141

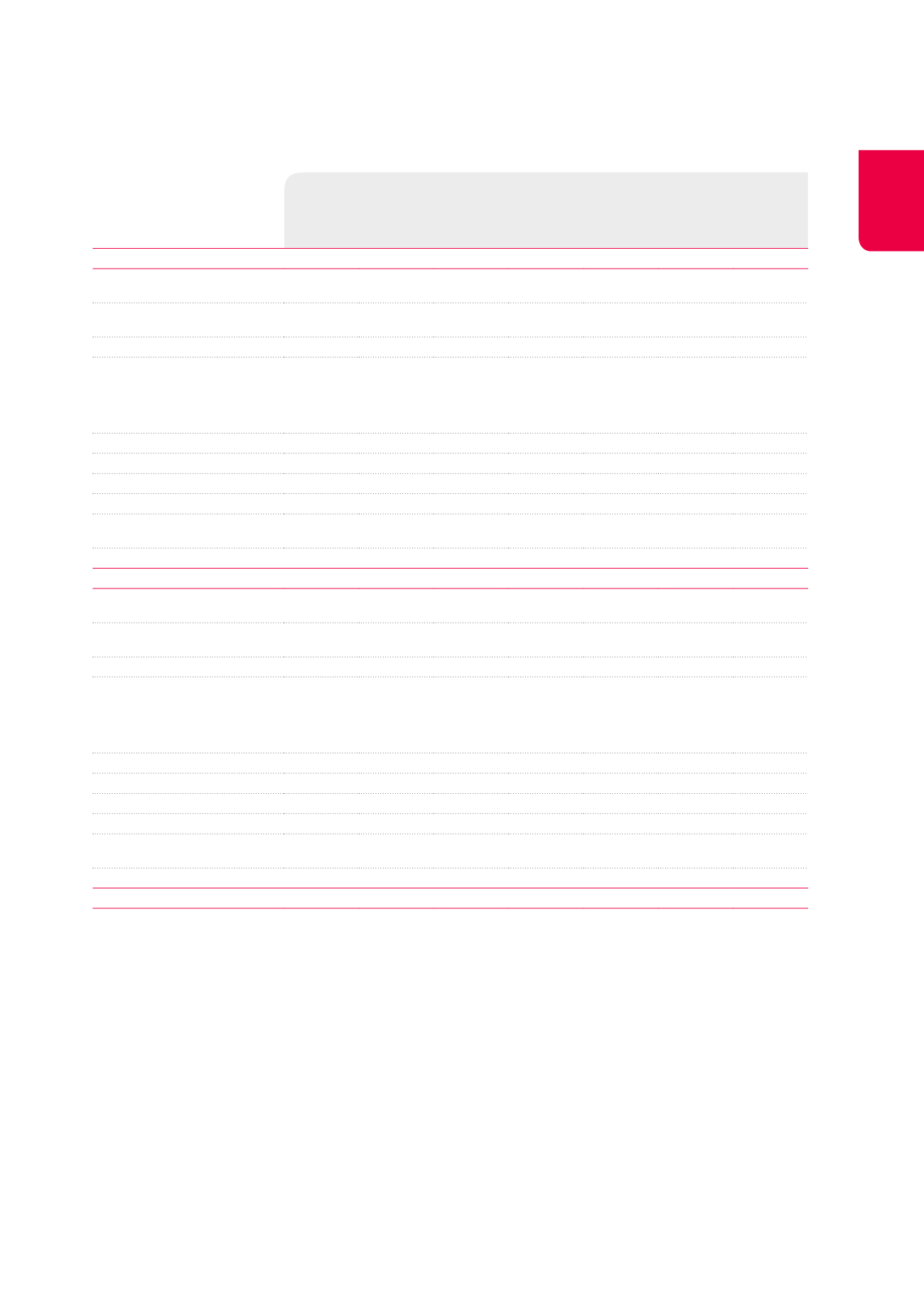

Consolidated statement of changes in shareholders’ equity

(x €1,000)

Capital

Share

premium

account

Reserves

1

Net result

of the

financial

year

Share-

holders’

equity

Parent

company

Minority

interests

Share-

holders’

equity

AT 01.01.2013

857,822

329,592

190,543

98,072 1,476,029

66,263 1,542,292

Appropriation of the 2012 net

result

98,072

-98,072

Elements recognised in the

global result

55,862

58,737

114,599

3,092

117,691

Cash flow hedging

2

57,288

57,288

57,288

Impact on the fair value

of estimated transfer

duties resulting from the

hypothetical disposal of

investment properties

-1,426

-1,426

-35

-1,461

Result of the period

58,737

58,737

3,127

61,864

Other

-42

-42

170

128

SUBTOTAL

857,822

329,592

344,435

58,737 1,590,586

69,525

1,660,111

Issue of shares

3

28,368

15,504

43,872

43,872

Acquisition/Disposal of own

shares

56,635

27,014

8,037

91,686

91,686

Dividends/Coupons

-111,207

-111,207

-3,000

-114,207

AT 31.12.2013

942,825

372,110

241,265

58,737

1,614,937

66,525 1,681,462

Appropriation of the 2013 net

result

58,737

-58,737

Elements recognised in the

global result

51,589

-52,671

-1,082

3,360

2,278

Cash flow hedging

2

51,799

51,799

51,799

Impact on the fair value

of estimated transfer

duties resulting from the

hypothetical disposal of

investment properties

-210

-210

-18

-228

Result of the period

-52,671

-52,671

3,378

-49,293

Other

2,046

2,046

131

2,177

SUBTOTAL

942,825

372,110

353,637

-52,671

1,615,901

70,016 1,685,917

Issue of shares

3

20,536

12,229

32,765

32,765

Acquisition/Disposal of own

shares

-294

-326

89

-531

-531

Dividends/Coupons

-106,164

-106,164

-3,022

-109,186

AT 31.12.2014

963,067

384,013

247,562

-52,671

1,541,971

66,994 1,608,965

1

See Note 31.

2

Recycling under the income statement included.

3

Shares (capital + share premiums) issued in the context of intragroup mergers, without shares being awarded to third parties outside the Group, are directly eliminated

during consolidation. The issued shares listed here are related to the optional dividend.