1

The summary and comments on the consolidated income statement are

presented on pages 18 and 19.

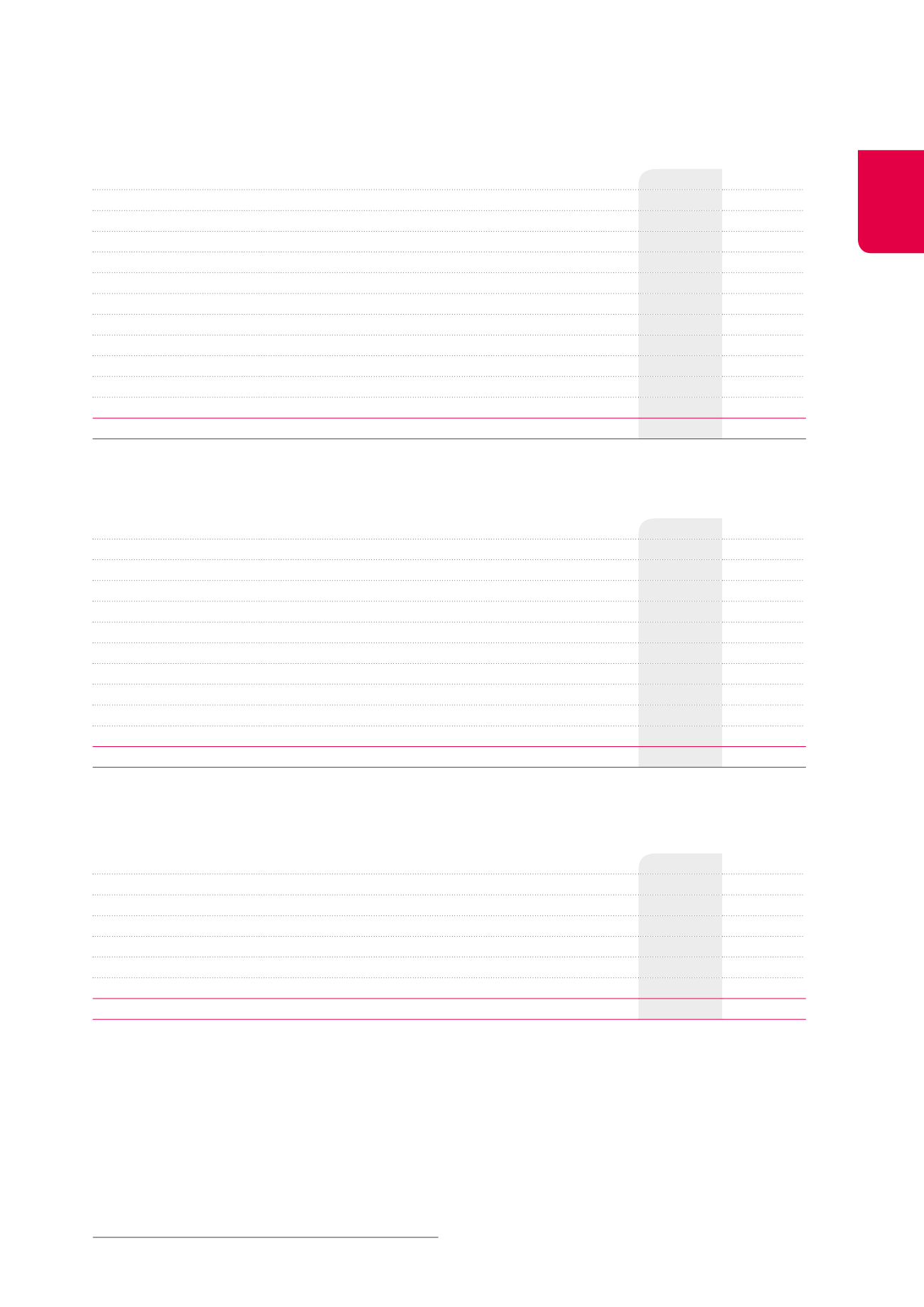

EPRA Earnings and EPRA Earnings per share

1

(x €1,000)

2014

2013

IFRS Earnings per financial statements

-52,671

58,737

Adjustments to calculate EPRA Earnings, to exclude:

173,150

60,471

(i) Changes in the fair value of investment properties and properties held for sale

5,455

26,260

(ii) Gains or losses on disposal of investment properties

22,441

-147

(v) Goodwill impairment

11,000

21,000

(vi) Changes in the fair value of financial instruments (IAS 39)

136,143

13,686

(vii) Costs & interests on acquisitions and joint ventures

177

1,570

(viii)Deferred taxes in respect of EPRA adjustments

-926

-618

(x) Minority interests in respect of the above

-1,140

-1,280

EPRA Earnings

120,479

119,209

Number of shares

17,971,494 17,593,767

EPRA EARNINGS PER SHARE

(in €)

6.70

6.78

EPRA Net Asset Value (NAV)

(x €1,000)

2014

2013

NAV per financial statements

1,541,972

1,614,937

NAV per share per financial statements

(in €)

85.80

91.79

Effect of the exercise of options, convertible debts or other equity instruments

464,229

357,333

Diluted NAV, after the exercise of options, convertible debts and other equity instruments

2,006,201

1,972,270

To exclude:

(i) Fair value of financial instruments

125,164

101,172

(ii) Deferred taxes

36,150

35,368

(iii) Goodwill as a result of deferred taxes

-72,648

-72,648

EPRA NAV

2,094,867

2,036,162

Number of shares

21,804,218 20,600,935

EPRA NAV PER SHARE

(in €)

96.08

98.85

EPRA Triple Net Asset Value (NNNAV)

(x €1,000)

2014

2013

EPRA NAV

2,094,867

2,036,162

To include:

(i) Fair value of financial instruments

-125,164

-101,172

(iii) Deferred taxes

36,498

37,280

EPRA NNNAV

2,006,201

1,972,270

Number of shares

21,804,218 20,600,935

EPRA NNNAV PER SHARE

(in €)

92.01

95.74

127