\ 167

Notes to the Consolidated Accounts

\ Annual Accounts

Fair value of financial assets and liabilities

1

The financial instruments that are valued, subsequent to their initial recog-

nition, at their fair value on the balance sheet, can be presented according

to three levels (1 to 3), based on the degree to which they are observable:

•

The level 1 fair value measurements are those derived from listed

prices (unadjusted) in active markets for similar assets or liabilities.

•

The level 2 fair value measurements are those derived from data,

other than listed prices included within level 1, that are observable

for the assets or liabilities in question, either directly (i.e. as prices)

or indirectly (i.e. as data derived from prices).

•

The level 3 fair value measurements are those that are not based on

observable market data for the assets or liabilities in question.

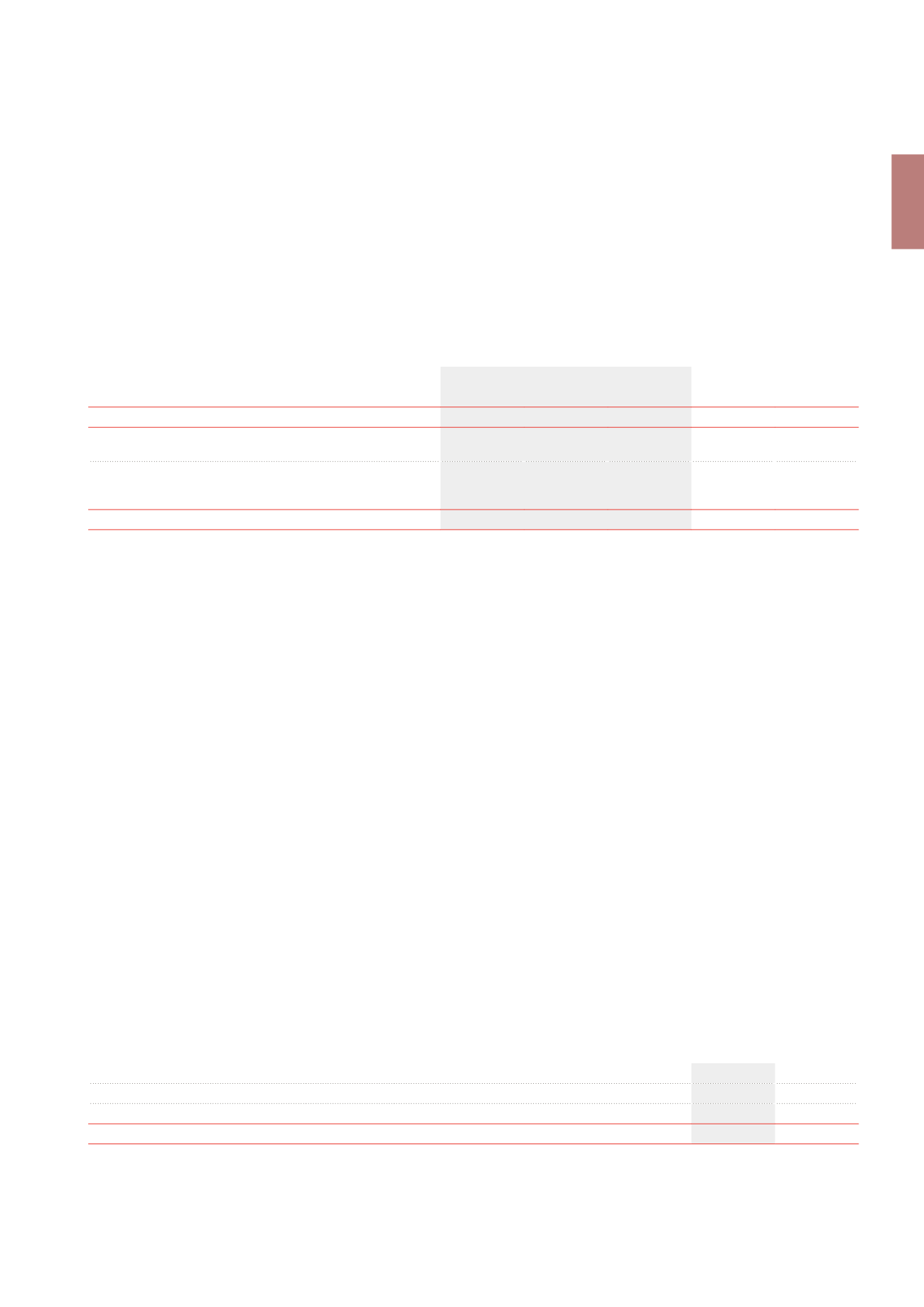

Change in the fair value of the convertible bonds

2013

2012

(x €1,000)

Convertible 1

Convertible 2

Total

Convertible 1

Convertible 2

AT 01.01

177,289

190,820

2

368,109

161,496

N/A

Residual change in the fair value attributable to changes in the

credit risk of the instrument recognised during the financial year

-5,746

-8,673

-14,419

7,937

N/A

Change in the fair value attributable to changes in market

conditions generating a market risk (interest rates, share prices)

during the financial year

6,529

12,916

19,445

7,856

N/A

AT 31.12

178,072

195,063

373,135

177,289

N/A

Level 1

The convertible bonds issued by Cofinimmo are level 1.

At 31.12.2013, the convertible bonds have a total fair value of €373,134,998.

If the bonds are not converted into shares, the redemption value will

amount to €364,147,188 at final maturity.

Level 2

All other financial assets and liabilities and namely the financial deriva-

tives stated at fair value by Cofinimmo are level 2. Their fair value is deter-

mined as follows.

The fair value of financial assets and liabilities with standard terms and

conditions and negotiated on active and liquid markets is determined

based on stock market prices.

The fair value of "trade receivables", "trade debts", "loans to associated

companies" as well as any floating-rate debt is close to their book value.

Bank debts are primarily in the form of roll-over credit facilities drawn over

one month.

The fair value of listed bonds (retail bonds and private placements) is

