\ 157

Notes to the Consolidated Accounts

\ Annual Accounts

1

Including goodwill.

2

As the value in use is greater than the net book value, the net book value is presented here.

3

Including the fair value of buildings which receivables were sold, which stands at k€421,574.

residual value is calculated. The disposal price of the properties and the

residual value are based on the average value per square meter of the

portfolio determined by the expert on 31.12.2013, plus a 20% margin as

from the fourth year, and indexed. This margin is based on the realised

gains observed on the sale of cafés/restaurants since the acquisition of

the Pubstone portfolio. The disposal of cafés/restaurants realised at mar-

ket conditions similar to the asumptions taken into account for the calcu-

lation of the value in use, i.e. that only the cafés/restaurants vacated by AB

InBev are sold, showed a 30% gain versus the last value of the real estate

expert. Out of caution, no margin is taken into account during the first

three years and the 20% margin taken into account afterwards is lower

than the average margin observed since the acquisition of the portfolio.

The indexation considered for these cash flows stands at 2% per year.

The discount rate used amounts to 6.50%.

Assumptions used in the calculation of the value in use

of Cofinimmo Investissements et Services

A projection of future net cash flows was drawn up over 27 years. The

assumption adopted is the renewal of all the leases during a 27-year

period from the acquisition date.

The cash flow comprises the present indexed rent up to the date of the

first renewal of the lease. After this date, the cash flow considered is the

indexed allowable rent. Cash expenditures foreseen in the buildings’ ren-

ovation plan are also taken into account. Allowable rents are rents esti-

mated by the expert, stated in his portfolio valuation at 31.12.2013, which

are considered sustainable in the long term in terms of the profitability of

the activity of the operating tenant.

At the 28th year, a residual value is calculated per property.

The indexation considered for these cash flows stands at 2% per year.

The discount rate used amounts to 6.50%.

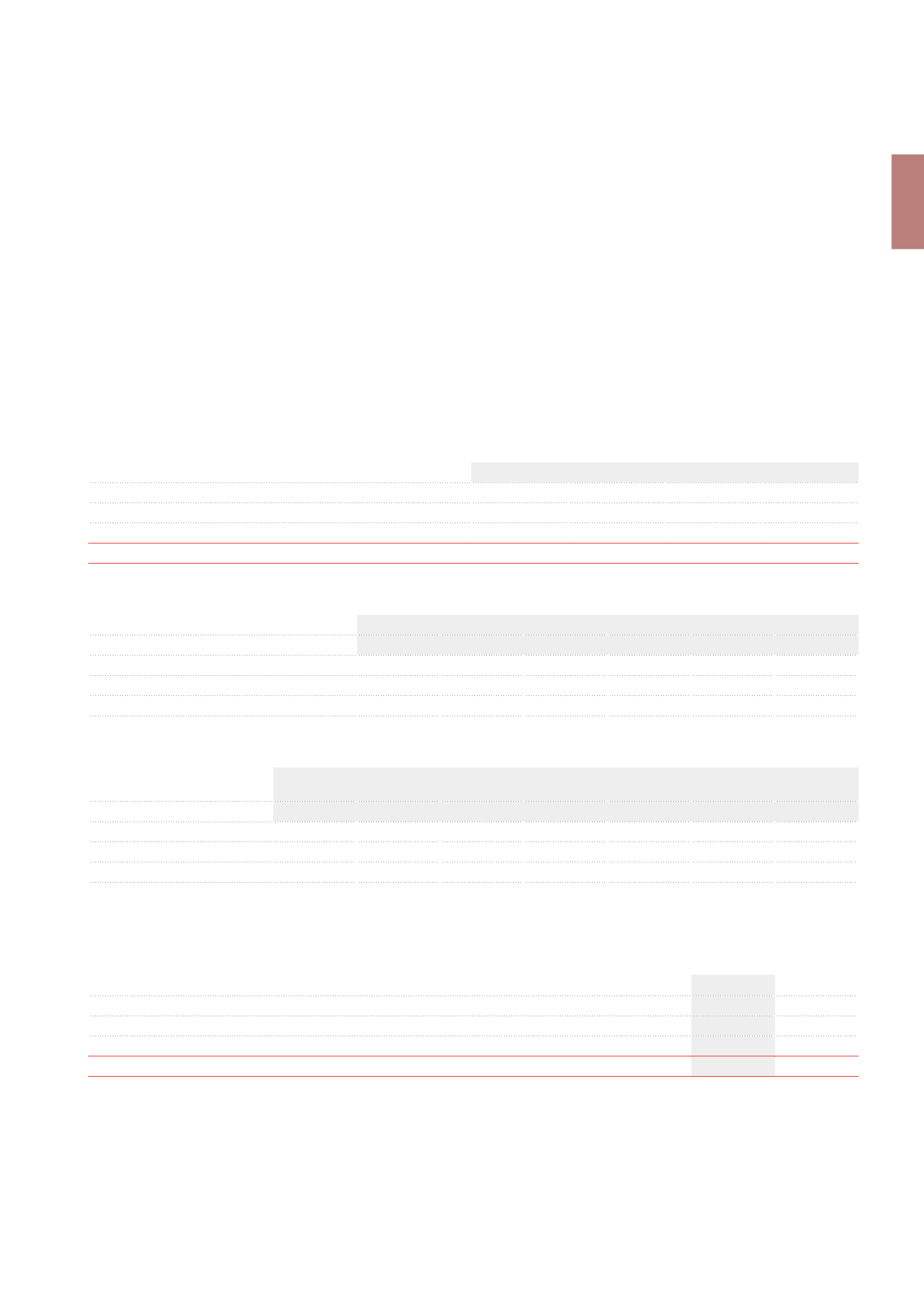

NOTE 20.

INVESTMENT PROPERTIES

(x €1,000)

2013

2012

Properties available for lease

3,199,030

3,156,893

Development projects

130,533

131,857

Assets held for own use

9,146

9,150

TOTAL

3,338,709

3

3,297,900

The fair value of the portfolio, as determined by the independent experts, stands at k€3,347,009 at 31.12.2013. It includes investment properties for

k€3,338,709 and assets held for sale for k€8,300.

(x €1,000)

Building group

Goodwill

Net book value

1

Value in use

Impairment

Pubstone Belgium

85,777

358,019

339,020

-19,000

Pubstone Netherlands

37,650

188,300

186,300

-2,000

CIS France

26,929

247,090

247,090

2

TOTAL

150,356

793,410

772,410

-21,000

Sensitivity analysis of the value in use when the main variables of the impairment test vary

Change in the value in use (%)

Building group

Changes in inflation

Changes in discount rate

Changes in margin

+0.50%

-0.50%

+0.50%

-0.50%

+5.00%

-5.00%

Pubstone Belgium

6.27%

-5.78%

-5.95%

6.52%

1.69%

-1.69%

Pubstone Netherlands

6.29%

-5.80%

-5.96%

6.53%

1.50%

-1.50%

CIS France

6.72%

-6.14%

-5.90%

6.49%

/

/

Sensitivity analysis of the impairment when the main variables of the impairment test vary

Impairment (x €1,000)

Building group

Impairment

booked

Changes in inflation

Changes in discount rate

Changes in margin

+0.50%

-0.50%

+0.50%

-0.50%

+5.00%

-5.00%

Pubstone Belgium

-19,000

0

-38,518

-39,114

0

-13,188

-24,669

Pubstone Netherlands

-2,000

0

-12,558

-12,869

0

0

-4,538

CIS France

0

0

-957

-332

0

/

/