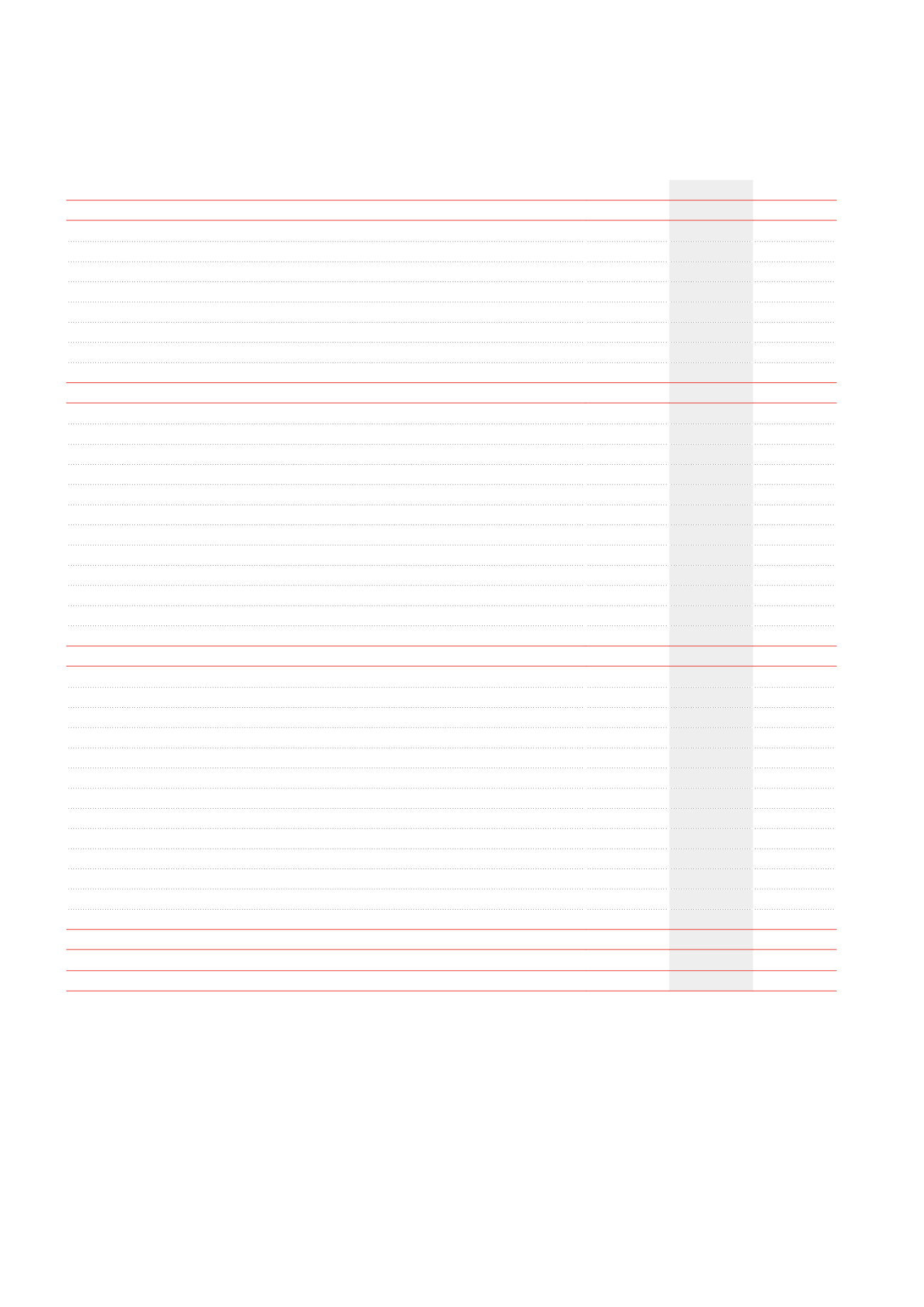

Consolidated cash flow statement

(x €1,000)

Notes

2013

2012

CASH AND CASH EQUIVALENTS AT THE BEGINNING OF THE FINANCIAL YEAR

3,041

10,207

Operating activities

Net result of the period

58,737

98,072

Adjustments for interest charges and income

61,002

59,429

Adjustments for gains and losses on disposals of property assets

-147

-304

Adjustments for gains and losses on disposals of financial assets

-348

Adjustments for non-cash charges and income

37

35,273

2,617

Changes in working capital requirements

38

-1,898

-9,285

CASH FLOW RESULTING FROM OPERATING ACTIVITIES

152,967

150,181

Investment activities

Investments in intangible assets and other tangible assets

-584

-461

Acquisitions of investment properties

39

-7,847

-15,497

Extensions of investment properties

39

-27,270

-33,237

Investments in investment properties

39

-19,916

-7,100

Acquisitions of consolidated subsidiaries

42

-14,573

Acquisitions of subsidiaries accounted for under the equity method

42

-5,661

Disposals of investment properties

39

6,562

2,394

Disposals of assets held for sales

39

1,993

925

Payment of exit tax

-1,201

-11,314

Finance lease receivables

-11,117

3,033

CASH FLOW RESULTING FROM INVESTMENT ACTIVITIES

-59,380

-81,491

Financing activities

Disposals of own shares

91,686

37,681

Dividends paid to shareholders

-67,335

-67,671

Repurchase of minority interests

42

-17,441

New minority interests

42

277

5,000

Coupons paid to minorities

42

-273

-85

Coupons paid to MCB-holders

42

-2,727

-1,379

Increase of financial debts

229 153

260,201

Decrease of financial debts

-245,027

-222,707

Financial income received

5,367

5,593

Financial charges paid

-66,368

-63,665

Other cash flows from financing activities

-25,412

1

-11,383

CASH FLOW RESULTING FROM FINANCING ACTIVITIES

-80,659

-75,856

CASH AND CASH EQUIVALENTS AT THE END OF THE FINANCIAL YEAR

15,969

3,041

1

This amount mainly comprises the total cost of the restructuration of the interest rate hedging scheme. For more details, see the chapter “Management of Financial Resources” of this

Annual Financial Report.

136

/

Annual Accounts /

Consolidated Accounts