\ 177

Notes to the Consolidated Accounts

\ Annual Accounts

NOTE 33.

PROVISIONS

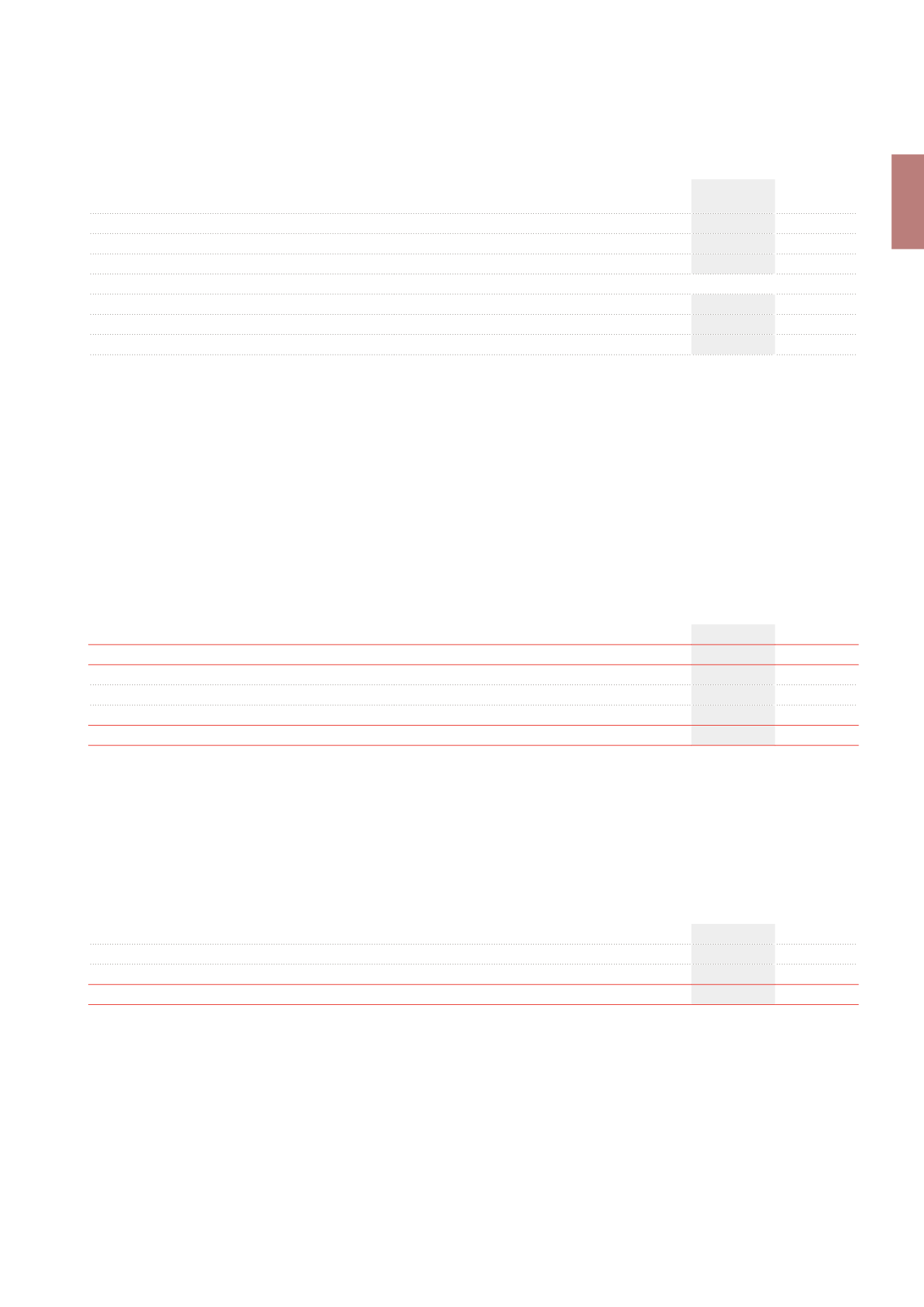

(x €1,000)

2013

2012

AT 01.01

20,493

18,474

Provisions charged to the income statement

1,421

5,992

Uses

-2,166

-1,598

Provision writebacks credited to the income statement

-1,568

-2,375

AT 31.12

18,180

20,493

The provisions of the Group (k€18,180) can be classified in two

categories:

•

provisions corresponding to a contingent quota of the cost of

the works that the Group has committed to undertake in several

buildings, for k€13,882 (2012: k€13,880);

•

provisions to face its potential commitments vis-à-vis tenants or

third parties, for k€4,298 (2012: k€6,613).

These provisions correspond to the discounted future payments consid-

ered as likely by the Board of Directors.

NOTE 34.

DEFERRED TAXES

(x €1,000)

2013

2012

Exit tax

1,183

2,128

Deferred taxes

33,572

33,666

TOTAL

34,755

35,794

The exit tax pertains to two French entities which opted for the SIIC status

in 2013. This exit tax is based upon the gains resulting from the valuation

of the properties, i.e. the difference between the value of the properties

as estimated by the expert at 31.12.2012 and the net book value of these

properties at the same date. The taxation rate applied to this figure stands

at 19%. The payment of the exit tax is spread over four years. The first pay-

ment took place in December 2013 for a total amount of k€626.

The deferred taxes pertain to the Dutch subsidiary Pubstone Properties

BV. The deferred taxes of this subsidiary correspond to the taxation, at a

rate of 25%, of the difference between the investment value of the assets,

less registration rights, and their tax value.

1

Based on the parent company’s result.

NOTE 32.

DIVIDEND PER SHARE

1

(in €)

Paid

in 2013

Paid

in 2012

Gross dividends attributable to the ordinary shareholders

99,568,137.50 91,820,813.50

Gross dividend per ordinary share

6.50

6.50

Net dividend per ordinary share

4.875

5.135

Gross dividends attributable to the preference shareholders

4,391,458.89 6,801,943.33

Gross dividend per preference share

6.37

6.37

Net dividend per preference share

4.7775

5.0323

A gross dividend in respect of the financial year 2013 of €6.00 per ordinary

share (net dividend of €4.50 per ordinary share), amounting to a total divi-

dend of €101,430,510.00, is to be proposed at the Ordinary General Meeting

of 14.05.2014

1

. Indeed, at the closing date, the number of ordinary shares

entitled to the 2013 dividend amounts to 16,905,085.

The Board of Directors proposes to suspend the right to dividend for the

40,211 own ordinary shares still held by Cofinimmo under its stock option

plan and to cancel the right to dividend of the remaining 8,706 own shares.

A gross dividend in respect of the financial year 2013 of €6.37 per prefer-

ence share (net dividend of €4.7775 per preference share), amounting to a

total dividend of €4,386,904.34, is to be proposed at the Ordinary General

Meeting of 14.05.2014. Indeed, at the closing date, the number of preference

shares entitled to the 2013 dividend stands at 688,682.

As a reminder, since 01.01.2013, the withholding tax rate applicable to dis-

tributed dividends stands at 25%. In addition, since 07.01.2013, no withhold-

ing tax is applied for non-resident investors having a non-profit activity and

which corporate purpose solely consists of the management and place-

ment of funds collected to serve legal or complementary pensions.