154

ANNUAL ACCOUNTS /

Notes to the consolidated accounts

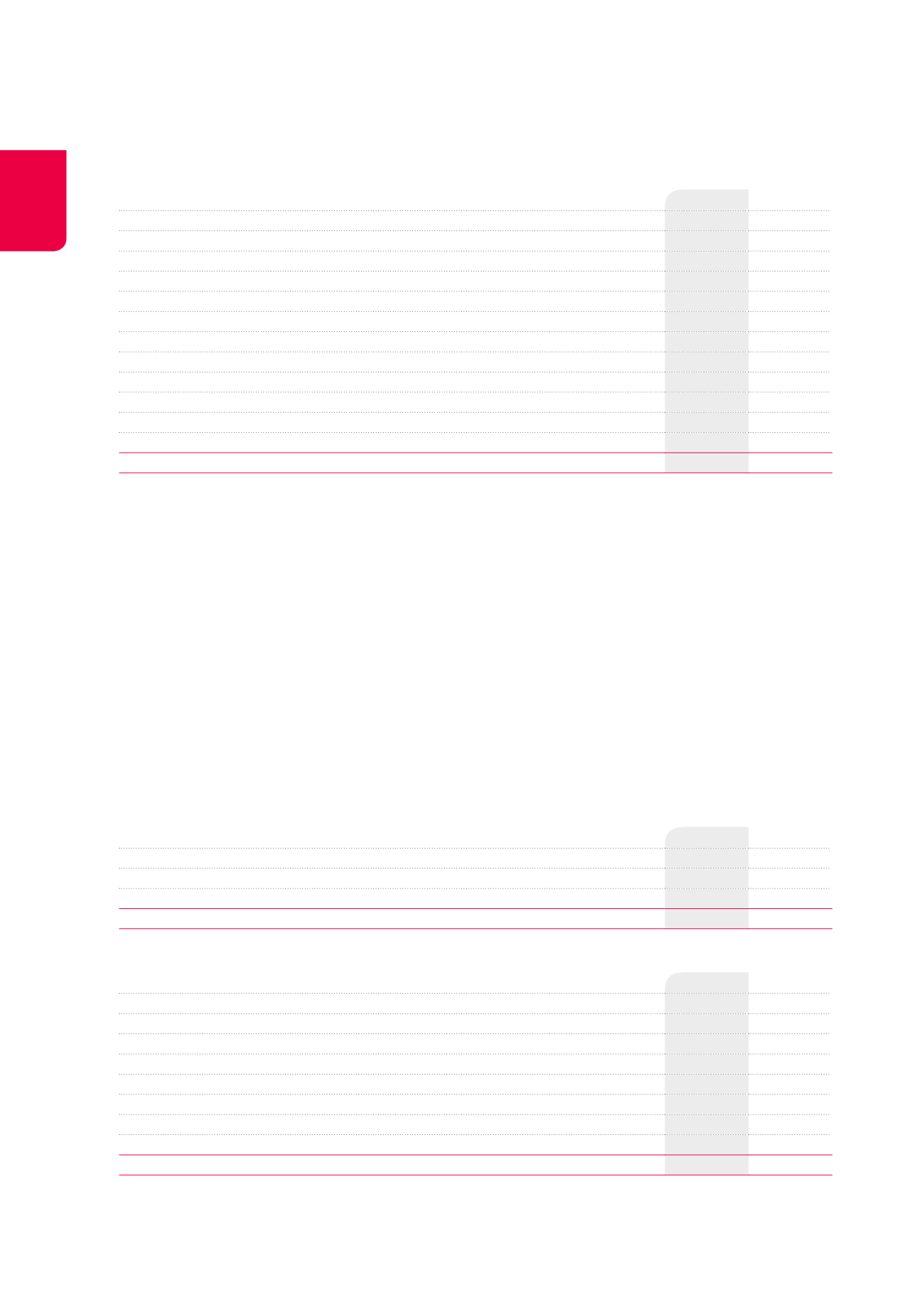

NOTE 6. RENTAL INCOME AND RENTAL-RELATED EXPENSES

Except in some rare cases, the leases contracted by the Group are subject to indexation.

The Group leases out its properties under operating leases and finance leases. Only revenues from operating leases appear under rental income.

The amount under the item “Writeback of lease payments sold and discounted” represents the difference between the discounted value, at the

beginning and at the end of the year, of the future inflation-linked payments on the lease contracts which receivables have been sold. The writeback

through the income statement allows for a gradual reconstitution of the gross initial value of the concerned buildings at the end of the lease. It is a

recurring and non-cash income item.

The change in the fair value of these buildings is determined by the independent real estate expert and is recorded as profit or loss under the item

“Changes in the fair value of investment properties”.This time, it is a non-recurring itemas it depends on the expert’s assumptions as to futuremarket

conditions.

Total rental income

When a lease is classified as a finance lease, the property is considered to be disposed of and the Group to have an interest in a finance lease

instead.Payments received on the finance leases are split between “capital” and “interests”: the capital element is recorded in the balance sheet and

offset against the Group’s finance lease receivable, and the interest element under the income statement. Hence, only the part of the rents relating

to interests flows through the income statement.

1

The gross potential income is the sum of the real rents received and the estimated rents attributed to unlet spaces.

2

The vacancy is calculated on unlet spaces based on the rental value estimated by the independent real estate experts.

3

Early termination compensations are recognised in full under the income statement.

(x €1,000)

2014

2013

Rental income

195,918

195,191

Rents

197,761

197,455

Gross potential income

1

209,112

207,688

Vacancy

2

-11,351

-10,233

Cost of rent-free periods

-2,933

-2,479

Client incentives

-558

-631

Indemnities for early termination of rental contracts

3

1,648

846

Writeback of lease payments sold and discounted

15,931

25,276

Rental-related expenses

-91

-6

Rents payable on rented premises

-88

-88

Writedowns on trade receivables

-44

-43

Writeback of writedowns on trade receivables

41

125

TOTAL

211,758

220,461

Total income generated from the Group’s properties through operating and finance leases

(x €1,000)

2014

2013

Rental income from operating leases

195,918

195,191

Interest income from finance leases

4,040

3,598

Capital receipts from finance leases

1,652

2,973

TOTAL

201,610

201,762

Total minimum future rents under non-cancellable operating leases and finance leases in effect at December31st

(x €1,000)

2014

2013

Operating lease

2,342,313

2,603,033

Less than one year

208,942

221,103

Between one and five years

531,266

582,939

More than five years

1,602,105

1,798,991

Finance lease

79,636

68,685

Less than one year

1,618

1,236

Between one and five years

21,467

18,827

More than five years

56,551

48,622

TOTAL

2,421,949

2,671,718