164

/

Annual Accounts /

Notes to the Consolidated Accounts

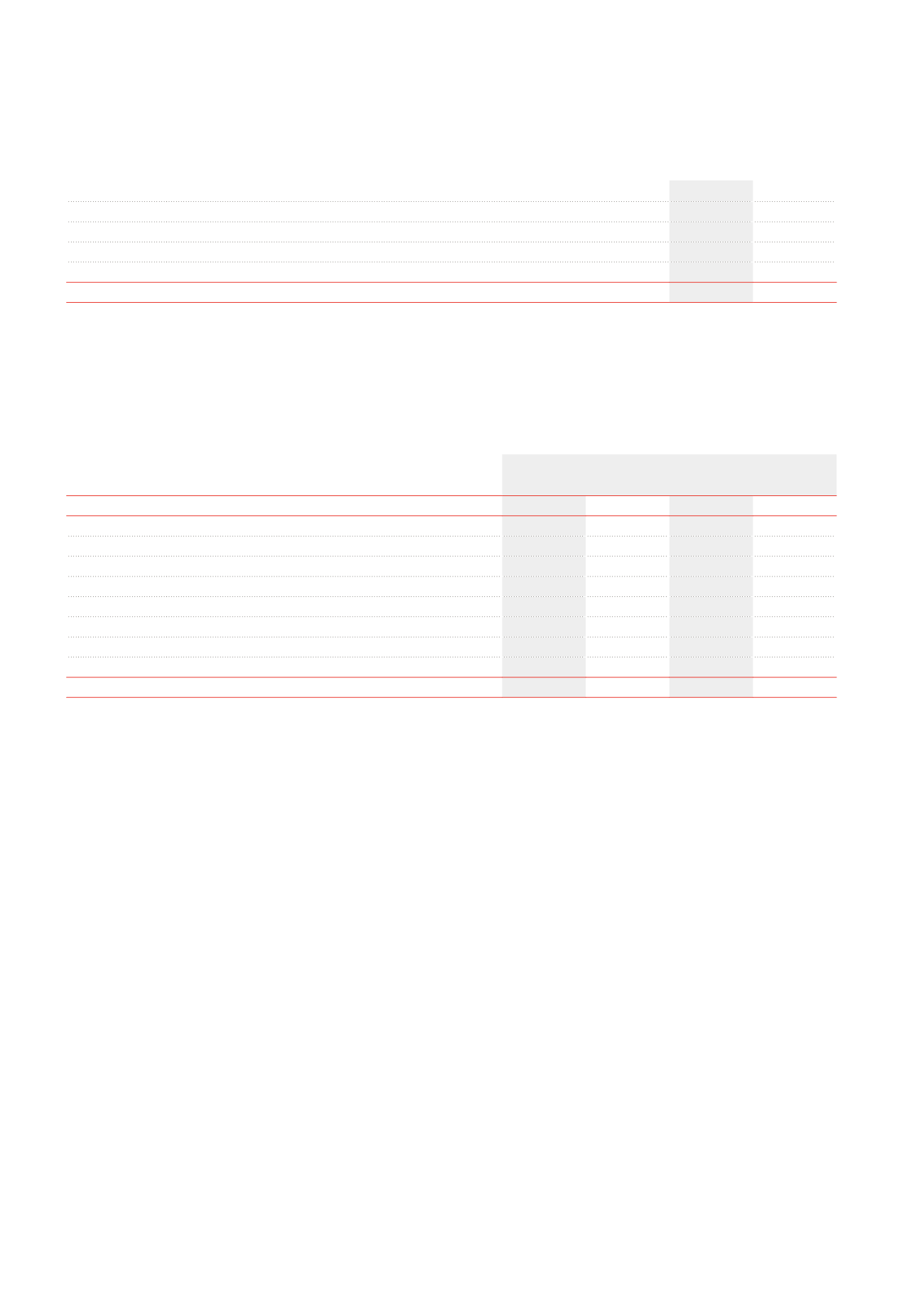

NOTE 21.

BREAKDOWN OF THE CHANGES IN THE FAIR VALUE OF INVESTMENT PROPERTIES

(x €1,000)

2013

2012

Properties available for lease

-8,920

35,485

Development projects

-16,327

-21,377

Assets held for own use

-4

20

Assets held for sale

-1,009

-1,931

TOTAL

-26,260

12,197

This section includes the change in the fair value of investment properties and assets held for sale.

The total portfolio is valued by the experts at 31.12.2013 based on a capitalisation rate of 7.03% applied to the contractual rents increased by the estimated

rental value on unlet space (see the Report of the Real Estate Experts).

NOTE 22.

INTANGIBLE ASSETS AND OTHER TANGIBLE ASSETS

(x €1,000)

Intangible assets

Other tangible assets

2013

2012

2013

2012

AT 01.01

605

745

856

966

Acquisitions of the financial year

477

293

107

163

IT software

477

293

Office fixtures and fittings

107

163

Depreciation of the financial year

329

433

282

273

IT software

329

433

Office fixtures and fittings

282

273

Disposals of the financial year

4

Office fixtures and fittings

4

AT 31.12

753

605

677

856

The intangible assets and other tangible assets are exclusively assets held for own use.

The depreciation rates used depend on the duration of the economic life:

•

fixtures: 10% to 12.5%;

•

IT hardware: 25%;

•

IT software: 25%.