COFINIMUR I: INSURANCE AGENCIES

In December 2011, Cofinimmo SA/NV and Foncière ATLAND, acting in part-

nership and on behalf of the subsidiary Cofinimur I SA/NV, acquired a

283-asset portfolio from the MAAF insurance group, comprising 265 retail

branches, 15 office buildings and three mixed-use buildings (retail/offices).

All these buildings are let for an initial average term of 9.7

1

years to MAAF, a

subsidiary of the French insurance group Covéa, which has a total network

of 587 branches throughout the French territory. These branches are run

by MAAF employees.

Foncière ATLAND REIM

2

is in charge of the asset and property manage-

ment of the entire portfolio on behalf of the acquisition structure held

jointly by Cofinimmo SA/NV and Foncière ATLAND.

In order to finance part of the acquisition of the MAAF branches, Cofinimur

I issued Mandatory Convertible Bonds (MCB) for a total amount of

€52.0 million. The conditions attached to these bonds are described on

page 48 of the 2011 Annual Financial Report.

In 2013, the in-house operational teams took on a number of projects,

including:

•

the configuration of the SAP software for the rendering of charges;

•

the update of the on-line database for the daily management of the

283 sites (Shareholders’ Meetings, inventories of fixtures at entry,

plans, works, etc.);

•

the validation and tracking of requests relating to around forty

“Agence 2010” works files (part of the €80 million works budget

agreed with MAAF at the time of the acquisition);

•

the sale of five assets which were unlet at the time of the acquisition

or under a one-year tenancy-at-will lease;

•

the complete renovation of the Compiègne branch, with a view to

reletting it to MMA

3

;

•

the operational follow-up via visits of around 175 branches.

1

Residual fixed term of 7.8 years at 31.12.2013.

2

REIM: Real Estate Investment Management.

3

A mutual insurance company, formerly known as “Mutuelles du Mans”, part of the Covéa Group.

4

See also our press release dated 21.12.2011, available on the website

www.cofinimmo.com.Cofinimur I - France

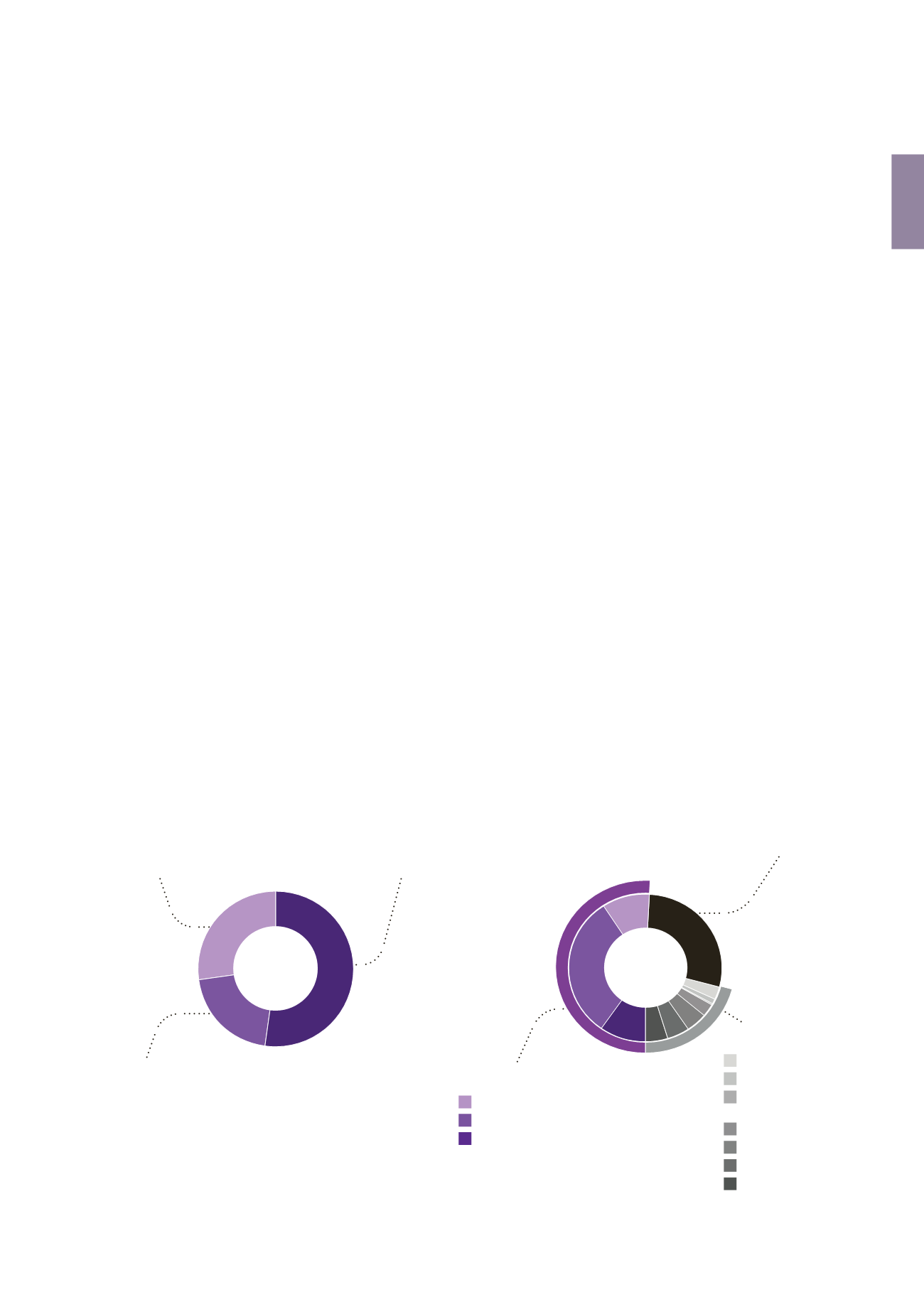

20.7%

Pubstone - Belgium

52.3%

Pubstone - Netherlands

27.0%

Breakdown by rent - by country

(in %)

Breakdown by urban location - in fair value

(in %)

Netherlands (Pubstone)

28.3%

Belgium (Pubstone)

51.1%

Walloon Region

9.9%

Flemish Region

31.1%

Brussels Capital Region

10.1%

SECTOR INFORMATION

Acquisitions

In November 2013, Cofinimmo acquired two insurance agency branches

in France (Oullins and Corbeil-Essonnes) for a total gross amount of

€0.6 million. This amount is in line with the investment value of the assets

as determined by the independent real estate expert. The two branches

are let to MAAF for a fixed nine-year term and offer a gross rental yield of

7.59% for the Oullins agency and 7.88% for the Corbeil-Essonnes agency.

Disposals

During 2013, Cofinimmo also sold five insurance agency branches in

France, located in Avignon, Noisiel, Marseille, Riom and Vernon, for a total

gross amount of €1.5 million. This amount is greater than the investment

value of the properties as determined by an independent real estate

expert at 31.12.2012.

When Cofinimmo acquired the MAAF portfolio, five of the 265 branches

were vacant and five others were under a one-year tenancy-at-will lease

4

.

At the publication date of this Annual Financial Report, seven of these ten

assets at risk have been sold. The realised gains on these sales amount

on average to 5% of the last investment value as determined by the inde-

pendent real estate expert.

France (Cofinimur I)

20.6%

English Channel coast

2.7%

Mediterranean coast

1.1%

Overseas departments (DOM)

and territories (TOM)

0.4%

Major cities

2.7%

Paris Region

4.4%

Provincial towns

4.6%

Rural areas

4.7%

\ 47

Property of Distribution Networks

\ Management Report