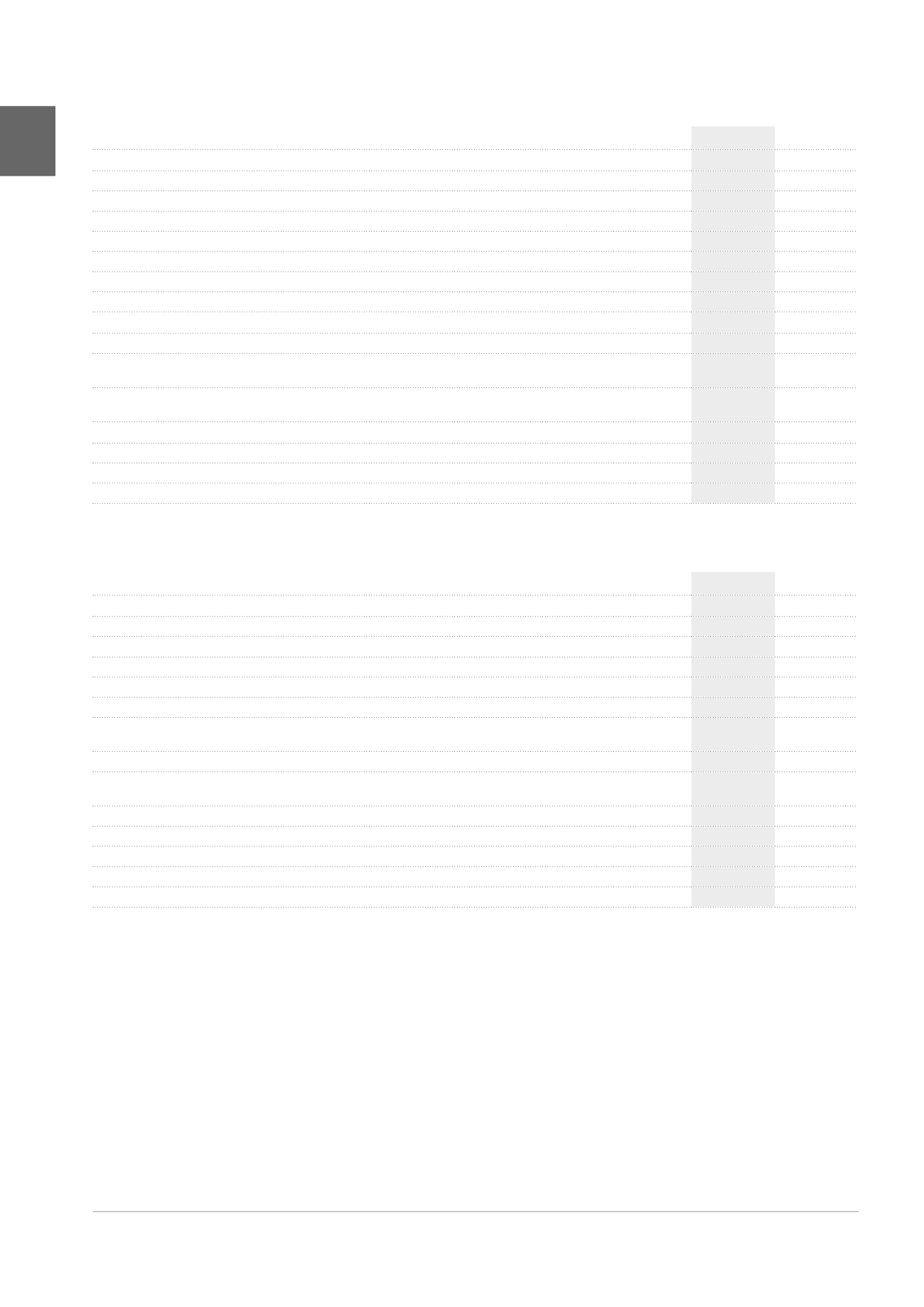

NON-DISTRIBUTABLE EQUITY ACCORDING TO ARTICLE 617 OF THE COMPANY CODE

(x 1,000 EUR)

2015

2014

Net assets

1,860,118 1,541,936

Distribution of dividends and profit-sharing plan

-110,496

-99,791

Net assets after distribution

1,749,622 1,442,145

Paid-up capital or, if greater, subscribed capital

1,126,980

965,983

Share premium account unavailable for distribution according to the Articles of Association

583,961

463,902

Reserve for the positive balance of changes in the fair value of investment properties

Reserve for the estimated transaction costs and transfer duties resulting from the hypothetical disposal of

investment properties

-55,777

-55,225

Reserve for the balance of changes in fair value of authorised hedging instruments qualifying for hedge account

-10,325

-42,665

Reserve for the balance of changes in fair value of authorised hedging instruments not qualifying for hedge

accounting

-67,123

-67,836

Reserve for own shares

Other reserves declared non-distributable by the General Meeting

3,520

3,453

Legal reserve

Non-distributable equity according to Article 617 of the Company Code

1,581,237

1,267,612

Margin remaining after distribution

168,385

174,533

OBLIGATION TO DISTRIBUTE DIVIDENDS ACCORDING TO THE ROYAL DECREE OF 13.07.2014 CONCERNING RRECS

(x 1,000 EUR)

2015

2014

Net result

-103,601

-53,639

Depreciation (+)

365

338

Writedowns (+)

671

-10

Writeback of writedowns (-)

Writeback of lease payments sold and discounted

-10,214

-15,931

Other non-cash elements (+/-)

6,173

79,165

Result on disposal of property assets (+/-)

-25,639

23,503

Changes in fair value of investment properties (+/-)

-7,675

-2,223

Corrected result (A)

67,283

31,203

Capital gains and losses realised

1

on property assets during the financial year (+/-)

25,374

3,925

Realised gains

1

on property assets during the year, exempt from the obligation to distribute if reinvested within

four years (-)

-25,729

-30,940

Realised gains on property assets previously exempt from the obligation to distribute and that were not reinvested

within four years (+)

Net gains on realisation of property assets not exempt from the distribution obligation (B)

-355

-27,015

TOTAL (A+B) X 80%

53,543

3,350

Debt decrease (-)

-153,229

-73,756

OBLIGATION TO DISTRIBUTE DIVIDENDS

2

0

0

1

In relation to the acquisition value, increased by the capitalised renovation costs.

2

Because of the decrease in its debt, Cofinimmo SA/NV has no distribution obligation.

214

ANNUAL ACCOUNTS /

Company accounts