163

The effective rate of the transfer duties therefore varies from 0% to

12.5%, whereby it is not possible to predict which rate would apply to

the transfer of a given property before that transfer has effectively

taken place.

In January 2006, all the independent real estate experts

1

who carry

out the periodic valuation of the Belgian RREC assets were asked to

compute a weighed average transaction cost percentage to apply

on the RREC property portfolios, based on supporting historical data.

For transactions concerning properties with an overall value exceed-

ing €2.5 million, given the range of different methods for property

transfers (see above), the experts have calculated, on the basis of

a representative sample of 220 transactions which took place in

the market between 2003 and 2005 and totalling €6.0 billion, that

the weighted average transfer tax comes to 2.5%. This percent-

age is reviewed annually and, if necessary, adjusted at each 0.5%

threshold.

For transactions concerning properties with an overall value of less

than €2.5 million, transaction costs of between 10.0% and 12.5%

apply, depending on the Region in which the property is located.

At 01.01.2004 (date of transition to IAS/IFRS), the transaction costs

deducted from the investment value of the property portfolio

amounted to €45.5 million and were recorded under a separate

equity item entitled “Impact on the fair value of estimated transac-

tion costs and transfer duties resulting from the hypothetical dis-

posal of investment properties”.

The 2.5% transaction costs have been applied to the subsequent

acquisitions of buildings. At 31.12.2014, the difference between the

investment value and the fair value of the global portfolio amounted

to €130.03 million or €7.24 per share.

It is worth noting that the average gain in relation to the invest-

ment value realised on the disposals of assets operated since the

changeover to the RREC regime in 1996 stands at 9.32%. Since that

date, Cofinimmo SA/NV has undertaken 147 asset disposals for

a total of €1,515.72 million. This gain would have been 11.40% if the

deduction of transaction costs and transfer duties had been recog-

nised as from 1996.

The transfer duties applied to the buildings located in France, in the

Netherlands and in Germany amount to 6.75%, 4.89% and 5.00%

respectively.

Determination of the valuation level of the fair value

of the investment properties

The fair value of the investment properties in the balance sheet

results exclusively from the portfolio’s valuation by independent real

estate experts.

To determine the fair value of the investment properties, the nature,

characteristics and risks of these properties, as well as available

market data, were examined.

Because of the state of market liquidity and the difficulty to find

unquestionably comparable transaction data, the level of valuation,

within the meaning of IFRS 13, of the fair value of the Cofinimmo

buildings is level 3, and this for the entire portfolio.

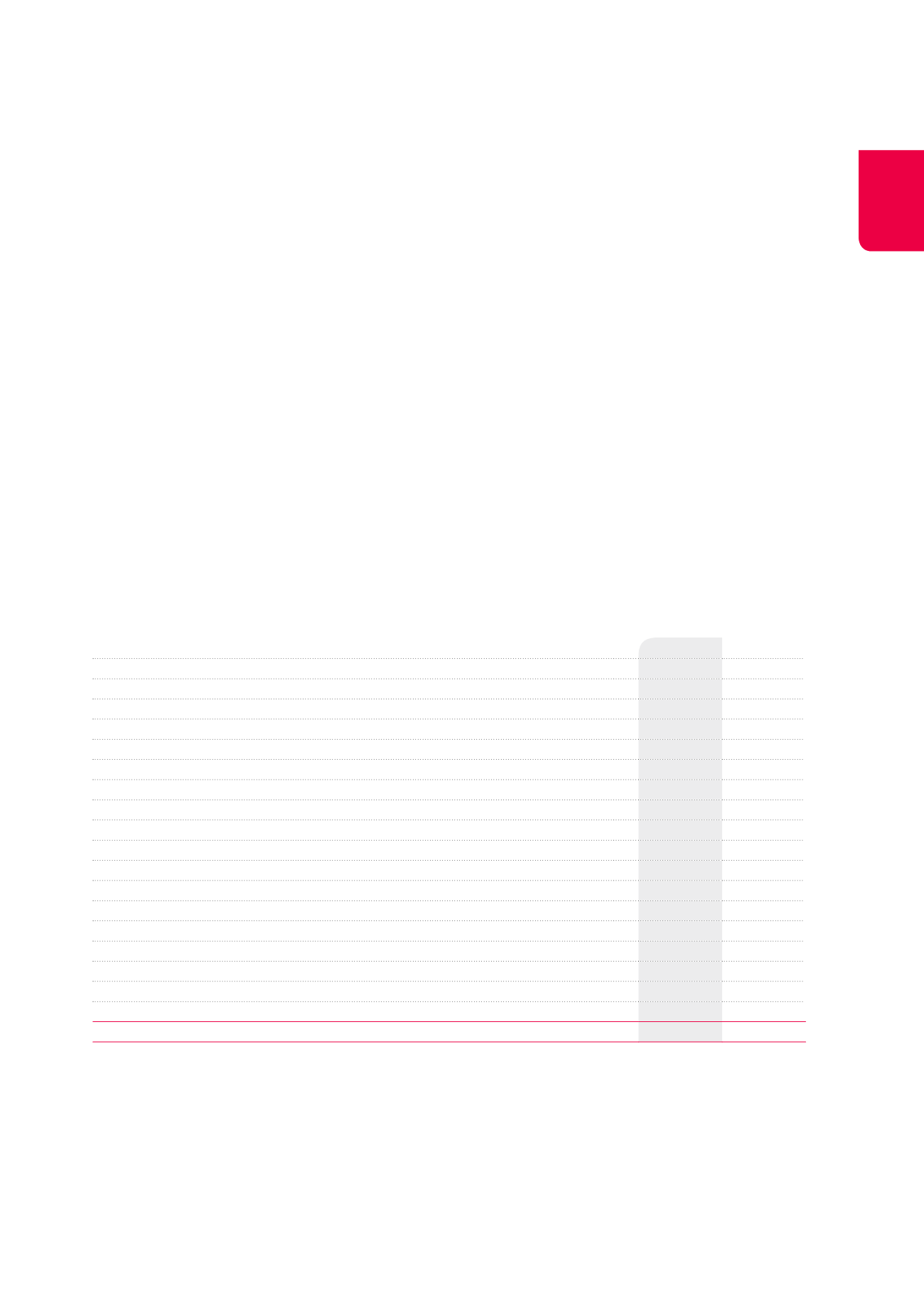

(x €1,000)

31.12.2014

31.12.2013

Asset category

Level 3

2

Level 3

2

Offices

1,311,976

1,524,811

Antwerp

64,945

61,847

Brussels CBD

378,917

548,569

Brussels Decentralised

547,432

582,029

Brussels Periphery/Satellites

141,703

143,336

Other Regions

113,278

111,323

Offices under development

65,701

77,707

Healthcare real estate

1,289,103

1,228,245

Belgium

804,956

747,969

France

375,417

418,130

Netherlands and Germany

87,290

11,250

Healthcare real estate under development

21,440

50,896

Property of distribution networks

533,538

532,818

Pubstone Belgium

272,202

272,243

Pubstone Netherlands

149,396

150,650

Cofinimur I France

111,940

109,925

Other

64,566

61,135

TOTAL

3,199,183

3,347,009

1

Cushman & Wakefield, de Crombrugghe & Partners, Winssinger & Associates,

Stadim and Troostwijk-Roux.

2

Under IFRS 13, the basis of the fair value valuations can be qualified as:

- Level 1: observable listed prices in active markets;

- Level 2: observable data other than the listed prices included in level 1;

- Level 3: unobservable data.