determined by using reference prices listed in an active market

3

.

The calculation of the fair value of "finance lease receivables" and "swap"

derivatives is based on the discounting of future capital flows at the

appropriate market rates. More details on the finance lease receivables

can be found in Note 24.

The fair value of derivative instruments is calculated based on stock mar-

ket prices. When such prices are not available, analyses of discounted

cash flows based on the applicable yield curve with respect to the

duration of the instruments are used in the case of non-optional deriva-

tives, and option valuation models are used in the case of optional deriva-

tives. Interest rate swaps are valued according to the discounted value of

estimated cash flows in accordance with the yield curves obtained on the

basis of market interest rates.

Level 3

Cofinimmo currently does not hold any financial instrument meeting the

definition of level 3.

B. MANAGEMENT OF FINANCIAL RISK

Interest rate risk

Since the Cofinimmo Group owns a (very) long-term property portfolio, it

is highly probable that the borrowings financing this portfolio will be refi-

nanced upon maturity by other borrowings.

Therefore, the company's total financial debt is regularly renewed for an

indetermined future period.

For reasons of cost efficiency, the Group’s financing policy by debt sep-

arates the raising of borrowings (liquidity and margins on floating rates)

from the management of interest rates risks and charges (fixing and

hedging of future floating interest rates).

Generally, funds are borrowed at a floating rate. Some borrowings con-

tracted at a fixed rate have been converted into a floating rate through

interest rate swaps. The goal of this is to take advantage of low short-term

rates.

1

For more details on the changes which occurred during 2013, and on the composition and conditions of our bonds, we also recommend reading the chapter “Management of Financial

Resources” of this Annual Financial Report.

2

Issue value in June2013.

3

It concerns namely bonds issued in 2004 and 2009 and maturing in 2014. Their valuation comes from Bloomberg.

Allocation of borrowings

(non-current and current)

at floating rate and at fixed rate

(calculated based on their nominal values)

(x €1,000)

2013

2012

Floating-rate borrowings (incl. €200,000 of bonds converted into floating rate)

1,224,150

1,161,721

Fixed-rate borrowings

464,826

578,365

TOTAL

1,688,976

1,740,086