172

ANNUAL ACCOUNTS /

Notes to the consolidated accounts

In accordance with its hedging policy, the Group hedges at least 50%

of its portfolio of total debts for at least three years by entering into

interest rate derivatives (CAP bought, fixed listed IRS, FLOOR sold).

The hedging period of minimum three years was chosen, on the one

hand, to offset the depressive effect this time lag would have on the

net income and, on the other hand, to forestall the adverse impact of

any rise in European short-term interest rates not accompanied by a

simultaneous increase in national inflation. Finally, a rise in real inter-

est rates would probably be accompanied or rapidly followed by a

revival of the overall economic activity which would give rise to more

robust rental conditions and subsequently benefit the net result.

The banks that sign these contracts are generally different from the

ones providing the funds, but the Group makes sure that the peri-

ods of the interest rate derivatives and the dates at which they are

contracted correspond to the renewal periods of its borrowing con-

tracts and the dates at which their rates are set.

If a derivative instrument hedges an underlying debt contracted at

a floating rate, the hedge relationship is qualified as a cash flow

hedge.

For optional instruments, only the intrinsic element is designated as

a hedging instrument.

The average rate without margin of the debt at the closing date, as

well as the fair value of the derivative instruments, are shown below.

In accordance with IFRS 7, a 1% sensitivity analysis was carried out

of the various market interest rates without margin applied to the

debt and the derivative instruments.

