162

ANNUAL ACCOUNTS /

Notes to the consolidated accounts

1

Note 22 reconciles the total change in the fair value of investment properties.

2

The decrease in value at 31.12.2014 comes mainly from the building Guimard

10-12 (K€-4,806). The value of this building was decreased because it is under

renovation.

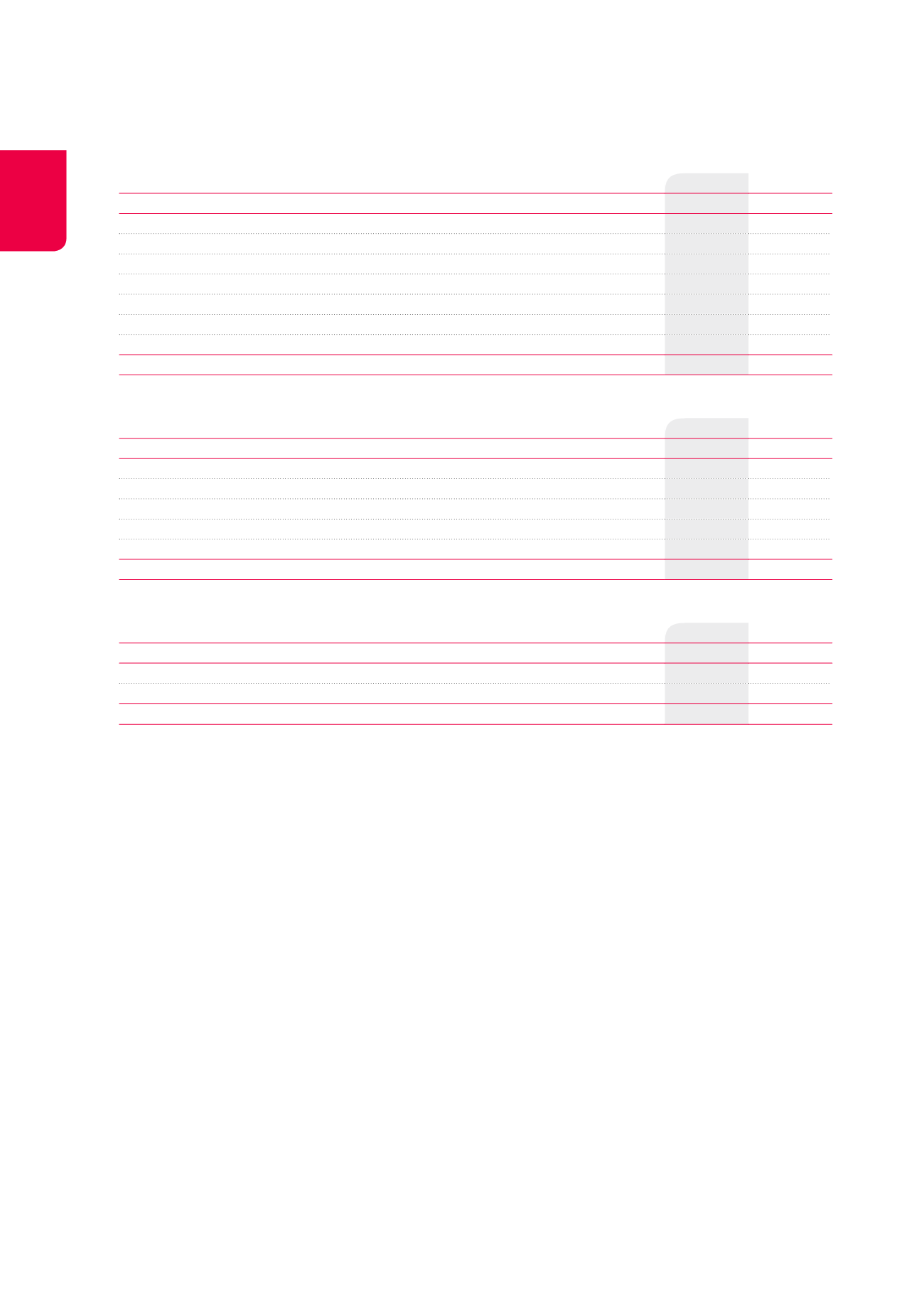

Properties available for lease

(x €1,000)

2014

2013

AT 01.01

3,199,030

3,156,893

Capital expenditures

15,240

17,868

Acquisitions

66,693

528

Transfers from/to Assets held for sale

-410

Transfers from/to Development projects

73,648

12,473

Sales/Disposals (fair value of assets sold/disposed of)

-272,274

-4,678

Writeback of lease payments sold and discounted

15,931

25,276

Increase/Decrease in the fair value

1

-336

-8,920

AT 31.12

3,097,932

3,199,030

Development projects

(x €1,000)

2014

2013

AT 01.01

130,533

131,857

Investments

47,858

35,015

Acquisitions

4,705

6,883

Transfer from/to Properties available for lease

-73,648

-12,473

Sales/Disposals (fair value of assets sold/disposed of)

-15,646

-14,422

Increase/Decrease in the fair value

1,2

-4,836

-16,327

AT 31.12

88,966

130,533

Assets held for own use

(x €1,000)

2014

2013

AT 01.01

9,146

9,150

Investments

14

Increase/Decrease in the fair value

1

-285

-4

AT 31.12

8,875

9,146

Fair value of investment properties

Investment properties are accounted for at fair value using the fair

value model in accordance with IFRS13. This fair value is the price at

which a property could be exchanged between knowledgeable and

willing parties in normal competitive conditions. It is determined by

the independent experts in a two-step approach.

In the first step, the experts determine the investment value of each

property (see methods below).

In a second step, the experts deduct from the investment value

an estimated amount for the transaction costs that the buyer or

seller must pay in order to carry out a transfer of ownership. The

investment value less the estimated transaction costs (transfer

duties) is the fair value within the meaning of IFRS13.

In Belgium, the transfer of ownership of a property is subject to the

payment of transfer duties. The amount of these taxes depends on

the method of transfer, the type of purchaser and the location of

the property. The first two elements, and therefore the total amount

of taxes to be paid, are only known once the transfer has been

completed.

The range of taxes for the major types of property transfers

includes:

•

sale of property assets: 12.5% for properties located in the

Brussels Capital Region and in the Walloon Region, 10% for

properties located in the Flemish Region;

•

sale of property assets under the rules governing estate

traders: 4.0% to 8.0%, depending on the Region;

•

long lease agreement for property assets (up to 50 years for

building leases and up to 99 years for long lease rights): 2%;

•

sale of property assets where the purchaser is a public entity

(e.g. an entity of the European Union, the Federal Government, a

regional government or a foreign government): tax exemption;

•

contribution in kind of property assets against the issue of new

shares in favour of the contributing party: tax exemption;

•

sale of shares of a real estate company: no taxes;

•

merger, split and other forms of company restructuring: no

taxes, etc.