\ 169

Notes to the Consolidated Accounts

\ Annual Accounts

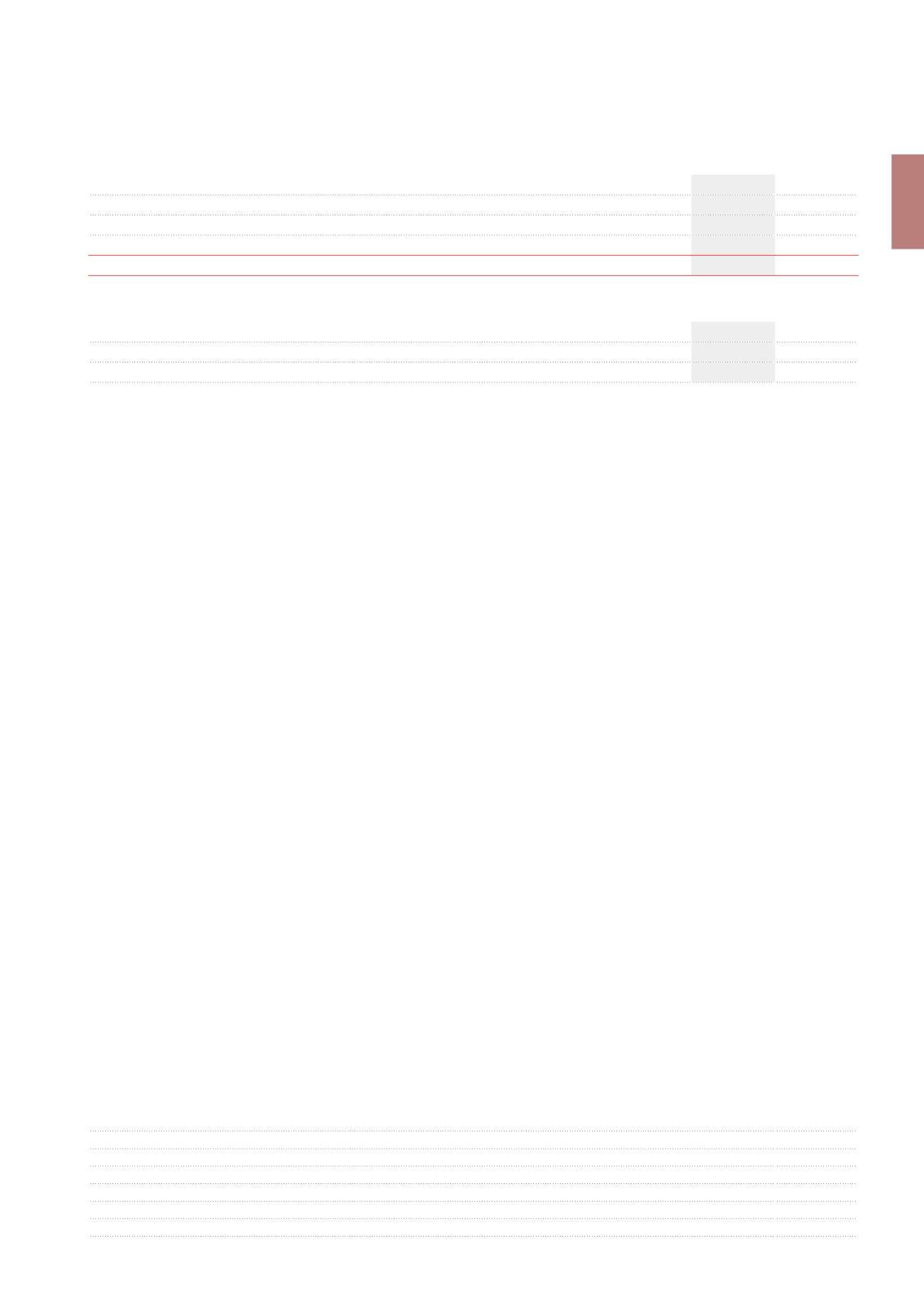

Liquidity obligation at maturity related to non-current loans

(contractual flows and non-discounted interests)

(x €1,000)

2013

2012

Between one and two years

268,546

651,690

Between two and five years

889,945

457,193

Beyond five years

153,422

280,000

TOTAL

1,311,912

1,388,883

Undrawn long-term credit facilities

(x €1,000)

2013

2012

Expiring within one year

50,000

Expiring after one year

614,400

669,400

Collateralisation

The book value of the pledged financial assets stands at €38,832,250 at

31.12.2013.

