157

Group insurance

The group insurance subscribed by Cofinimmo (under the defined

contribution form) for its employees and the members of its

Executive Committee, has the following objectives:

•

payment of a life benefit to the affiliate at retirement;

•

payment of a death benefit to the beneficiaries of the affiliate

in case of death before retirement;

•

payment of a disability pension in case of accident or long-

term illness other than professional;

•

waiver of premiums in the same cases.

In order to protect workers, the Law on the Supplementary Pensions

defines a guaranteed minimum return required on the “Life” share of

premiums.

This minimum return amounts to 3.75% of the gross premiums for the

personal contributions and to 3.25% of the premiums for the employ-

er’s contributions.

The rate guaranteed by the insurer stands at 2.25% since 2013.

Cofinimmo therefore covers part of the rates guaranteed by the Law

on Supplementary Pensions. If necessary, additional amounts must

be brought under the reserves to reach the guaranteed returns for

the services given. A provision of €72,843 was recorded under the

income statement at 31.12.2014.

Emoluments of the Auditor

The fixed emoluments of Deloitte, Company Auditors for reviewing

and certifying Cofinimmo’s company and consolidated accounts

amounted to €116,700 (excluding VAT). Its emoluments for certifying

the company accounts of Cofinimmo’s subsidiaries amounted to

€131,150 (excluding VAT) and are calculated per company based on

their effective performances.

The fees of the Degroof Bank as financial service provider for the pay-

ment of the dividends are to be found under the item “Other” of “Fees

paid to third parties”. It is a fixed amount for their annual services.

