170

/

Annual Accounts /

Notes to the Consolidated Accounts

For the years 2013 to 2017, Cofinimmo projects to maintain a property port-

folio partially financed through debt. The company will thus owe an inter-

est flow to be paid, which forms the element covered by the derivative

financial instruments described above.

At 31.12.2013, Cofinimmo has a debt of €1,244 million which is covered by

derivative instruments such as cash flow hedging instruments. Based

on future projections, this debt will amount to €1,288 million at 31.12.2014,

€1,344 million at the end of 2015 and €1,442 million at the end of 2016

1

.

Fair value hedges

Cofinimmo Luxemburg has contracted an Interest Rate Swap whereby

the company pays the Euribor three months +0.80% and receives a fixed

interest rate of 5.25% corresponding to the payable coupon related to the

€100 million bond maturing on 15.07.2014 that it issued in 2004.

Cofinimmo SA/NV has contracted an Interest Rate Swap whereby the com-

pany pays the Euribor three months +2.22% and receives a fixed interest

rate of 5.00% corresponding to the payable coupon related to the €100mil-

lion bond maturing on 25.11.2014 that it issued in 2009.

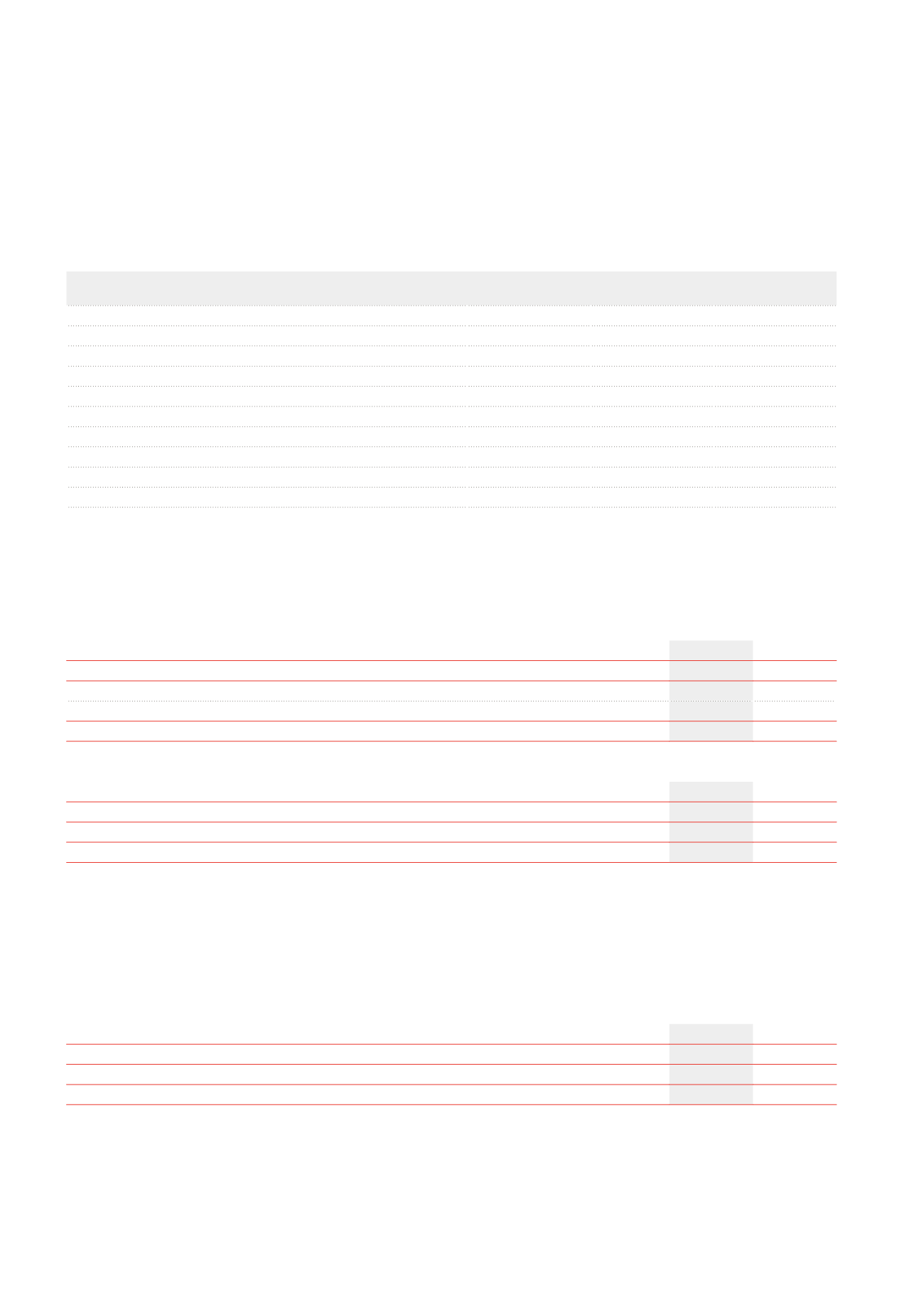

Effective part of the changes in the fair value of the derivative financial instruments, qualified as cash flow hedge

(x €1,000)

2013

2012

AT 01.01

-157,113

-116,379

Changes in the effective part of the changes in the fair value of derivative financial instruments

29,613

-51,009

Transfer to the income statement of the intrinsic value of derivative financial instruments active during the period

27,679

634

AT 31.12

-99,821

-166,754

Ineffective part of the changes in the fair value of the derivative financial instruments, qualified as cash flow hedge

(x €1,000)

2013

2012

AT 01.01

-20,942

-9,862

Changes in the ineffective part of the changes in the fair value of derivative financial instruments

619

-11,080

AT 31.12

-20,323

-20,942

Cash flow hedge

Period

Option

Exercise price

Notional amount

(x €1,000)

2013

CAP bought

3.75%

1,000,000

2014

CAP bought

4.25%

1,000,000

2015

CAP bought

4.25%

1,000,000

2016

CAP bought

4.25%

1,000,000

2017

CAP bought

4.25%

1,000,000

2013

FLOOR sold

3.00%

1,000,000

2014

FLOOR sold

3.00%

1,000,000

2015

FLOOR sold

3.00%

1,000,000

2016

FLOOR sold

3.00%

1,000,000

2017

FLOOR sold

3.00%

1,000,000

Change in the fair value of the fair value hedging instruments

(x €1,000)

2013

2

2012

AT 01.01

11,069

11,488

Changes in the fair value of the fair value hedging instruments

-6,806

-418

AT 31.12

4,263

11,070

At 31.12.2013, Cofinimmo had a floating-rate debt for a notional amount of

€1,224 million. This amount was hedged against interest rate risks with

CAPs for a notional amount of €1.0 billion, FLOORs sold forming a collar

with CAPs for a notional amount of €1.0 billion, and Interest Rate Swaps for

a notional amount of €140 million.

The value of the CAPs effective from 15.01.2013 to 15.01.2014 was zero for

an exercise price at 3.75%, far above the Euribor three months, which

amounted to 0.287% at 31.12.2013.

1

Cofinimmo took advantage of the low interest rates to refinance with fixed-rate instruments instead of floating-rate instruments. FLOORs were cancelled to avoid overhedging. CAPs,

which are out-of-the-money and have a value of €0, give an exercise right, not an exercise obligation, and were not cancelled.

2

The important “Changes in the fair value of the fair value hedging instruments” in 2013 is the result of the fact that a bond swapped into floating rate with a nominal value of €50 million

was replaced by a fixed-rate bond with a nominal value of €50 million.