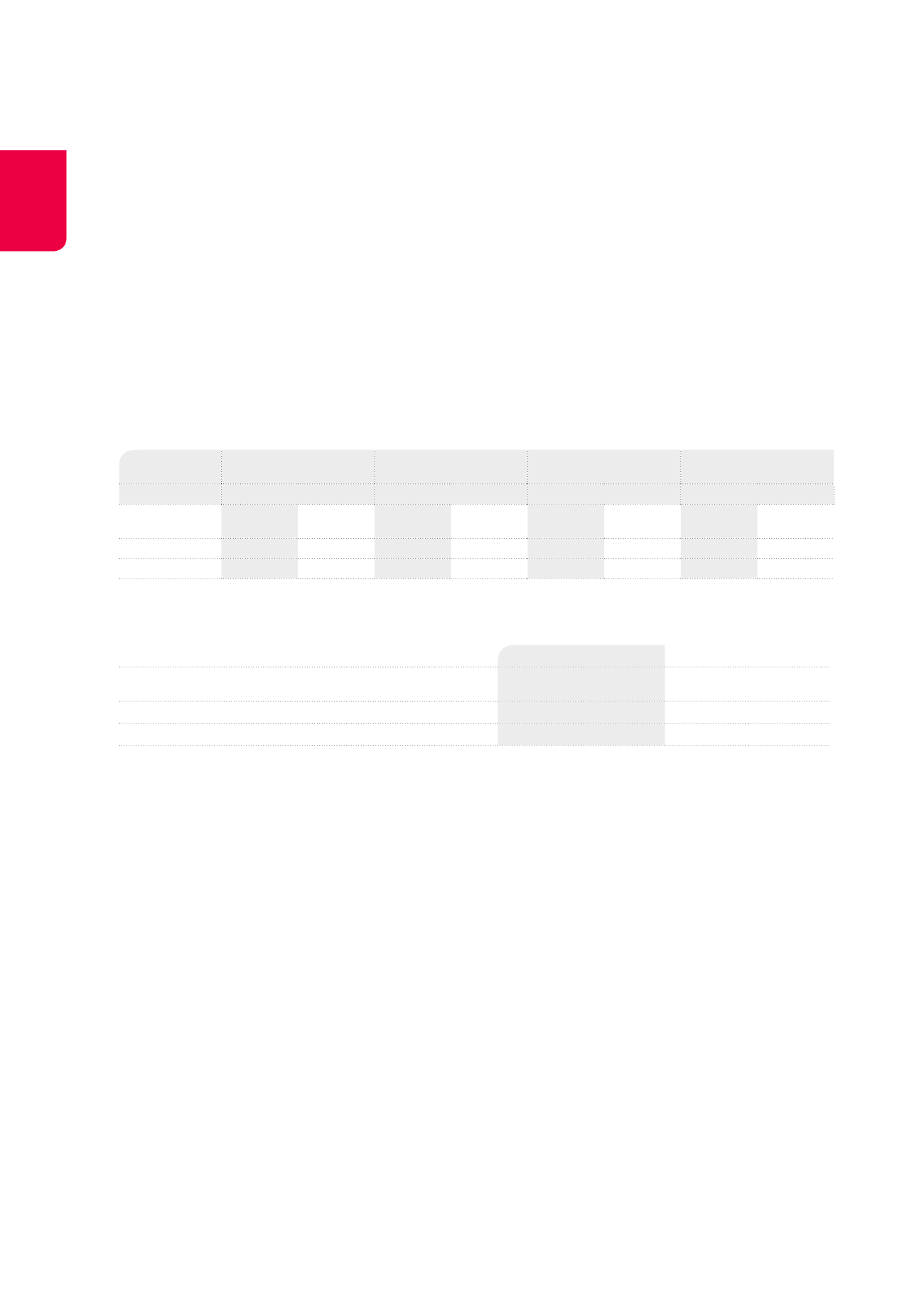

Summary of the potential effects, on equity and on the income statement, of a 1% change in the interest rate resulting from changes in the fair

value of the financial instruments (derivatives + convertibles), changes in the floating payments of the financial derivatives and changes in the

floating-rate credits

(x €1,000)

2014

2013

Change

Income

statement

Equity

Income

statement

Equity

+1%

57,442

7,171

57,312

30,411

-1%

-37,791

-13,135

-53,268

-38,288

If the future interest rate curve at 31.12.2014 increases in parallel

by 1%, the fair value of the valued financial derivatives increases

by €67.23 million (2013: €+77.22 million). Given the actual level of

short-term interest rates and the exercise price of the financial

instruments, this would result in an increase by €7.17 milllion (2013:

€+30.41 million) of equity and by €60.06 million (2013: €+46.81 mil-

lion) of the income statement

2

.

If the curve decreases in parallel by 1%, the fair value of the finan-

cial derivatives decreases by €44.19 million (2013: €-79.83 million).

Given the current level of short-term interest rates and the exercise

price of the financial instruments, this would result in a decrease by

€13.13 million (2013: €-38.29 million) of equity and by €31.05 million

(2013: €-41.54 million) of the income statement

2

.

Credit risk

By virtue of Cofinimmo’s operational business, it deals with two main

counterparties: banks and clients.

The Group maintains a minimum rating standard for its finan-

cial counterparties. All financial counterparties have an external

“investment grade” rating.

Client risk is mitigated by a diversification of clients and an analysis

of their solvency before and during the lease contract. The two main

office clients come from the public sector. Also see pages 32 and 47

of this Annual Financial Report, which contains a table with the top

ten clients and their rating as assigned by an external rating agency.

Price risk

The Group could be exposed to a price risk linked to the Cofinimmo

stock options tied to its convertible bonds.

Foreign exchange risk

The Group is not currently exposed to any foreign exchange risk.

Liquidity risk

The liquidity risk is limited by the diversification of the financing

sources and by the refinancing which is done one year before the

maturity date of the financial debt.

1

The figures shown exclude the changes in payments related to the current year

and the convertible bonds.

2

These figures differ from those presented in the table above because they do not

include the impact of the convertible bonds and of the floating-rate credit lines.

Impact of a 1% change in the interest rate on the average interest rate of the debt, the notional principal amount and the fair value of the

instruments (based on the debt and the derivative positions at the closing date)

1

(x €1,000,000)

Change

Average interest rate

Notional principal amount

Change in the fair value of

the financial derivatives

Change in the fair value of

the convertible bonds

2014

2013

2014

2013

2014

2013

2014

2013

Fair value at

31.12

3.43%

3.79%

1,119

1,224

-125

-105

381

373

+1%

3.57%

3.86%

67

77

-9

-11

-1%

3.40%

3.78%

-44

-79

9

12