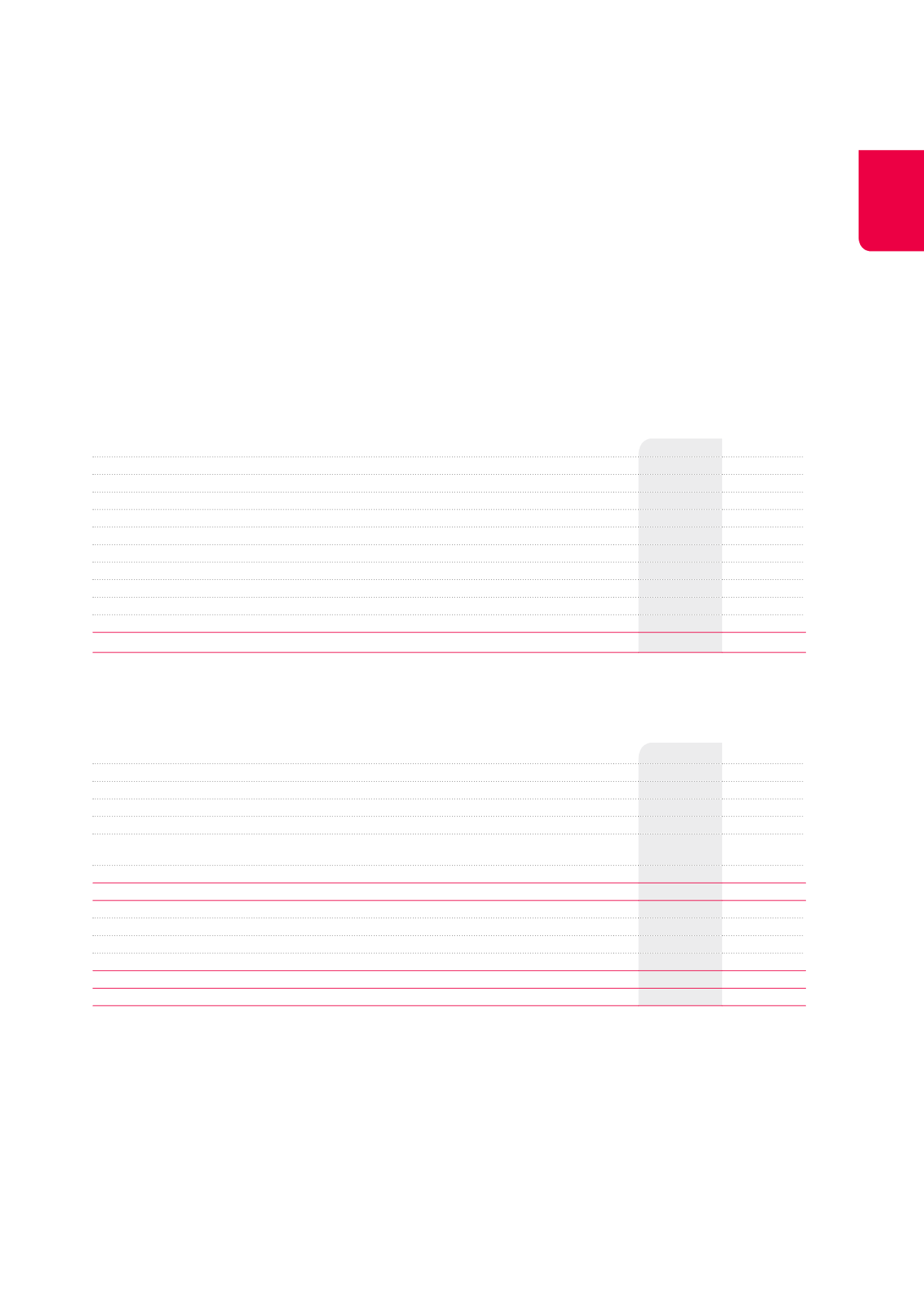

(x €1,000)

2014

2013

Emoluments of the Company Auditor

318

312

Emoluments for the execution of a mandate of Company Auditor

248

247

Emoluments for exceptional services or special assignments within the Group

70

65

Other certification assignments

55

24

Assignments other than auditing duties

15

41

Emoluments of people with whom the Auditor is connected

124

70

Emoluments for exceptional services or special assignments within the Group

124

70

Other certification assignments

15

Tax advisory duties

106

70

Assignments other than auditing duties

3

TOTAL

442

382

The emoluments of the Company Auditors, other than Deloitte, appointed for the Group’s French companies amounted to K€14 (excluding VAT).

NOTE 12. GAINS OR LOSSES ON DISPOSALS OF INVESTMENT PROPERTIES AND

OTHER NON-FINANCIAL ASSETS

(x €1,000)

2014

2013

Disposals of investment properties

Net disposals of properties (selling price - transaction costs)

75,351

21,699

Book value of properties sold

-74,014

-21,589

Fair value of properties sold

-70,855

-20,909

Writeback of the impact on the fair value of estimated transfer duties resulting from

the hypothetical disposal of investment properties

-3,159

-680

Other

612

37

SUBTOTAL

1,949

147

Disposals of other non-financial assets

Net disposals of other non-financial assets

6,530

Book value of other non-financial assets sold

-19,953

Other

1

-10,967

SUBTOTAL

-24,390

TOTAL

-22,441

147

1

The amount of K€10,967 is the realised loss from the transfer of the freehold of the North Galaxy building from Cofinimmo SA/NV to Galaxy Properties SA/NV, as well as the

cancellation of the writeback of lease payments sold and discounted booked since 01.01.2014.

The future hypothetical transaction costs and transfer duties are

deducted directly from the shareholders’ equity on the acquisition of

properties. When the properties are sold, this amount must therefore

be deducted from the difference between the price obtained and the

book value of these properties in order to calculate the gain or loss

effectively made.

The loss on disposals of subsidiaries is related to the disposal of

100% of the shares of the company Galaxy Properties SA/NV, owner

the North Galaxy building. The disposal price of the shares of the

company amounted to €7 million, the difference with the conven-

tional value of the building comprising mainly in debts taken over

by the buyers.

The transaction implied a realised book loss of K€24,390 for

Cofinimmo, resulting mainly from the difference between the price

received by Cofinimmo for the shares of Galaxy Properties SA/NV

and their book value, and, incidentally, from the cancellation of the

writeback of lease payments sold and discounted booked since

01.01.2014.

This operation implied the payment of K€26,729 of registration rights.

The net amount received by Cofinimmo within the context of this dis-

posal stood at K€207,988, less the cash of the closing balance sheet

of the subsidiary (K€10,005).