160

/

Annual Accounts /

Notes to the Consolidated Accounts

Valuation methods used

Based on a multi-criteria approach, the valuation methods used by the

real estate experts are the following:

Discounted estimated rental value method

This method involves capitalising the property's estimated rental value by

using a capitalisation rate (yield) in line with the real estate market. The

choice of the capitalisation rate used depends essentially on the capitali-

sation rates applied in the property investment market, taking into consid-

eration the location and the quality of the property and of the tenant at the

valuation date. The rate corresponds to the rate anticipated by potential

investors at the valuation date. The determination of the estimated rental

value takes into account market data, the property's location, it’s quality,

the number of beds for healthcare assets and, if available, the tenant's

financial data (EBITDAR).

The resulting value must be adjusted if the current rent generates an oper-

ating income above or below the estimated rental value used for the cap-

italisation. The valuation also takes into account the costs to be incurred

in the near future.

Discounted cash flow method

This method requires an assessment of the net rental income generated

by the property on an annual basis during a defined period. This flow is

then discounted. The projection period generally varies between 10 and

18 years. At the end of this period, a residual value is calculated using

the capitalisation rate on the terminal value, which takes into account

the building's expected condition at the end of the projection period,

discounted.

Market comparables method

This method is based on the principle that a potential buyer will not pay

more for the acquisition of a property than the price recently paid on the

market for the acquisition of a similar property.

Residual value method

The value of a project is determined by defining what can/will be devel-

oped on the site. This means that the purpose of the project is known or

foreseeable in terms of quality (planning) and quantity (number of square

meters that can be developed, future rents, etc.). The value is obtained by

deducting the costs to completion of the project from its anticipated value.

Other considerations

If the fair value cannot be determined reliably, the properties are valued at

the historical cost. In 2013, the fair value of all properties could be deter-

mined reliably so that no building was valued at historical cost.

In the event that the future selling price of a property is known at the valu-

ation date, the properties are valued at the selling price.

For the buildings for which several valuation methods were used, the fair

value is the average of the results of these methods.

During the year 2013, there was no transfer between level 1, level 2, and

level 3. In addition, there was no change in valuation methods for the

investment properties.

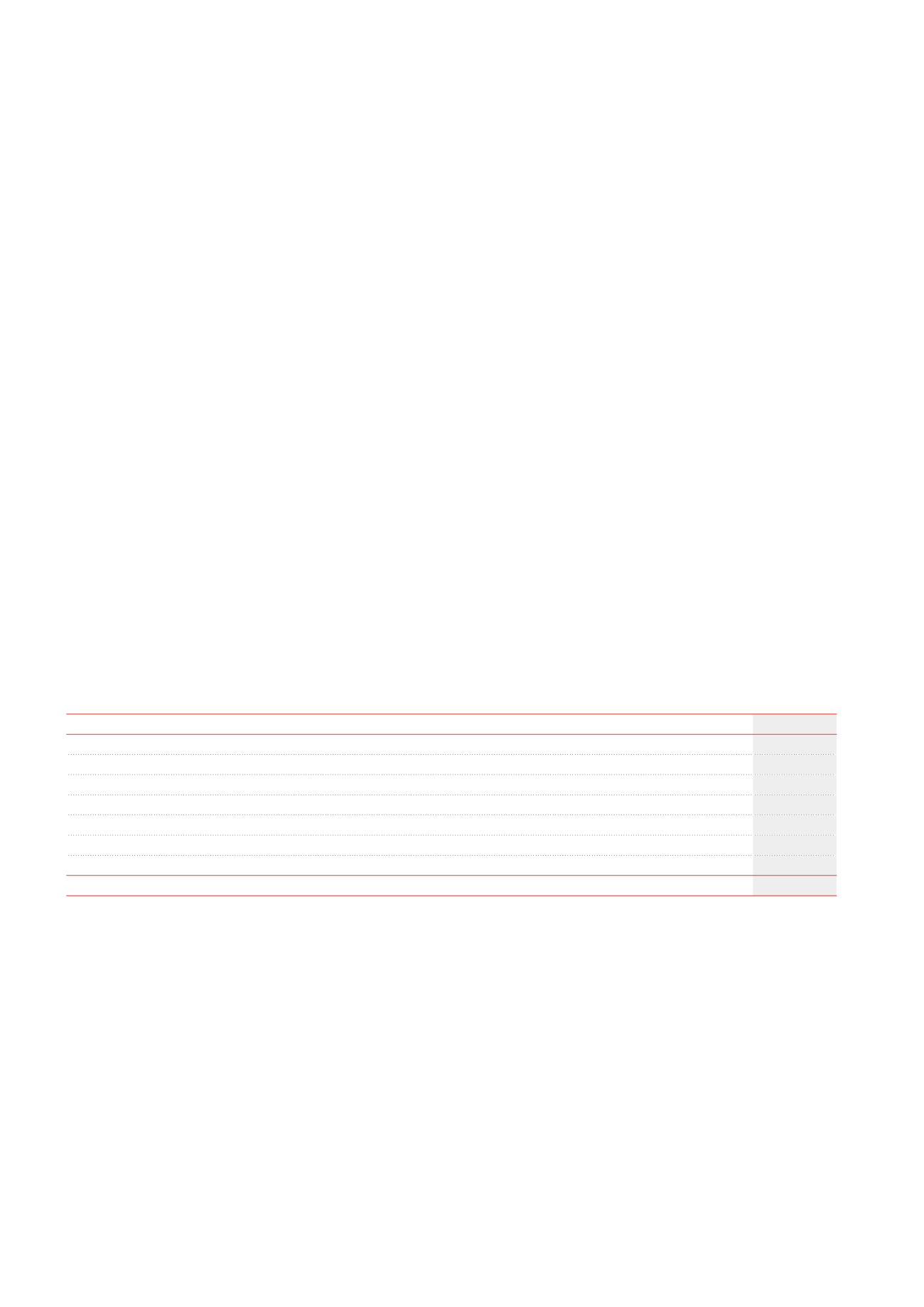

Changes in the fair value of investment properties, based on unobservable data

(x €1,000)

FAIR VALUE AT 31.12.2012

3,308,570

Gains/losses recognised under the income statement

-26,260

Acquisitions

7,412

Extensions/redevelopments

39,474

Investments

13,446

Writeback of lease payments sold

25,276

Disposals

-20,909

Transfers of levels

FAIR VALUE AT 31.12.2013

3,347,009