176

/

Annual Accounts /

Notes to the Consolidated Accounts

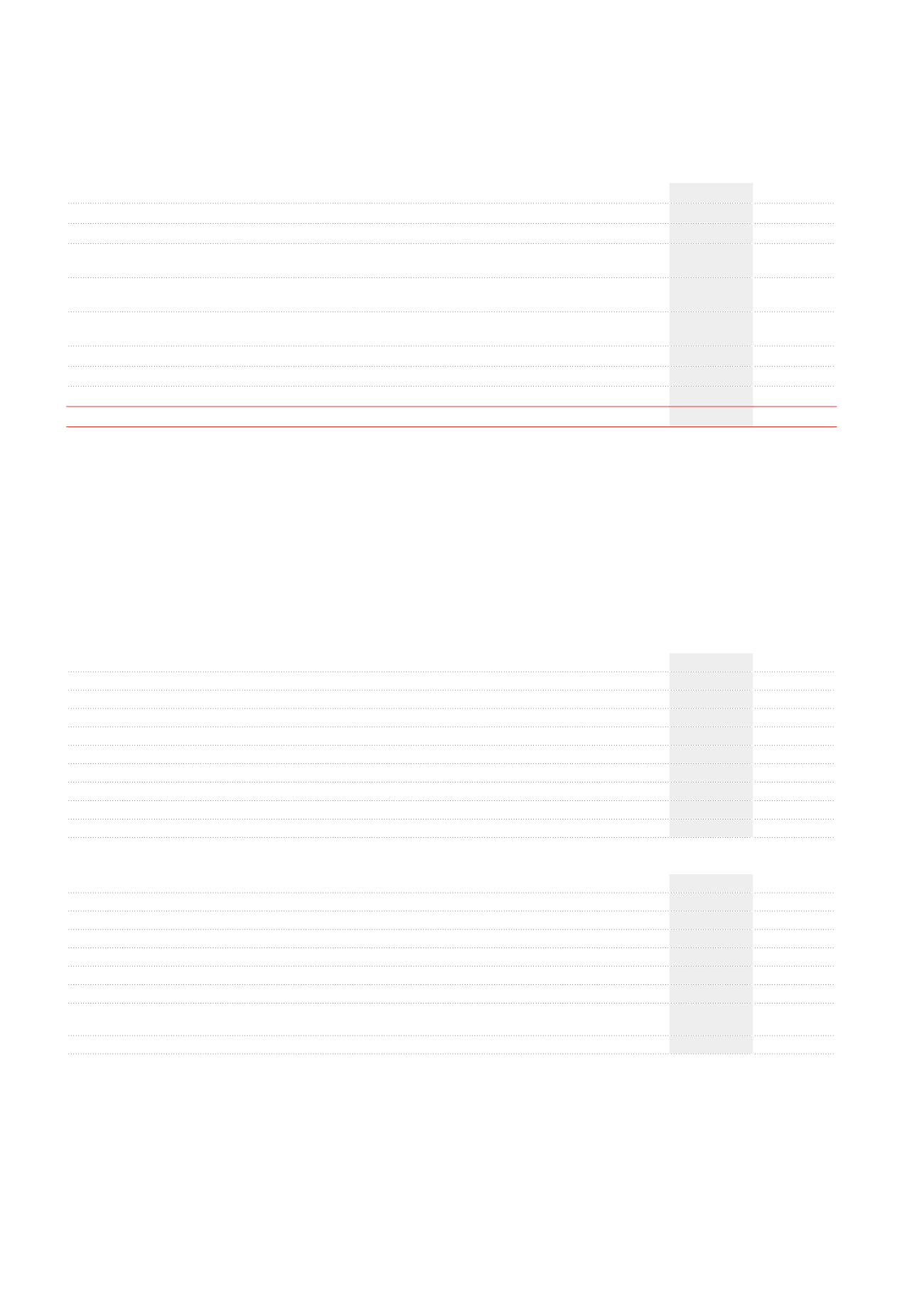

NOTE 30.

RESERVES

(x €1,000)

2013

2012

Legal reserve

1,735

1,662

Reserve for the balance of changes in the fair value of investment properties

-144,422

-150,059

Reserve for the estimated transaction costs and transfer duties resulting

from the hypothetical disposal of investment properties

-75,715

-71,424

Reserve for the balance of changes in the fair value of authorised hedging instruments

qualifying for hedge account

-88,745

-157,113

Reserve for the balance of changes in the fair value of authorised hedging instruments

not qualifying for hedge accounting as defined under IFRS

-37,553

-1,479

Other

585,965

568,956

Tax-exempt reserves

3,037

2,685

Distributable reserves

582,928

566,271

TOTAL

241,265

190,543

The reserves are presented before appropriation of the result of the financial year.

NOTE 31.

RESULT PER SHARE

The calculation of the result per share at the closing date is based on the

net current result/net result attributable to the ordinary and preference

shareholders of k€104,924 (2012: k€97,486)/k€58,737 (2012: k€98,072) and

a number of ordinary and preference shares entitled to share in the result of

the period ended 31.12.2013 of 17,593,767 (2012: 16,015,572

1

).

The net current result - excluding IAS 39 impact stands at k€119,209 for the

financial year 2013. Per share, this result amounts to €6.78.

The diluted result per share takes into account the impact of a theoretical

conversion of the convertible bonds issued by Cofinimmo, of the mandatory

convertible bonds issued by Cofinimur I and of the stock options

1

Including 8,000 own shares sold in January2013 and entitled to the dividend of the financial year 2012.

2

In accordance with IAS33, the convertible bonds are excluded from the calculation of the diluted net result of 2012 and 2013, as they would have an accretive impact on the diluted

result per share.

3

The calculation method of the diluted net result was reviewed in 2013. The 2012 diluted net result - Group share was recalculated based on the method applied in 2013.

Result attributable to the ordinary and preference shares

(x €1,000)

2013

2012

Net current result attributable to the ordinary and preference shares

104,924

97,486

Net current result of the period

109,930

101,192

Minority interests

-5,006

-3,706

Result on the portfolio attributable to the ordinary and preference shares

-46,187

586

Result on the portfolio of the period

-48,066

1,503

Minority interests

1,879

-917

Net result attributable to the ordinary and preference shares

58,737

98,072

Net result of the period

61,864

102,695

Minority interests

-3,127

-4,623

Diluted result per share

(in €)

2013

2012

Net result

58,736,945

98,071,556

Number of ordinary and preference shares entitled to share in the result of the period

17,593,767

16,015,572

Net current result per share - Group share

5.96

6.09

Result on the portfolio per share - Group share

-2.62

0.03

Net result per share - Group share

3.34

6.12

Diluted net result - Group share

54,350,041

96,485,853

Number of ordinary and preference shares entitled to share in the result of the period taking into account the

theoretical conversion of the convertible bonds, of the mandatory convertible bonds and of the stock options

16,945,296

2

15,907,128

2.3

Diluted net result per share - Group share

3.21

2

6.07

2.3