\ 155

Notes to the Consolidated Accounts

\ Annual Accounts

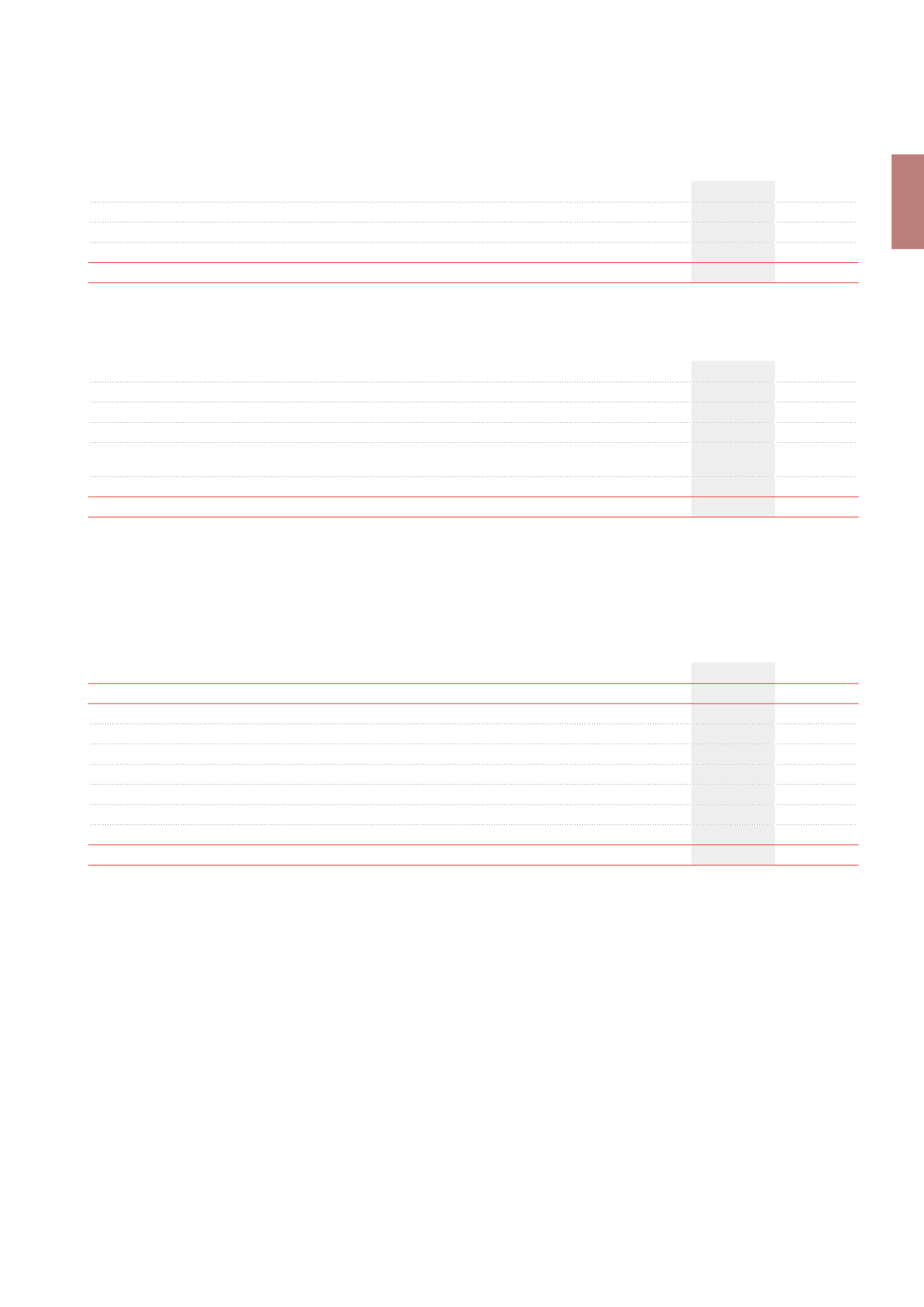

NOTE 16.

OTHER FINANCIAL CHARGES

(x €1,000)

2013

2012

Bank fees and other commissions

357

493

Interests on advance payments

272

8

Other

300

383

TOTAL

929

884

NOTE 17.

CHANGES IN THE FAIR VALUE OF FINANCIAL ASSETS AND LIABILITIES

(x €1,000)

2013

2012

Authorised hedging instruments qualifying for hedge accounting

643

1

11,080

Authorised hedging instruments not qualifying for hedge accounting

13,153

2

-18,536

Convertible bonds

-5,026

-15,793

Impact of the recycling under the income statement of hedging instruments which relationship with the hedged risk

was terminated

-20,501

Other

-1,955

-1,095

TOTAL

-13,686

-24,344

Only the changes in the ineffective part of the fair value of cash flow hedging instruments, as well as the changes in the fair value of trading instruments,

are taken into account here. The changes in the effective part of the fair value of cash flow hedging instruments are booked directly under equity.

When a relationship between a cash flow hedging instrument and the hedged risk is terminated (even partially), the cumulated gain or loss at that date,

until then deferred under equity, is recycled under the income statement.

NOTE 18.

CORPORATE TAX AND EXIT TAX

(x €1,000)

2013

2012

CORPORATE TAX

2,179

4,273

Parent company

378

1,417

Pre-tax result

56,601

98,208

Result exempted from income tax due to the Sicafi/Bevak regime

-56,601

-98,208

Taxable result from non-deductible costs

3,721

3,710

Tax at rate of 33.99%

1,265

1,261

Other

-887

156

Subsidiaries

1,801

2,856

EXIT TAX - SUBSIDIARIES

-618

596

The non-deductible costs mainly comprise the office tax in the Brussels Capital Region. The item “Other” mainly comprises taxes related to merged com-

panies. With the exception of the institutional Sicafis/Bevaks, the Belgian subsidiaries do not benefit from the Sicafi/Bevak regime. The Dutch subsidiary

Pubstone Properties BV does not benefit from the FBI regime.

1

The gross amounts are respectively an income of k€2,051 and a charge of k€1,408.

2

The gross amounts are respectively an income of k€15,715 and a charge of k€2,562.