169

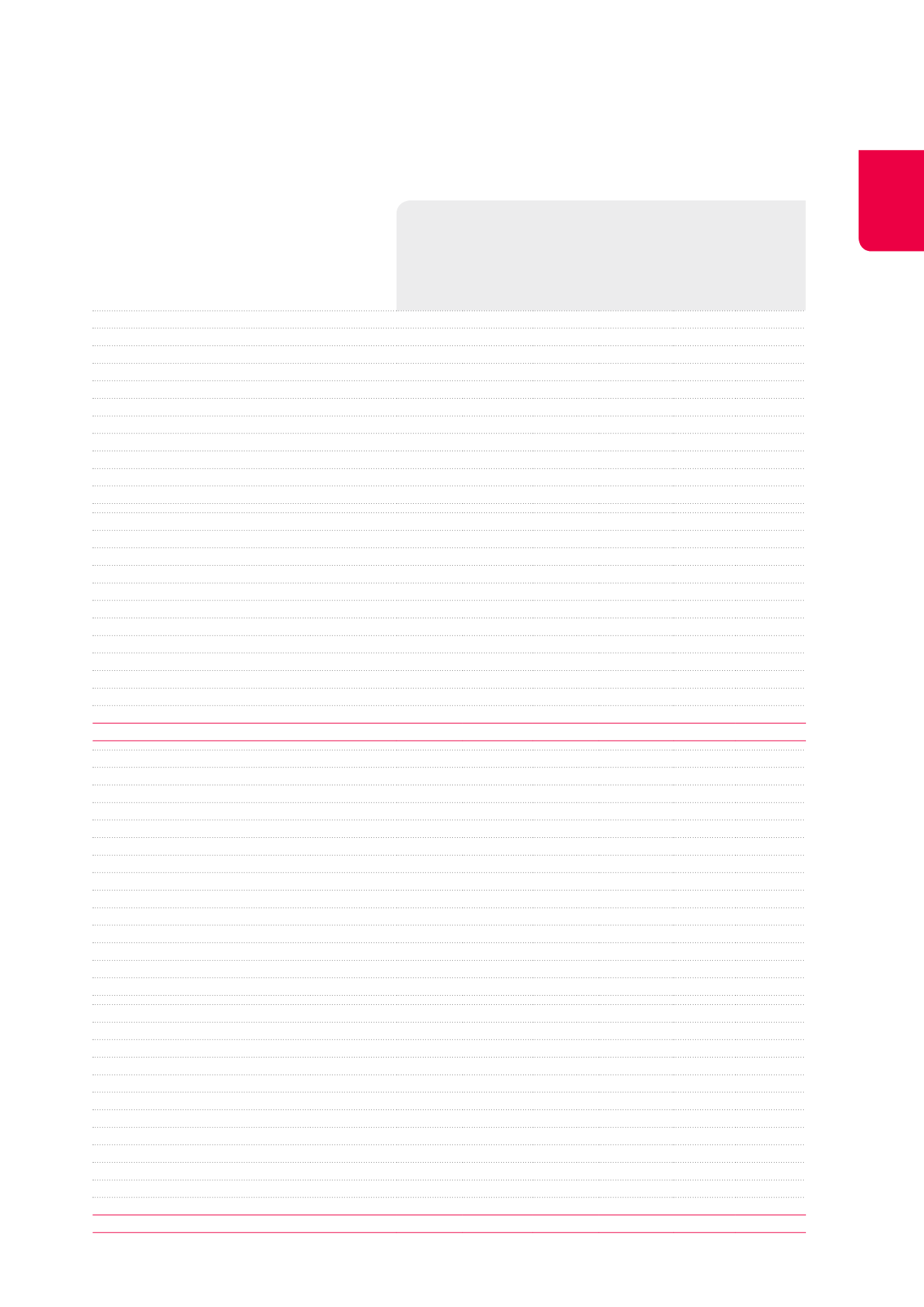

NOTE 24. FINANCIAL INSTRUMENTS

A. CATEGORIES AND DESIGNATION OF FINANCIAL INSTRUMENTS

(x €1,000)

31.12.2014

Designated

in a

hedging

relationship

Designated

at fair value

through the

net result

Held for

trading

Loans,

receivables

and financial

liabilities at

amortised

cost

Fair value Fair value

qualification

I. NON-CURRENT ASSETS

E. Non-current financial assets

Authorised hedging instruments

CAP

1,000

2

1,002

Level 2

FLOOR

IRS

Share in associated companies

5,862

5,862

Level 2

Other

Trade receivables

38

38

Level 2

Other

9,931

9,931

Level 2

F. Non-current finance lease receivables

78,018 130,320

Level 2

II. CURRENT ASSETS

B. Current financial assets

Authorised hedging instruments

CAP

FLOOR

IRS

498

498

Level 2

C. Current finance lease receivables

1,618

2,703

Level 2

D. Trade receivables

24,781

24,781

Level 2

E. Tax receivables and other current assets

Taxes

2,394

2,394

Level 2

Other

15,111

15,111

Level 2

F. Cash and cash equivalents

17,117

17,117

Level 2

TOTAL

1,000

500

154,870 209,757

I. NON-CURRENT LIABILITIES

B. Non-current financial debts

Bonds

190,000 190,000

Level 2

(Mandatory) convertible bonds

385,454

385,454

Level 1

Bank debt

565,420 565,420

Level 2

Other

Rental guarantees received

5,140

5,140

Level 2

Other

2,009

2,009

Level 2

C. Other non-current financial liabilities

Authorised hedging instruments

CAP

391

391

Level 2

FLOOR

35,551

35,551

Level 2

IRS

66,024

66,024

Level 2

Autres

75

75

Level 2

II. CURRENT LIABILITIES

B. Current financial debts

Commercial paper - fixed rate

15,000 15,000

Level 2

Commercial paper - floating rate

201,500 201,500

Level 2

Bank debt

256,969 256,969

Level 2

Other

30

30

Level 2

C. Other current financial liabilities

Authorised hedging instruments

CAP

FLOOR

480

480

Level 2

IRS

24,218

24,218

Level 2

D. Trade debts and other current debts

59,850 59,850

Level 2

TOTAL

36,422 385,454 90,242 1,295,993 1,808,111