166

ANNUAL ACCOUNTS /

Notes to the consolidated accounts

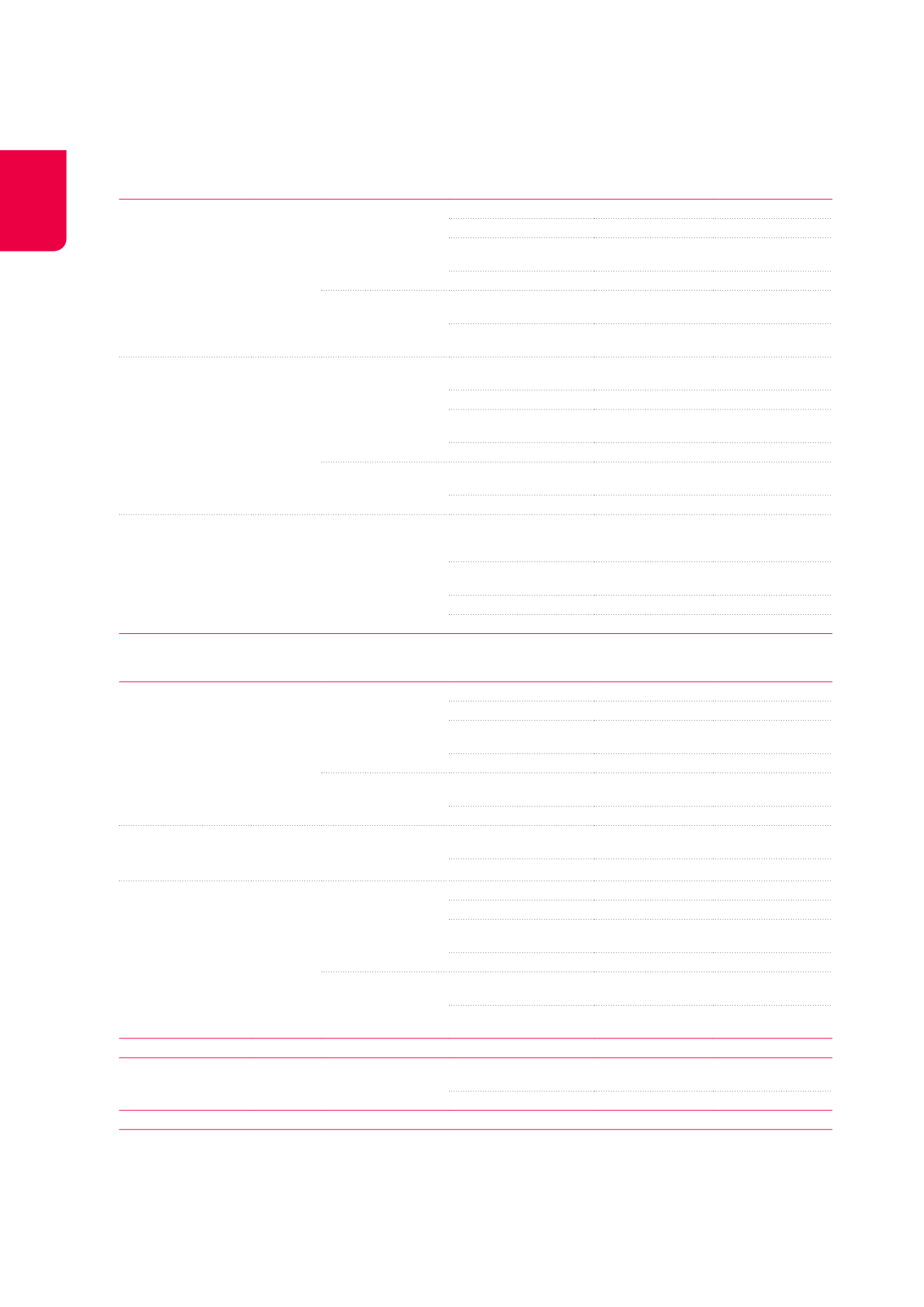

Asset category

Fair value at

31.12.2014

Valuation method

Unobservable data (a)