The terms and conditions of the pledged financial assets are detailed in

Note 40.

During 2013, there were no payment defaults on loan agreements, nor vio-

lations of the terms of these agreements.

C. HEDGING DERIVATIVE FINANCIAL INSTRUMENTS

The Group uses derivative financial instruments (Interest Rate Swaps, pur-

chase of CAP options, sale of FLOOR options) to hedge its exposure to

interest rate risks arising from its operational, financing and investment

activity.

Type of hedging derivative financial instruments

CAP

A CAP is an interest rate option. The buyer of a CAP buys the right to pay

a maximum interest rate during a specific period. He only exercises this

right if the actual short-term rate exceeds the CAP’s maximum interest rate

level. In order to buy a CAP, the buyer pays a premium to the counterparty.

By buying a CAP, Cofinimmo obtains a guaranteed maximum rate. The CAP

therefore hedges against unfavourable rate increases.

FLOOR

The seller of a FLOOR sells the right to benefit from a minimum interest

rate during a specific period and will thus have to pay this rate to the

buyer, even if it is higher than the market rate. By selling a FLOOR, the seller

receives a premium from the buyer.

Through the combination of the purchase of a CAP and the sale of a FLOOR,

Cofinimmo ensures itself of an interest rate that is fixed in a corridor (inter-

est rate collar) between a minimum rate (the rate of the FLOOR) and a max-

imum rate (the rate of the CAP), while limiting the cost of the premium paid

for this insurance.

For 2014, this corridor is fixed between 3.00% and 4.25% for an amount of

€1.0 billion.

The bought CAP options and sold FLOOR options are detailed below.

Interest Rate Sw

ap (IRS)

An Interest Rate Swap (IRS) is an interest rate forward contract, unlike a

CAP or a FLOOR, which are interest rate options. With an IRS, Cofinimmo

exchanges a floating interest rate against a fixed interest rate or vice

versa.

As part of its hedging policy of financial charges, Cofinimmo has con-

tracted Interest Rate Swaps to exchange floating rates against fixed rates.

With regard to its two bonds issued in 2004 and 2009 at a fixed rate,

Cofinimmo has contracted Interest Rate Swaps in order to exchange the

fixed rates against floating rates. Both these Swaps are designated as

cash flow hedging. The €140million bond issued in 2012 was partially con-

verted from a fixed rate to a floating rate; the Swap, with a nominal value of

€100 million, is designated as held for trading. The increase in the floating

rates is hedged via the CAP options bought by the Group.

The combination of these IRS contracts and CAP options bought allows

Cofinimmo to benefit from the decreasing interest rates (compared to the

initial fixed rates of the bonds) whilst protecting itself against an increase

of these rates via the CAP options. The IRS contracts are detailed in the

table on page 171.

Cancellable Interest Rate Swap

A Cancellable Interest Rate Swap is a classic IRS that also contains a

cancellation option for the bank as from a certain date. Cofinimmo has

contracted Cancellable Interest Rate Swaps to exchange floating inter-

est rates against fixed interest rates. The sale of this cancellation option

allowed to reduce the guaranteed fixed rates during the period covering at

least the first cancellation date.

The Cancellable Interest Rate Swaps are detailed in the table on page 171.

In accordance with its financial policy, the Group does not hold nor issue

derivative financial instruments for trading purposes. However, derivatives

that do not qualify for hedge accounting are accounted for as trading

instruments.

Floating-rate borrowings at 31.12.2013 hedged by derivative financial

instruments

The floating-rate debt (€1,224 million) is obtained by deducting from the

total debt (€1,722million) the elements of the debt which remained at fixed

rate after taking into account the Interest Rate Swaps, as detailed in the

table below:

(x €1,000)

Financial debts

1,722,174

Convertible bonds

-373,135

Fixed-rate bonds

-90,000

Mandatory Convertible Bonds (MCB)

-4,196

Fixed-rate borrowings

-10,726

Other

-19,967

Floating-rate borrowings hedged by derivative financial instruments

1,224,150