In 2007 and 2011, Cofinimmo acquired the real estate of two distribution networks:

cafés and restaurants in Belgium and in the Netherlands as well as insurance agencies

in France.

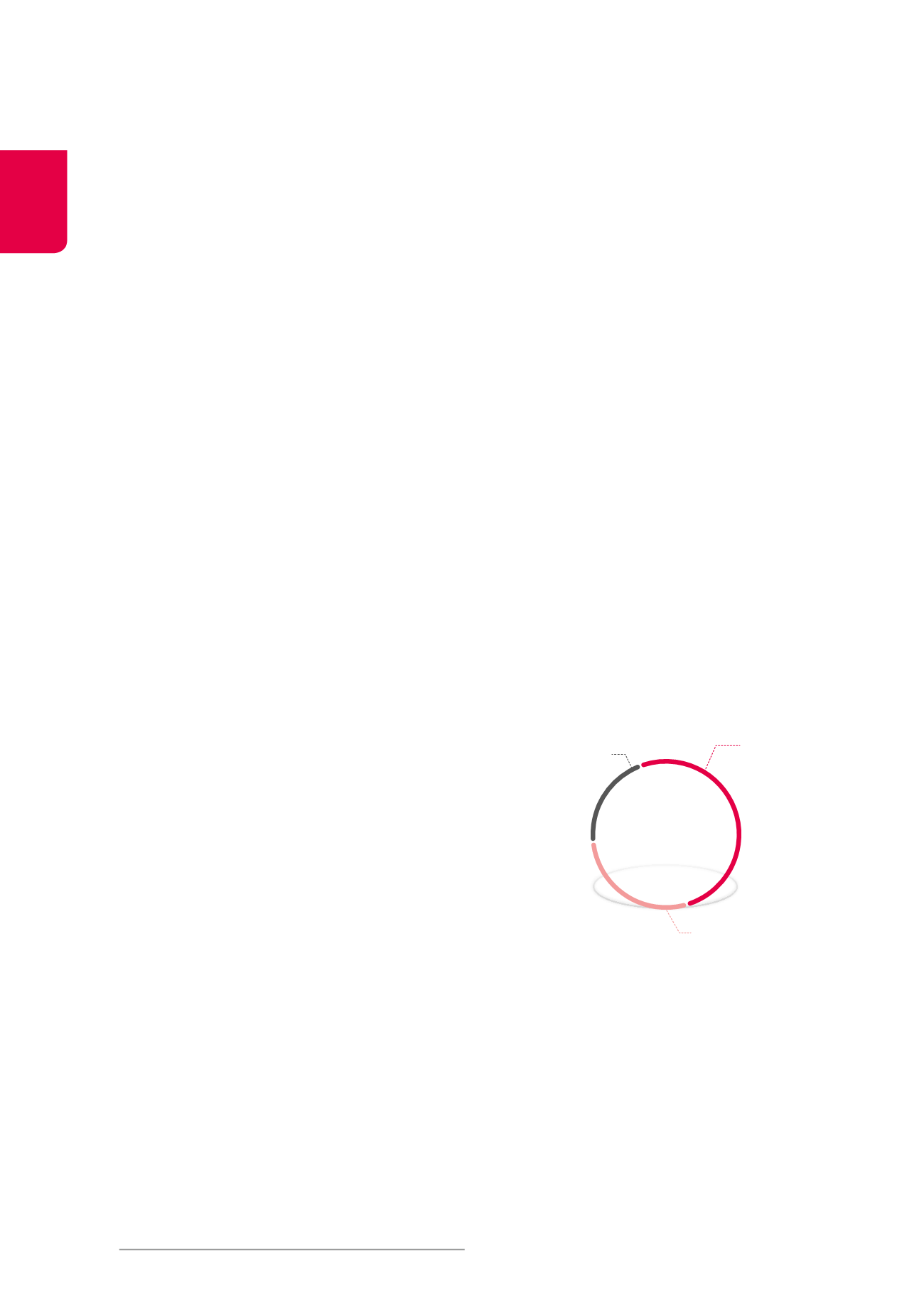

Portfolio at 31.12.2014

At 31.12.2014, Cofinimmo’s property portfolio of distribution networks

accounted for 16.7% of its total invested portfolio. It comprised two

portfolios, representing a fair value of €533.5 million:

PUBSTONE: cafés and restaurants

Under the terms of a real estate partnership, Cofinimmo acquired,

at the end of 2007, an entire portfolio of cafés and restaurants

previously owned by Immobrew SA/NV, a subsidiary of AB InBev

and renamed Pubstone SA/NV. The premises were then leased

back to AB InBev under a commercial lease for an initial average

term of 23 years. AB InBev retains an indirect stake of 10% in the

Pubstone structure (see diagram on pages 190 and 191). On expiry

of the lease, AB InBev has the option of renewing it under the same

conditions or of returning the vacated premises.

At 31.12.2014, the Pubstone portfolio consists of 800 properties

located in Belgium and 245 properties located in the Netherlands,

representing a total aboveground surface area of 360,887m² and

a fair value of €421.6 million (Belgium: €272.2 million; Netherlands:

€149.4 million).

Cofinimmo does not assume any risk from the commercial opera-

tion of the cafés and restaurants. This risk is borne exclusively by

AB InBev, which passes it on partially to the individual operators,

who are subtenants. However, Cofinimmo is responsible for the

structural maintenance of the roofs, walls, façades and external

woodwork. Under the partnership, Cofinimmo also continues to

assist AB InBev with the dynamic development of this portfolio. In

Belgium, the in-house Pubstone team, not including support ser-

vices, consists of six people involved in the portfolio management

(Property and Project Management). In the Netherlands, it consists

of two people.

This in-house management guarantees continual technical and

financial supervision of the various properties, as well as the stand-

ardisation of the various aspects related to property and urban

planning.

COFINIMUR I: insurance agencies

In December 2011, Cofinimmo SA/NV and Foncière ATLAND, acting

in partnership and on behalf of the subsidiary Cofinimur I SA/NV,

acquired a 283-asset portfolio from the MAAF insurance group,

comprising 265 retail agencies, 15 office buildings and three mixed-

use buildings (retail/offices).

All these buildings have been let for an initial average term of 9.7

1

years to MAAF, a subsidiary of the French insurance group Covéa,

which has a total network of 587 branches throughout the French

territory. These branches are operated by MAAF employees.

The agencies network expanded in 2014, with the acquisition of an

agency let to MAAF and two agencies let to GMF, another Covéa

Group brand.

1

Residual fixed term of 7.1 years at 31.12.2014.

Distribution by location - in fair value (in %)

Belgium

(Pubstone)

France

(Cofinimur I)

Netherlands (Pubstone)

28.0

%

51.0

%

21.0

%

9.9%

Walloon

Region

31.1%

Flemish

Region

10.0%

Brussels

Region

2.7%

English Channel

coast

1.1%

Mediterranean

coast

0.4%

Overseas

departments (DOM)

& territories (TOM)

2.7%

Major cities

4.5%

Paris region

4.7%

Provincial towns

4.9%

Rural areas

MANAGEMENT REPORT / PROPERTY PORTFOLIO /

Property of distribution networks

62