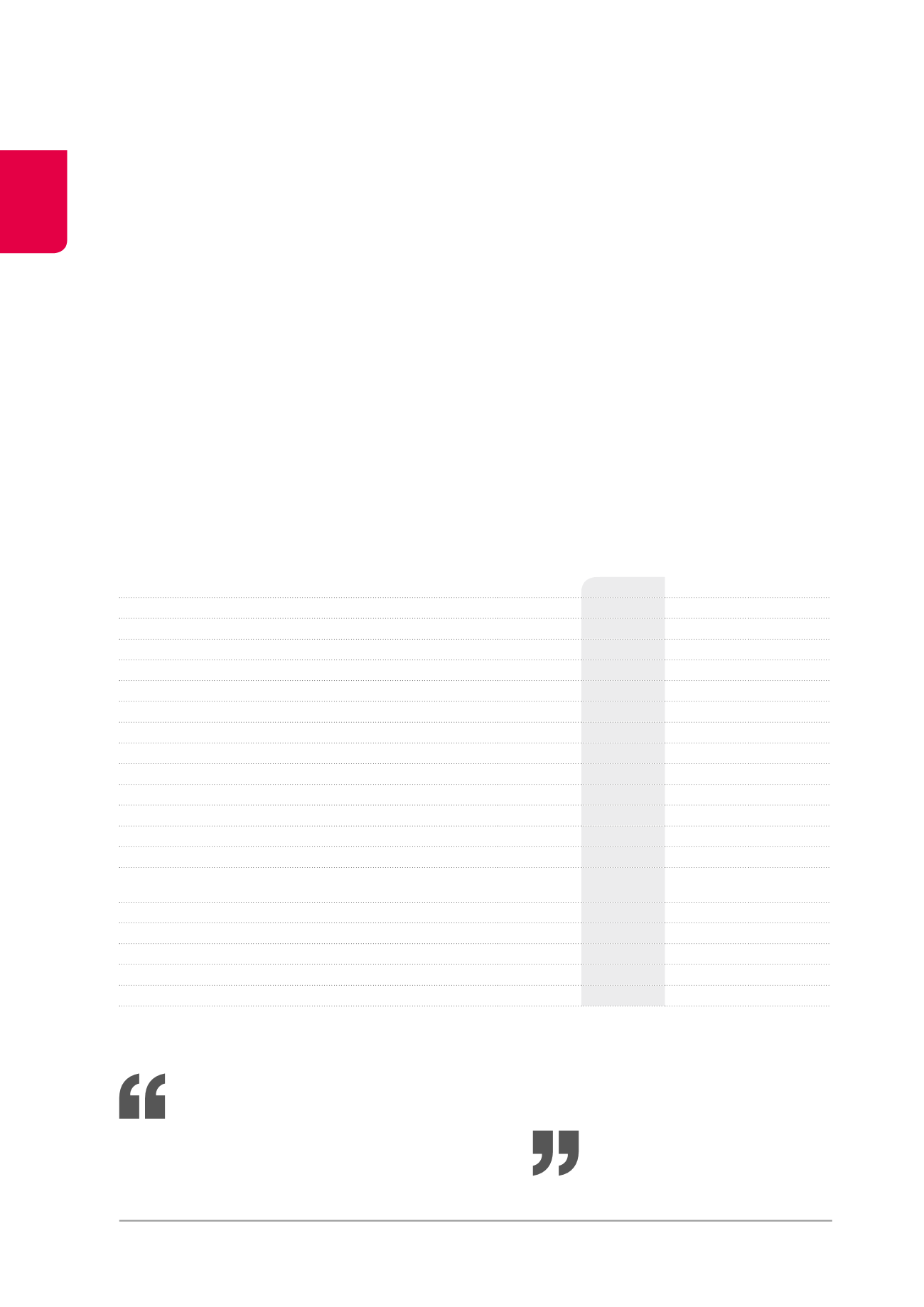

ISIN BE0003593044

2014

2013

2012

Share price (in €)

Highest

97.83

93.50

95.00

Lowest

84.74

82.23

83.38

At close

95.97

89.75

89.60

Average

89.76

88.26

88.40

Dividend yield

1

6.7%

7.4%

7.4%

Gross return

2

(over 12 months)

14.3%

7.5%

6.0%

Dividend

3

(in€)

Gross

5.50

4

6.00

6.50

Net

4.13

4

4.50

4.88

Volume

Average daily volume

33,883

37,975

33,584

Annual volume

8,844,025

9,911,464

8,765,448

Number of shares entitled to share

in the consolidated results of the financial year

17,339,423 16,954,002 16,007,572

Market capitalisation at the end of the period (x €1,000)

1,664,064

1,521,570

1,470,688

Free float zone

5

90%

90%

90%

Velocity

5

49.0%

58.5%

53.4%

Adjusted velocity

5

56.7%

65.0%

57.2%

Pay-out ratio

6

82.1%

88.5%

85.4%

Shareholder/investor profile

Cofinimmo has a large number of investors with diversified

profiles, comprised, on the one hand, of retail investors, based

mainly in Belgium, and, on the other hand, of institutional inves-

tors spread namely over Belgium, France, Germany, Luxembourg,

the Netherlands, Switzerland, the United Kingdom and the United

States.

At 31.12.2014, no shareholder crossed the threshold of 5% which

requests a transparency declaration.

Cofinimmo share liquidity

In 2014, Cofinimmo continued its efforts to enhance the liquid-

ity of its share. The company participated in 30 roadshows and

conferences throughout the year. It also invested in promotional

campaigns aimed at both institutional and retails investors.

With a market capitalisation of its ordinary shares standing at

€1.66 billion and an average daily volume of €3.0 million or just over

34,000 shares, Cofinimmo’s liquidity level is sufficient to keep it on

the radar screen of major institutional investors.

Dividend

At the Ordinary General Shareholders’ Meeting of 13.05.2015, the

Board of Directors will offer a dividend in line with the forecast

published in the 2013 Annual Financial Report. It amounts to

€5.50 gross per ordinary share, which corresponds to a gross

yield of 6.1% against the average share price of the ordinary share

during the financial year 2014. In accordance with the Articles of

Association of the company, the dividend of the preference shares,

on the other hand, is fixed at €6.37 gross (see also the chapter

“Standing document” of this Annual Financial Report).

Withholding tax

Since 01.01.2013, the applicable withholding tax on distributed

dividends amounts to 25%.

The Belgian Law provides for exemptions that the beneficiaries

of the dividends can rely on depending on their status and the

conditions that must be met to benefit from them. Moreover, the

agreements to prevent double taxation provide for reductions of the

withholding tax on dividends.

1

Gross dividend distributed in 2014 on the average annual share price.

2

Appreciation of the share price + dividend yield.

3

Dividends are subject to a 25% withholding tax.

4

Forecast.

5

According to the Euronext method.

6

In the net current result - Group share, excluding IAS 39 impact.

COFINIMMO IN THE STOCK MARKET /

The ordinary share

In 2014, Cofinimmo celebrated the 20th anniversary of

its listing on the stock exchange.

122