158

ANNUAL ACCOUNTS /

Notes to the consolidated accounts

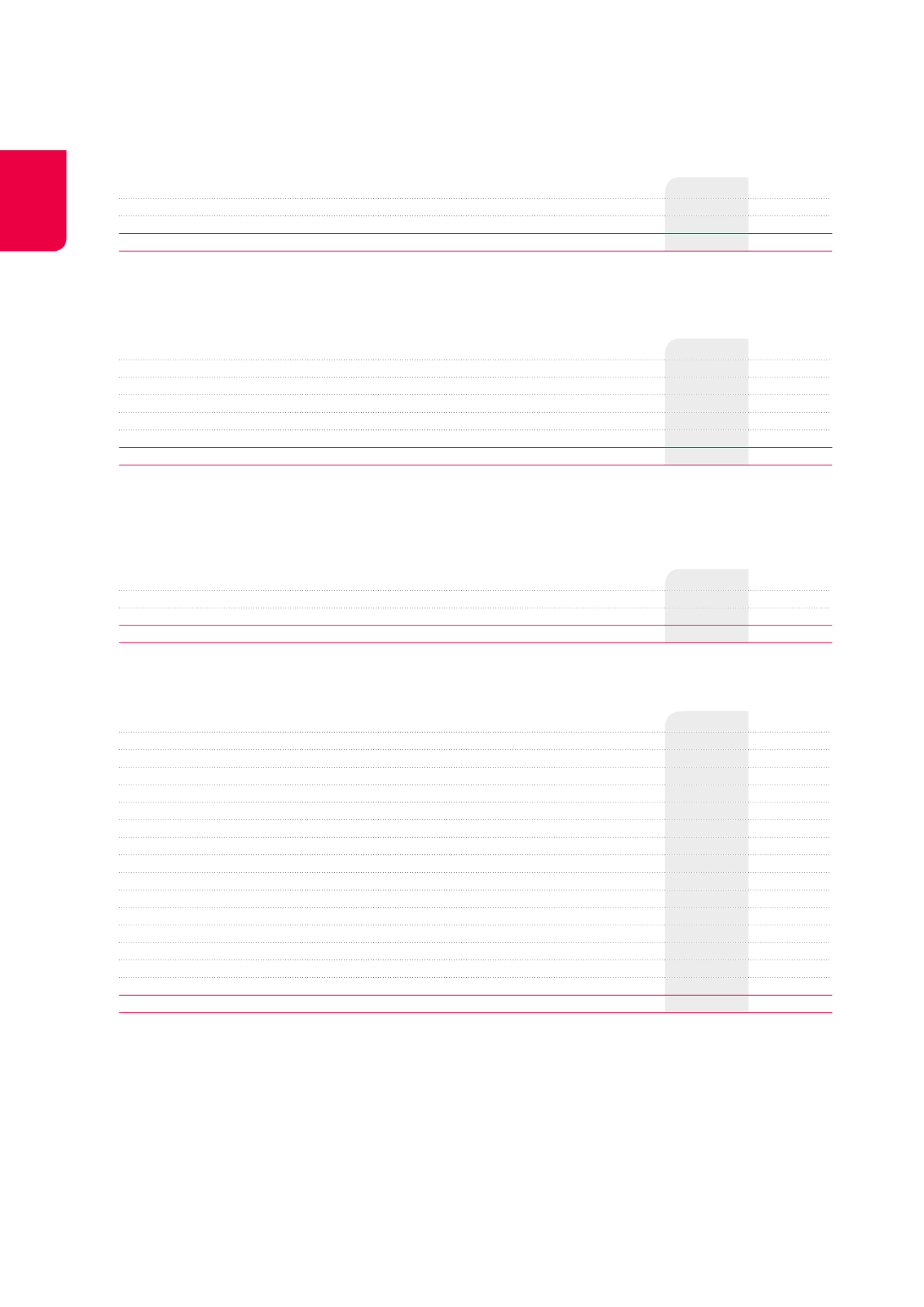

NOTE 16. NET INTEREST CHARGES

(x €1,000)

2014

2013

Nominal interests on loans

32,194

33,742

Bilateral loans - floating rate

7,623

7,174

Syndicated loans - floating rate

272

Commercial papers - floating rate

926

902

Investment credits - floating or fixed rate

634

1,262

Bonds - fixed rate

13,778

16,709

Convertible bonds

9,233

7,423

Reconstitution of the nominal amount of financial debts

721

845

Charges from authorised hedging instruments

31,738

51,329

Authorised hedging instruments qualifying for hedge accounting as defined under IFRS

21,644

36,902

Authorised hedging instruments not qualifying for hedge accounting as defined under IFRS

10,094

14,427

Income from authorised hedging instruments

-13,283

-22,960

Authorised hedging instruments qualifying for hedge accounting as defined under IFRS

-9,203

-13,715

Authorised hedging instruments not qualifying for hedge accounting as defined under IFRS

-4,080

-9,245

Other interest charges

3,330

4

3,087

TOTAL

54,700

5

66,043

6

The effective interest charges on loans correspond to an average effective interest rate on loans of 3.43% (2013: 3.92%). The effective charges

without taking into account the hedging instruments stands at 2.27%. This percentage can be split up between 1.94% for the borrowings at

fair value and 2.37% for the borrowings at amortised cost.

NOTE 15. FINANCIAL INCOME

(x €1,000)

2014

2013

Interests and dividends received

3

1,537

2,125

Interest receipts from finance leases and similar receivables

4,040

3,598

TOTAL

5,577

5,723

NOTE 14. OTHER RESULT ON THE PORTFOLIO

(x €1,000)

2014

2013

Changes in the deferred taxes

1

-1,739

-312

Writeback of rents already earned but not expired

505

-2,071

Changes in the fair value of other non-financial assets

-5

Goodwill impairment

2

-11,000

-21,000

Other

930

705

TOTAL

-11,304

-22,683

The writeback of already earned rents not expired, recognised during the period, results from the application of the accounting method

detailed in Note 2, paragraph R.

1

See Note 35.

2.

See Note 20.

3.

The amount of dividends received is nil at 31.12.2014.

4.

Commitment fees.

5

In 2014, the interests on loans at amortised cost (K€27,012) are comprised of the “Other interest charges” of the “Reconstitution of the nominal amount of financial debts”

and the “Nominal interests on loans” (except for the “Convertible bonds”). The interests on loans at fair value throught the net result (K€27,688) are comprised of the

“Charges and income from authorised hedging instruments” and the “Convertible bonds”.

6

In 2013, the interests on loans at amortised cost (K€30,251) are comprised of the “Other interest charges” of the “Reconstitution of the nominal amount of financial debts”

and the “Nominal interests on loans” (except for the “Convertible bonds”). The interests on loans at fair value throught the net result (K€35,792) are comprised of the

“Charges and income from authorised hedging instruments” and the “Convertible bonds”.

NOTE 13. CHANGES IN THE FAIR VALUE OF INVESTMENT PROPERTIES

(x €1,000)

2014

2013

Positive changes in the fair value of investment properties

55,806

26,659

Negative changes in the fair value of investment properties

-61,261

-52,919

TOTAL

-5,455

-26,260

The breakdown of the changes in the fair value of properties is presented in Note 22.