\ 171

Notes to the Consolidated Accounts

\ Annual Accounts

Financial instruments held for trading

The Group contracted a Cancellable Interest Rate Swap. This instrument,

recognised as trading, is made up of a classic IRS (here: fixed payer) and

a short position in an option that allows the counterparty to cancel this

Swap as from a certain date. The sale of this option allowed to reduce the

guaranteed fixed rate during the entire period.

1

The important “Changes in the fair value of the hedged instrument” in 2013 is explained by the fact that a bond swapped into floating rate with a nominal value of €50million was

replaced by fixed-rate bond with a nominal value of €50million.

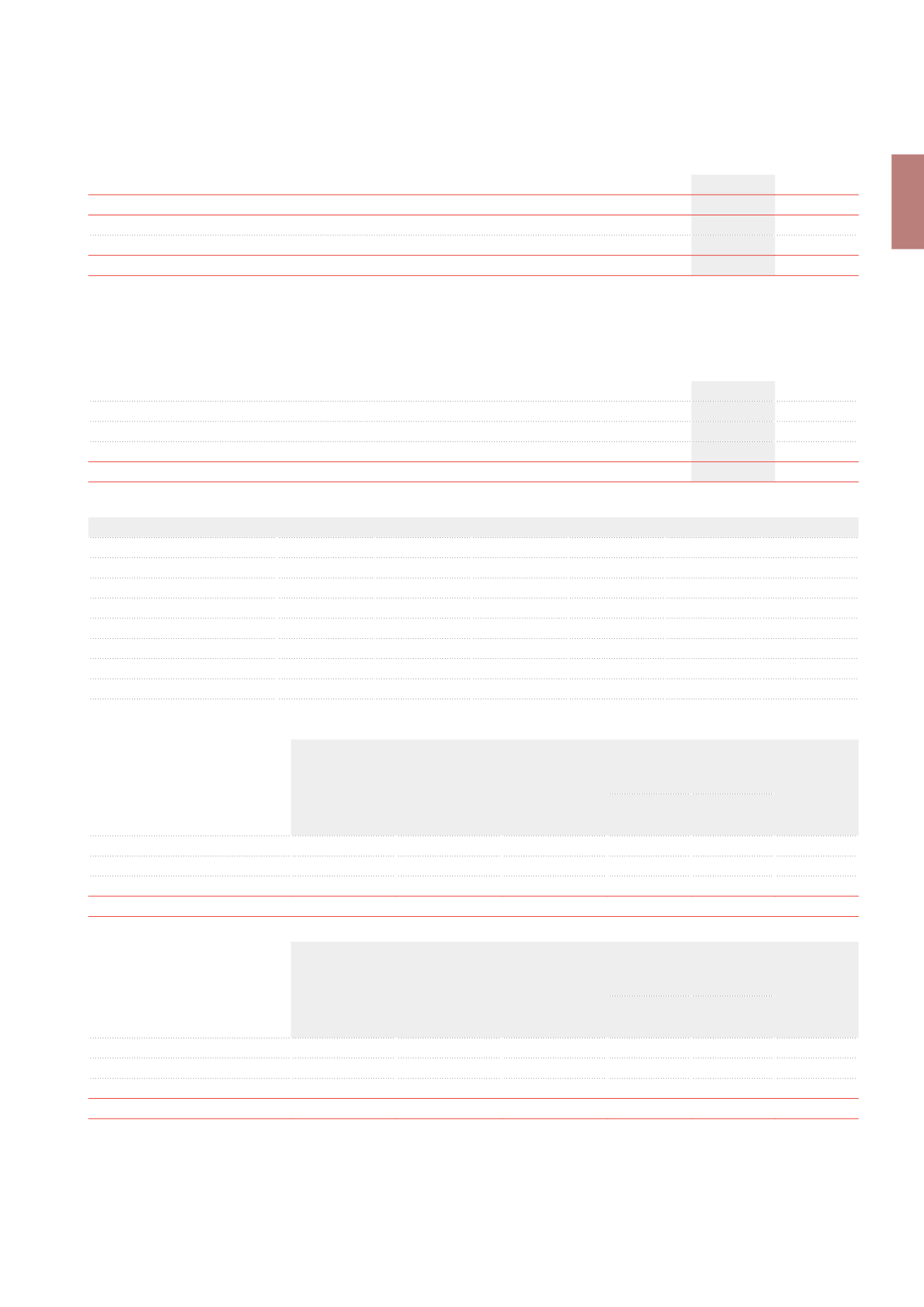

Changes in the fair value of the hedged instruments

(x €1,000)

2013

2012

AT 01.01

261,069

261,488

Changes in the fair value caused by the maturity of the instruments

-50,000

1

Changes in the fair value of the hedged instruments

-6,806

-418

AT 31.12

204,263

261,070

(x €1,000)

Period

Option Exercise price

Floating rate Annual amount

First option Option frequency

2008-2018

Cancellable IRS

4.10%

3M

140,000

15.10.2011

Annual

2018

IRS

2.11%

1M

660,000

2019

IRS

2.37%

1M

800,000

2018-2019

IRS

2.18%

1M

200,000

2020-2022

IRS

2.73%

1M

500,000

2012-2016

IRS

3.60% 3M + 300.5bps

100,000

2014

CAPs bought

4.25%

3M

200,000

2015

CAPs bought

4.25%

3M

200,000

(x €1,000)

31.12.2013

Gross amount of

financial liabilities

recognised

Gross amount

of financial

assets set off

in the financial

statements

Net amount of

financial liabilities

presented in

the financial

statements

Amounts not set off in the

financial statements

Net amount

Financial

instruments

Cash collateral

received

Financial liabilities

CAPs, FLOORs

100,335

100,335

6,394

93,941

IRS

22,069

22,069

9,724

12,345

TOTAL

122,404

122,404

16,118

106,285

These tables present the net positions of the assets and liabilities of the financial instruments per counterparty.

Compensation of the financial assets and liabilities

(x €1,000)

31.12.2013

Gross amount of

financial assets

recognised

Gross amount

of financial

liabilities set off

in the financial

statements

Net amount of

financial assets

presented in

the position of

financial liabilities

Amounts not set off in the

financial statements

Net amount

Financial

instruments

Cash collateral

received

Financial assets

CAPs, FLOORs

6,954

6,954

6,394

560

IRS

12,123

12,123

9,724

2,399

TOTAL

19,077

19,077

16,118

2,959

Liquidity obligation at maturity related to the financial derivatives

(x €1,000)

2013

2012

Between one and two years

-29,280

-35,123

Between two and five years

-43,948

-66,302

Beyond five years

622

-5,783

TOTAL

-72,606

-107,208