\ 161

Notes to the Consolidated Accounts

\ Annual Accounts

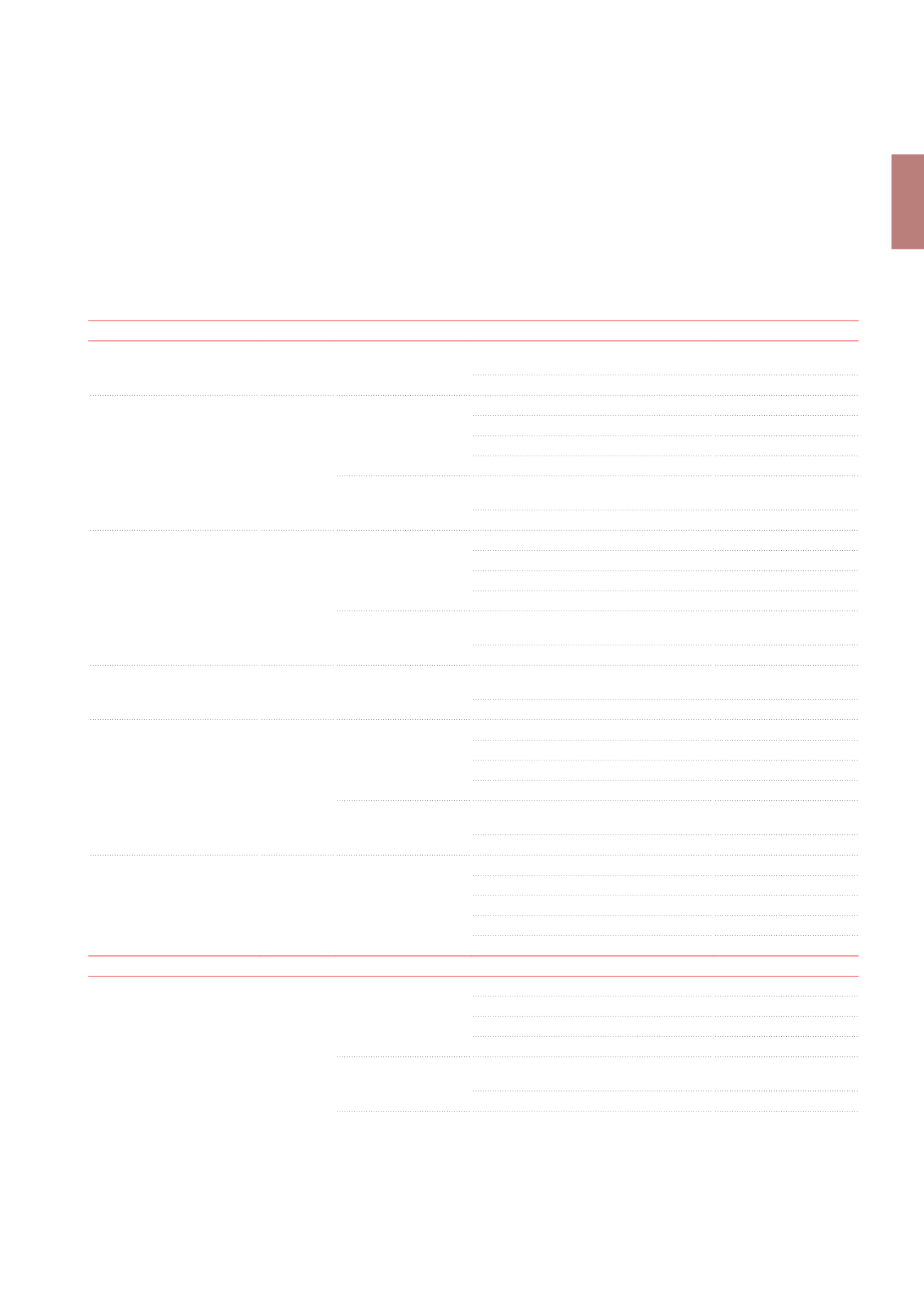

Quantitative information related to the determination of the fair value of investment properties,

based on unobservable data (level 3)

The quantitative information in the following tables is taken from the different reports produced by the independent real estate experts. The figures are

extreme values and the weighed average of the asumptions used in the determination of the fair value of investment properties. The lowest discount

rates apply to specific situations.

(x €1,000)

Asset category

Fair value at

31.12.2013

Valuation method

Unobservable data (a)

Extreme values (weighted

average)

OFFICES

1,524,811

Antwerp

61,847 Discounted estimated

rental value

Estimated rental value (ERV)

117 - 162 (142)€/m²

Capitalisation rate

7.10% - 8.65% (8.11%)

Brussels CBD

548,569 Discounted cash flow

Estimated rental value (ERV)

195 - 277 (246)€/m²

Discount rate

0.50% - 4.60% (3.44%)

Capitalisation rate of the final net ERV

6.05% - 6.90% (6.44%)

Inflation rate

2.00%

Discounted estimated

rental value

Estimated rental value (ERV)

162 - 277 (213)€/m²

Capitalisation rate

5.30% - 7.20% (5.80%)

Brussels Decentralised

582,029 Discounted cash flow

Estimated rental value (ERV)

145 - 152 (148)€/m²

Discount rate

1.55% - 8.00% (3.91%)

Capitalisation rate of the final net ERV

6.40% - 8.00% (6.99%)

Inflation rate

2.00%

Discounted estimated

rental value

Estimated rental value (ERV)

70 - 190 (160)€/m²

Capitalisation rate

5.80% - 8.75% (7.32%)

Brussels Periphery/

Satellites

143,336 Discounted estimated

rental value

Estimated rental value (ERV)

50 - 178 (138)€/m²

Capitalisation rate

5.75% - 9.00% (7.80%)

Other Regions

111,323 Discounted cash flow

Estimated rental value (ERV)

114 - 141 (117)€/m²

Discount rate

4.65% - 8.00% (5.78%)

Capitalisation rate of the final net ERV

6.45% - 8.00% (6.65%)

Inflation rate

2.00%

Discounted estimated

rental value

Estimated rental value (ERV)

114 - 141 (124)€/m²

Capitalisation rate

5.70% - 7.25% (6.35%)

Offices under development

77,707 Residual value

Estimated rental value (ERV)

99 - 225 (192)€/m²

Capitalisation rate of the final net ERV

5.76% - 9.35% (6.06%)

Costs to completion

(b)

Inflation rate

2.00%

HEALTHCARE REAL ESTATE

1,228,245

Belgium

747,969 Discounted cash flow

Estimated rental value (ERV)

52 - 189 (116)€/m²

Discount rate

6.25% - 7.70% (6.89%)

Capitalisation rate of the final net ERV

6.75% - 9.25% (7.73%)

Inflation rate

2.00%

Discounted estimated

rental value

Estimated rental value (ERV)

52 - 189 (116)€/m²

Capitalisation rate

5.65% - 7.00% (6.11%)

(a)

The net rental income is detailed in Note5.

(b)

The costs required for the completion of a property are specific to each project and depend on the degree of progress of the works.