154

/

Annual Accounts /

Notes to the Consolidated Accounts

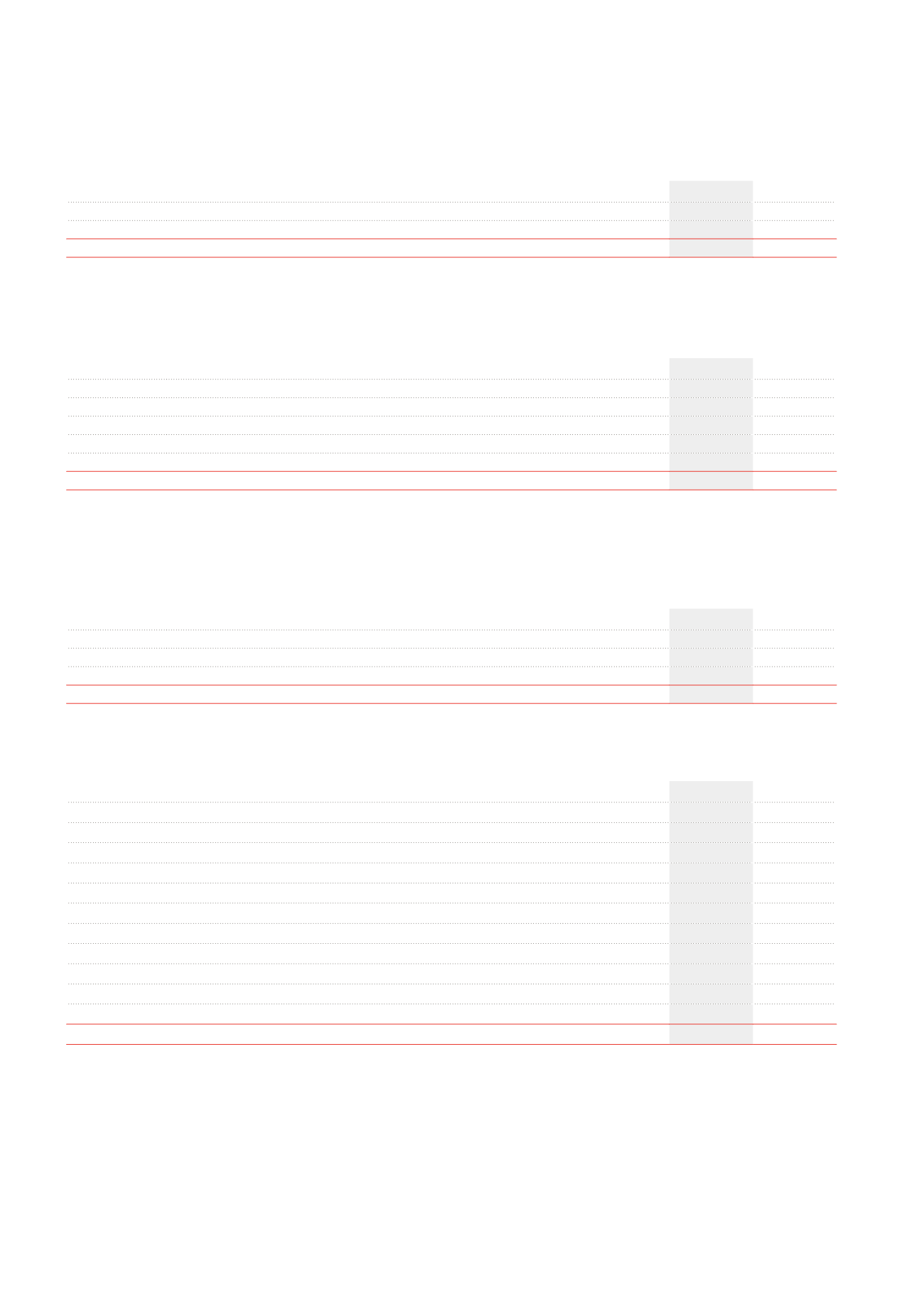

NOTE 12.

CHANGES IN THE FAIR VALUE OF INVESTMENT PROPERTIES

(x €1,000)

2013

2012

Positive changes in the fair value of investment properties

26,659

93,875

Negative changes in the fair value of investment properties

-52,919

- 81,678

TOTAL

-26,260

12,197

The breakdown of the changes in the fair value of properties is presented in Note 21.

NOTE 15.

NET INTEREST CHARGES

(x €1,000)

2013

2012

Nominal interests on loans at amortised cost

30,251

25,156

Bilateral loans - floating rate

7,174

8,876

Syndicated loans - floating rate

272

778

Commercial papers - floating rate

902

2,966

Investment credits - floating or fixed rate

1,262

1,544

Bonds - fixed rate

16,709

7,286

Other interest charges

4

3,932

3,706

Nominal interests on loans at fair value through the net result

35,792

39,052

Convertible bonds

7,423

5,436

Authorised hedging instruments qualifying for hedge accounting

23,187

28,948

Authorised hedging instruments not qualifying for hedge accounting

5,182

4,668

TOTAL

66,043

64,208

The effective interest charges on loans correspond to an average effective interest rate on loans of 3.92% (2012: 4.11%

5

). The effective charges without

taking into account the hedging instruments stands at 2.23%. This percentage can be split up between 2.70% for the borrowings at fair value and 2.14%

for the borrowings at amortised cost.

NOTE 14.

FINANCIAL INCOME

(x €1,000)

2013

2012

Interests and dividends received

3

1,772

2,290

Interest receipts from finance leases and similar receivables

3,598

3,176

Other financial income

353

93

TOTAL

5,723

5,559

NOTE 13.

OTHER RESULT ON THE PORTFOLIO

(x €1,000)

2013

2012

Changes in the deferred taxes

1

-312

-181

Writeback of rents already earned but not expired

-2,071

-2,644

Changes in the fair value of other non-financial assets

-5

Goodwill impairment

2

-21,000

-7,100

Other

705

-1,517

TOTAL

-22,683

-11,442

The writeback of already earned rents not expired, recognised during the period, results from the application of the accounting method detailed in Note 2,

paragraph R.

1

See Note34.

2.

See Note19.

3.

The amount of dividends received is nil at 31.12.2013.

4.

This amount is made up of k€3,087 of fees on unused credit and k€845 of fees on credit line drawings.

5.

Until the end of 2012, the calculation of the average interest rate on borrowings included the depreciation costs of hedging instruments pertaining to the period. As a result of the

restructuration of the hedging scheme during 2013, the method used for the calculation of the average interest rate on borrowings has been reviewed and no longer includes these

costs. If this calculation method had been applied at 31.12.2012, the average interest rate on borrowings would have stood at 3.77% instead of 4.11%.