Extreme values

(weighed average)

2014

Extreme values

(weighed average)

2013

France

375,417

Discounted cash flow

Estimated rental value (ERV)

53 - 280 (143)€/m²

53 - 224 (131)€/m²

1

Capitalisation rate

5.75% - 7.50% (5.79%) 5.75% - 8.00% (5.77%)

1

Capitalisation rate of the

final net ERV

5.75% - 12.31% (6.71%) 6.00% - 12.31% (7.11%)

1

Inflation rate

1.25% - 2.05% (2.02%)

1.75% - 2.12% (2.10%)

1

Discounted estimated

rental value

Estimated rental value (ERV)

53 - 280 (141)€/m²

53 - 224 (130)€/m²

1

Capitalisation rate

3.81% - 26.95% (7.11%)

3.32% - 25.35%

(6.64%)

1

Netherlands

and

Germany

87,290 Discounted cash flow

Estimated rental value (ERV)

101 - 180 (148)€/m²

N/A

1.2

Capitalisation rate

7.25% - 7.30% (7.27%)

N/A

1.2

Capitalisation rate of the

final net ERV

7.00% - 11.68% (9.72%)

N/A

1.2

Inflation rate

1.80% - 2.00% (1.92%)

N/A

1.2

Discounted estimated

rental value

Estimated rental value (ERV)

87 - 235 (158)€/m²

N/A

1.2

Capitalisation rate

5.30% - 7.50% (6.51%)

N/A

1.2

Healthcare real

estate under

development

21,440 Residual value

Estimated rental value (ERV)

80 - 202 (170)€/m²

80 - 198 (127)€/m²

Capitalisation rate

5.70% - 14.26%

(7.65%)

5.00% - 7.25% (6.08%)

Costs to completion

(b)

(b)

Inflation rate

1.50% - 1.92% (1.83%)

2.00%

PROPERTY OF

DISTRIBUTION

NETWORKS

533,538

Pubstone Belgium

272,202 Discounted cash flow

Estimated rental value (ERV)

13 - 307 (77)€/m²

13 - 307 (77)€/m²

Capitalisation rate

6.25%

6.85%

Capitalisation rate of the

final net ERV

6.55%

7.10%

Inflation rate

2.00%

2.00%

Discounted estimated

rental value

Estimated rental value (ERV)

13 - 307 (77)€/m²

13 - 307 (77)€/m²

Capitalisation rate

3.50% - 8.50% (5.63%) 4.00% - 9.50% (6.15%)

Pubstone

Netherlands

149,396 Discounted estimated

rental value

Estimated rental value (ERV)

47 - 495 (207)€/m²

47 - 415 (205)€/m²

Capitalisation rate

4.50% - 7.60% (5.44%) 4.50% - 7.60% (5.82%)

Cofinimur I France

111,940 Discounted cash flow

Estimated rental value (ERV)

85 - 700 (150)€/m²

80 - 700 (147)€/m²

Capitalisation rate

6.00% - 8.00% (6.01%)

6.00%

Capitalisation rate of the

final net ERV

4.73% - 14.04%

(7.80%)

4.91% - 14.07% (8.02%)

Inflation rate

1.67% - 2.00% (1.98%)

2.00%

Discounted estimated

rental value

Estimated rental value (ERV)

85 - 700 (150)€/m²

80 - 700 (147)€/m²

Capitalisation rate

4.36% - 36.20%

(6.98%)

4.60% - 27.20%

(7.00%)

OTHER

64,566

Other

64,566 Discounted estimated

rental value

Estimated rental value (ERV)

43 - 369 (163)€/m²

41 - 261 (194)€/m²

Capitalisation rate

4.00% - 8.50% (6.45%) 4.75% - 8.50% (6.07%)

TOTAL

3,199,183

(a)

The net rental income is detailed in Note 6.

(b)

The costs required for the completion of a property are specific to each project and depend on the degree of progress of the works.

1

In 2013, because of the very small size of the healthcare portfolio in the Netherlands, the asumptions used for the Netherlands were grouped with those for France.

2

In 2013, we had not made any acquisitions in Germany yet.