31.12.2013. Per share, these

figures stand at €-2.93 at 31.12.2014 and €3.34 at 31.12.2013.

1

Paid margins to be added to the floating rate (Euribor).

19