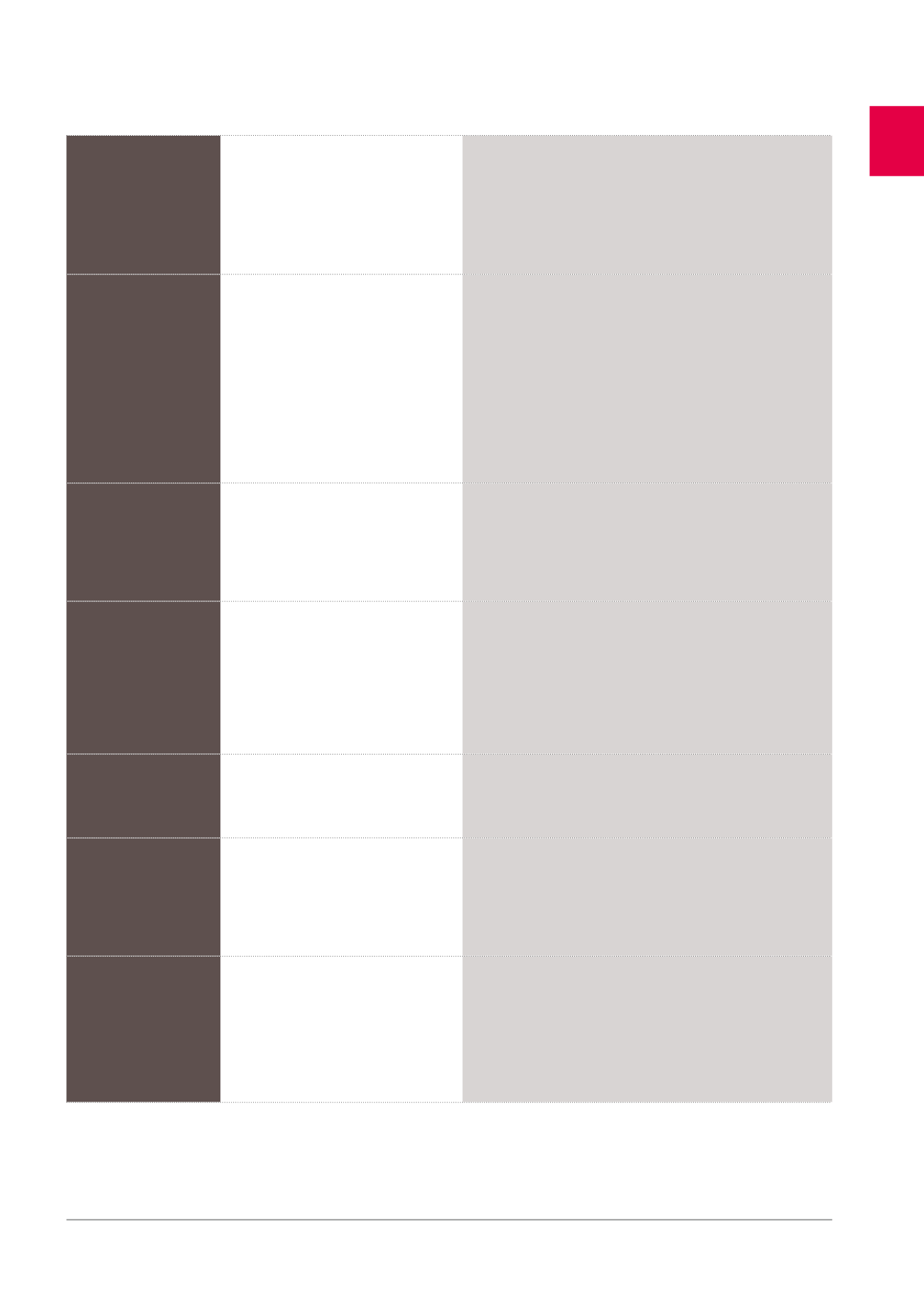

DESCRIPTION OF THE RISK POTENTIAL IMPACT

MITIGATING FACTORS AND MEASURES

Non-renewal or

termination of financing

contracts

Negative impact on liquidity.

Ten renowned banks.

Different sources of financing: bank debt, issue of convertible and non-

convertible bonds, etc.

Refinancing carried out at least 12 months in advance in order to optimise

conditions and liquidity.

Change in the fair value of

hedging instruments

Positive or negative effect on shareholder’s

equity and intrinsic value per share.

If Cofinimmo had closed its positions at

31.12.2015, the settlement amount would

have stood at zero (vs. -125.16 million EUR at

31.12.2014) given that all CAPs and FLOORs are

cancelled in 2015.

At 31.12.2015, the variation of rates has not

affected the capital, given that all CAPs and

FLOORs are cancelled in 2015.

Cofinimmo uses hedging for its entire portfolio, not for specific credit lines.

Deflation risk

Negative impact on rental income.

The leases usually provide that the new rent may not be lower than either

the previous rent or the rent of the first year of the lease.

Indexation of a minority of technical charges may be higher than that

applied to rents.

Risk of debt

1

Cancellation/termination of loan agreements

or early repayment.

Non-compliance with the RREC legislation and

resulting penalties.

Prudent financial and debt policy and ongoing monitoring.

At 31.12.2015, Cofinimmo’s legal debt stood at 39.62%, in compliance with

the maximum ratio of 65% according to the RREC legislation. This ratio

applies to borrowing agreements and credit lines (max. 60%).

Financial charges (excluding impact of IAS 39) amounted to

-42.31 million EUR at 31.12.2015 (vs. -54.70 million EUR at 31.12.2014).

Exchange risk

Loss of value of the investments and cash

flows.

All investments are denominated in Euros, as are income and expenditure.

Volatility in the share price

More difficult access to new capital.

Monitoring of any in-house factor which may have a negative impact on

the market price.

Frequent communication with shareholders and publication of financial

information forecasts.

Change in the Group’s

public rating

Cost of financing and liquidity.

Close relationship with rating agency which recommendations are taken

into account regarding financial ratios to be reached for the various

rating levels and regarding sources of financing, liquidity and interest rate

hedging.

The company is also in contact with another rating agency, which rating

is private.

1

In accordance with Article 13 of the Royal Decree of 13.07.2014, where the debt ratio exceeds 50%, Cofinimmo must draw up a financial plan accompanied by an execution schedule,

detailing the measures taken to prevent this debt ratio from exceeding 65% of the consolidated assets, see Note 24.

9