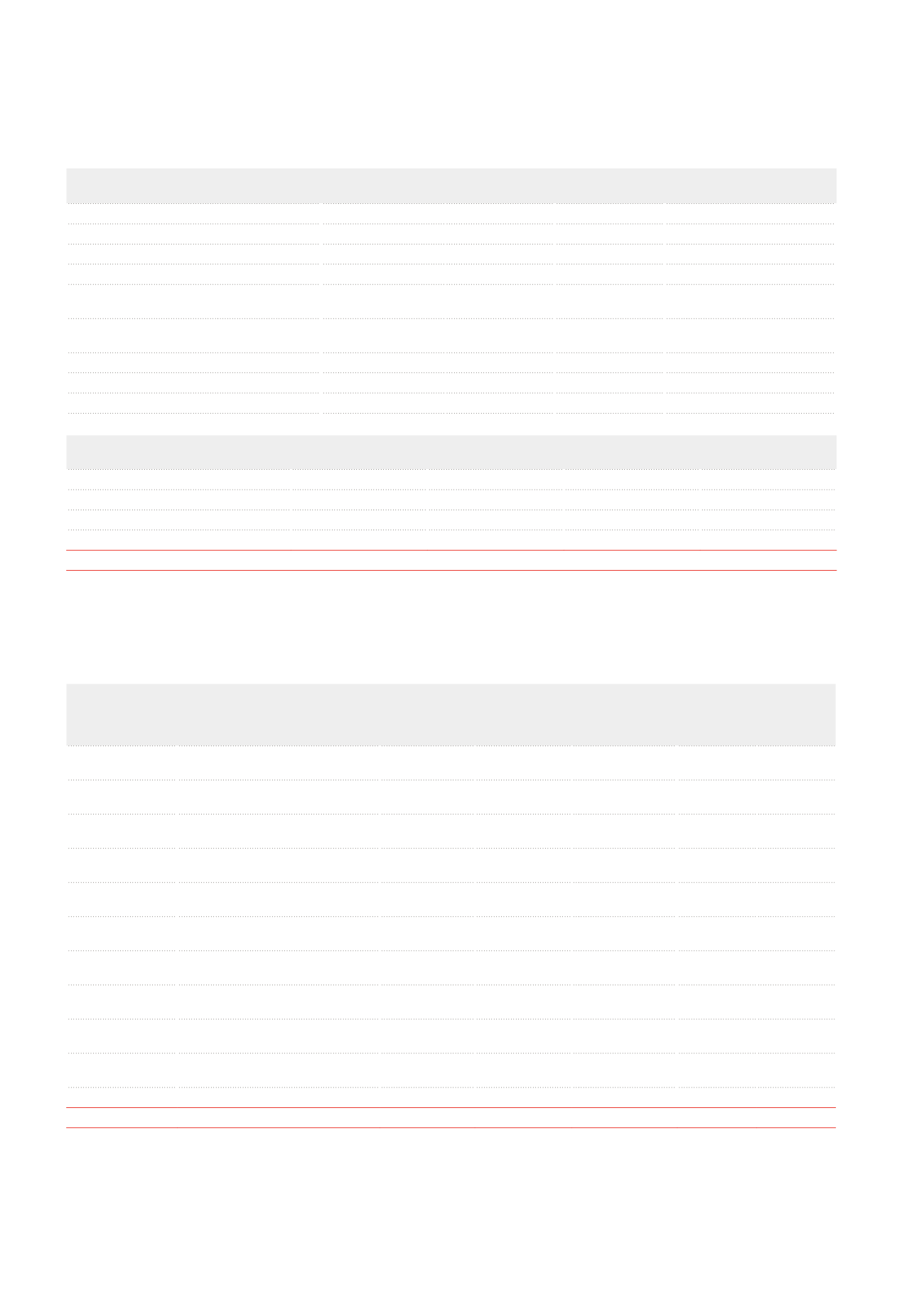

Inventory of buildings excluding investment properties

Property

Superstructure

(m²)

Contractual rent

1

(x €1,000)

