\ 165

Notes to the Consolidated Accounts

\ Annual Accounts

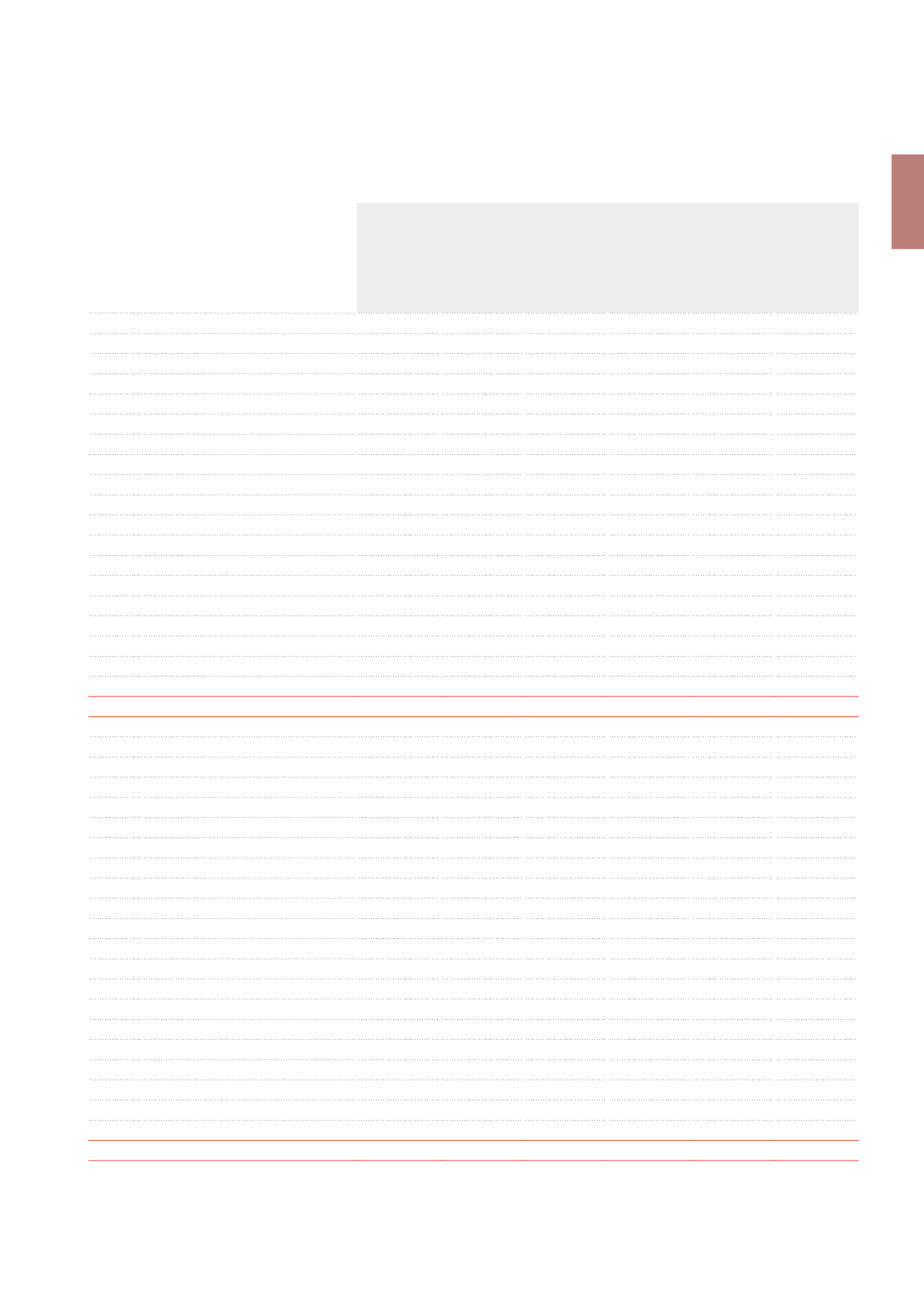

NOTE 23.

FINANCIAL INSTRUMENTS

A. CATEGORIES AND DESIGNATION OF FINANCIAL INSTRUMENTS

(x €1,000)

31.12.2012

Designated

in a hedging

relationship

Designated

at fair value

through the

net result

Held for

trading

Loans,

receivables

and financial

liabilities at

amortised

cost

Fair value

Fair value

qualification

Non-current financial assets

Hedging instruments

CAPs

8,009

8,009

Level 2

FLOORs

IRS

11,069

11,069

Level 2

Credits and receivables

Loans to associated companies

5,594

5,594

Level 2

Non-current finance lease receivables

53,396

81,112

Level 2

Trade receivables and other non-current assets

97

97

Level 2

Current financial assets

Hedging instruments

CAPs

15

15

Level 2

FLOORs

IRS

6,486

6,486

Level 2

Credits and receivables

Loans to associated companies

Current finance lease receivables

2,973

4,516

Level 2

Trade receivables

22,636

22,636

Level 2

Cash and cash equivalents

3,041

3,041

Level 2

TOTAL

8,024

11,069

6,486

87,737

142,575

Non-current financial liabilities

Non-current financial debts

Bonds

401,229

393,833

Level 2

Commercial papers - fixed rate

15,000

15,000

Level 2

(Mandatory) Convertible bonds

177,289

177,289

Level 1

Bank debts

781,621

781,621

Level 2

Other non-current financial liabilities

CAPs

3,669

3,669

Level 2

FLOORs

154,132

154,132

Level 2

IRS

32,062

32,062

Level 2

Current financial liabilities

Current financial debts

Commercial papers - floating rate

321,750

321,750

Level 2

Bank debts

16,171

16,171

Level 2

Other current financial liabilities

CAPs

6

6

Level 2

FLOORs

7,129

7,129

Level 2

IRS

5,760

5,760

Level 2

Other financial debts

26,428

26,428

Level 2

Trade debts

64,560

64,560

Level 2

TOTAL

157,807

578,518

44,951

1,225,530

1,999,411