0

5

10

15

14.8

6.3

13.1

21.7%

27.3%

51.0%

52.3 %

27.1 %

20.6 %

0

20

40

60

In each of these two networks, there is only one tenant company and a long-term lease. The quality

of the location of the assets also guarantees an attractive residual value. In-house specialised teams

monitor the structural maintenance of the assets of the two networks.

PROPERTY OF DISTRIBUTION NETWORKS: PUBSTONE & COFINIMUR I

Main advantages of these networks:

“Sale & lease back” transactions

The sale price per square metre requested by the seller is reasonable

given that it involves buildings let to their seller, who must therefore

bear the rent after the sale.

Optimisation of the network of sales points

for the activity of the tenant

The buildings are necessary for the tenant’s activity because of their

location and are under a long-term lease contract.

Therefore, the probability of relocation at the end of the lease is high

for most of them.

Risk granularity

If the tenant leaves, a significant part of these assets may be sold as

shops or homes to local professional or non-professional investors,

given that the amounts to be invested are often accessible to such

investors.

Support for the tenant in the management,

development and renovation of assets

The tenant company and Cofinimmo maintain an ongoing dialogue in

order to develop its geographic sales network. Buildings that have a

lease that will not be renewed on expiry or will require renovation in the

medium term can thus be identified in advance. Similarly, Cofinimmo

may target new properties that the tenant may wish to integrate into

its network.

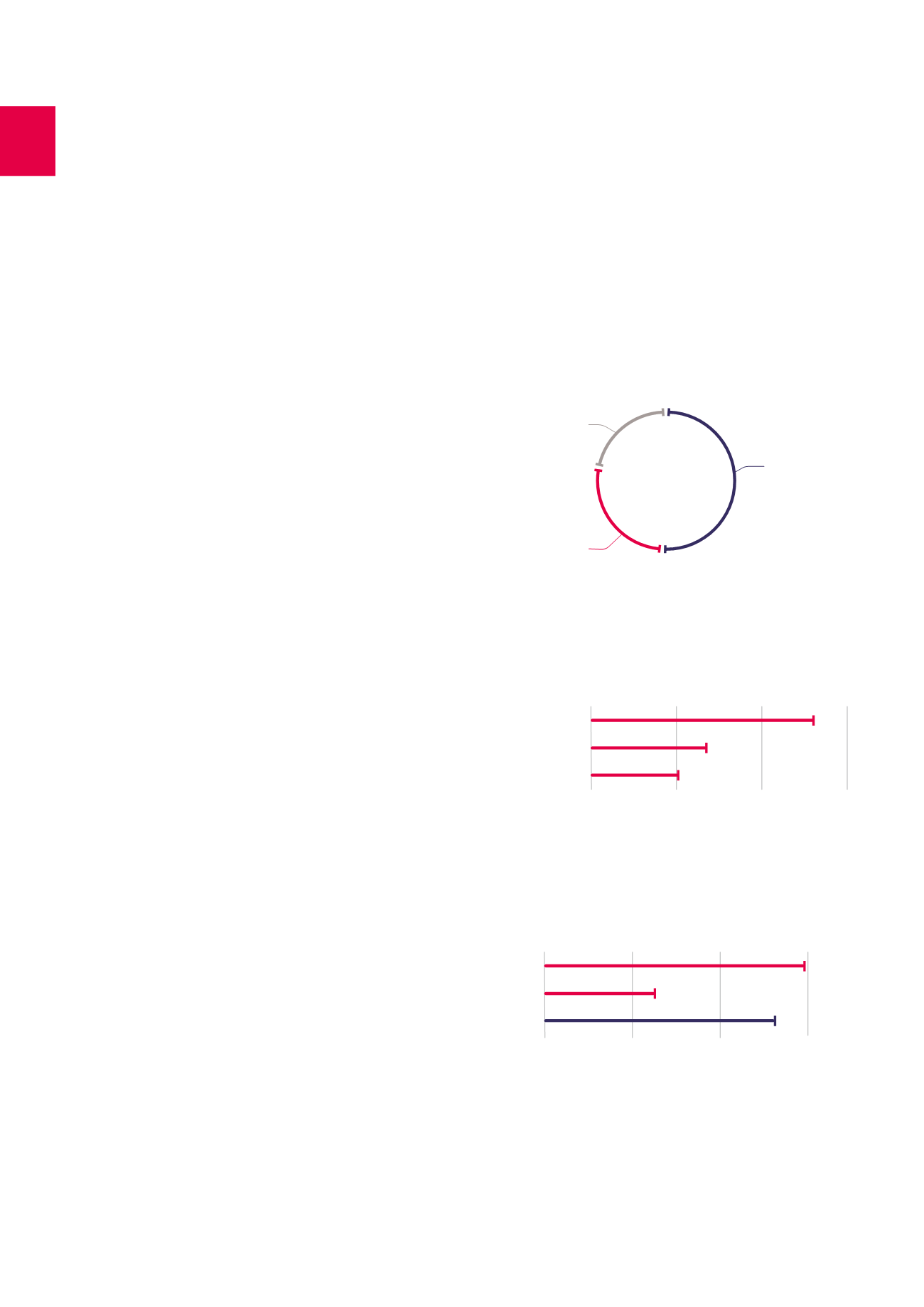

Geographic breakdown by rent - in contractual rents (in %)

Average residual lease length (in number of years)

Pubstone

Cofinimur I

TOTAL

Geographic breakdown – at fair value (in %)

France

(Cofinimur I)

Netherlands

(Pubstone)

Belgium

(Pubstone)

Belgium (Pubstone)

Netherlands

(Pubstone) France

(Cofinimur I)

68

Management report /

Property of distribution networks