Occupancy

rate

Tenant

Financial assets

Courthouse - Antwerp

72,131

1,366

100%

Buildings Agency

Fire station - Antwerp

23,585

189

100%

City of Antwerp

Police station - HEKLA zone

4,805

N/A

100%

Federal Police

Depage student housing residence - Brussels

3,196

355

2

100%

Université Libre de Brussels

(ULB – Brussels University)

Nelson Mandela student housing residence -

Brussels

8,088

81

100%

Université Libre de Brussels

(ULB – Brussels University)

Assets held in joint ventures

EHPAD Les Musiciens - France

4,264

1,324

100%

Orpea France

Prison - Leuze-en-Hainaut

3

N/A

N/A

N/A

N/A

Inventory of property assets

Segment

Acquisition price

(x €1,000,000)

Insured value

4

(x €1,000,000)

Fair value

(x €1,000,000)

Gross rental yield

(in %)

Offices

2,020.8

1,784.6

1,524.8

7.77

Healthcare real estate

988.4

1,228.2

6.31

Property of distribution networks

535.6

532.8

6.61

Other

56.1

21.0

61.1

7.06

TOTAL

3,600.9

1,805.6

3,347.0

7.03

In the case of healthcare real estate and property of distribution networks, the insurances are contractually taken by the tenants. The portfolio is thus

100% insured.

1

Non-assigned part of the rents, which varies between 4% and 100%.

2

Contractual rent from 10.09.2013 to 31.12.2013.

3

The prison of Leuze-en-Hainaut is under development.

4

This amount does not include the insurances taken during works, nor those relating to finance leases. The insured value comprises the full value, land excluded, of the office buildings of

which the receivables were sold, whereas the fair value of these buildings only represents the residual value of the building after the sale of its receivables.

5

The occupancy rate is calculated as follows: contractual rents divided by rents + ERV on unlet spaces.

6

Writeback of lease payments sold and discounted.

Property

Address

Year of

construction/

last renovation

(extension)

Superstructure

(in m²)

Contractual

rents

(x €1,000)

Occupancy

rate

2013

5

Estimated

Rental

Value

(ERV)

NORTH GALAXY

33/37 Boulevard Albert II/Albert II-laan

1000 Brussels

2005

105,420

17,131

6

100%

17,131

SOUVERAIN/VORST

23-25

23/25 Boulevard du Souverain/Vorstlaan

1170 Brussels

S/V25: 1970

S/V23: 1987

56,891

11,514

100%

10,437

EGMONT I

36 Rue du Pépin/Kernstraat

1000 Brussels

1997

36,616

2,430

6

100%

2,430

BOURGET 42

42 Avenue du Bourget/Bourgetlaan

1130 Brussels

2001

25,756

4,447

86%

3,940

GEORGIN 2

2 Avenue Jacques Georgin/Jacques

Georginlaan - 1030 Brussels

2006

17,439

3,105

100%

2,665

TERVUEREN/

TERVUREN 270-272

270/272 Avenue de Tervueren/

Tervurenlaan - 1150 Brussels

2013

19,043

1,978

56%

3,623

SERENITAS

2/6 Avenue Van Nieuwenhuyse/Van

Nieuwenhuyselaan - 1160 Brussels

1995

19,823

3,454

93%

3,041

ALBERT I

er

4 -

CHARLEROI

Rue Albert 1

er

, 4

6000 Charleroi

2004

19,189

2,686

100%

2,180

COCKX 8-10

8/10 Rue Jules Cockx/Jules Cockxlaan

1160 Brussels

2008

16,557

2,529

86%

2,763

DAMIAAN - TREMELO

Pater Damiaanstraat, 39

3120 Tremelo

2003 (2012)

20,274

2,432

100%

2,215

Other

1,516,459

172,678

96%

169,770

TOTAL

1,853,467

224,385

95.43%

220,196

Review of the consolidated property portfolio

The assumptions used for the estimation of the rental value are based on rental transactions observed on the market taking into account the location

and the type of asset.

Management Report /

Property Report

120

/