With a portfolio of 654,115m

2

and a fair value of €1,312.0million, Cofinimmo is one of the

key players in office real estate in Brussels. The company has a dynamic and creative

in-house management team of 19 people, with an open ear to its tenants’ needs.

demand allows Cofinimmo to maintain an occupancy rate of

almost 100% in the Leopold district. The market’s vacancy rate

in this district stands around 4.8%

1

, one of the lowest in 11 years.

Furthermore, by launching the works on the Belliard 40 building as

from February 2015, Cofinimmo is anticipating the scarcity of new

developments in the Leopold district leading up to 2017, particularly

for grade A buildings.

Portfolio at 31.12.2014

At 31.12.2014, Cofinimmo’s office portfolio accounted for 41.0% of

its total invested portfolio. It comprised 83 properties

2

, with a total

above-ground floor area of 654,115m

2

and a fair value of €1,312.0 mil-

lion. The buildings are located exclusively in Belgium, with a con-

centration in Brussels. Its occupancy rate in terms of surface area

remains high (90.4%) compared with the Brussels market.

Over the course of 2014, Cofinimmo has pursued its strategy of

active rotation of its office portfolio, encouraged by the volume of

the investment market, up by 80% compared with 2013, and falling

investment yields. The company therefore sold the shares of the

company Galaxy Properties, owner of the North Galaxy building, as

well as the Montoyer 14 building in Brussels.

The rental market faces numerous challenges: contraction in

demand for premises among clients, reduction in the average

surface area occupied per employee, pressure on rents and high

vacancy rates in peripheral and decentralised areas. In this context,

Cofinimmo has continued the active marketing of its office space,

as demonstrated by the great success represented by the letting of

the Livingstone II building to the European Commission for a 15-year

term. The presence of European and international institutions and

lobbies stimulates the office market in Brussels, particularly in the

CBD (Central Business District).

The combination of a high-quality letting activity and a strong

1

Source: CBRE.

2

Business parcs are accounted for as a single asset but may be comprised of

several buildings.

3

The buildings which underwent a large-scale renovation are considered as new.

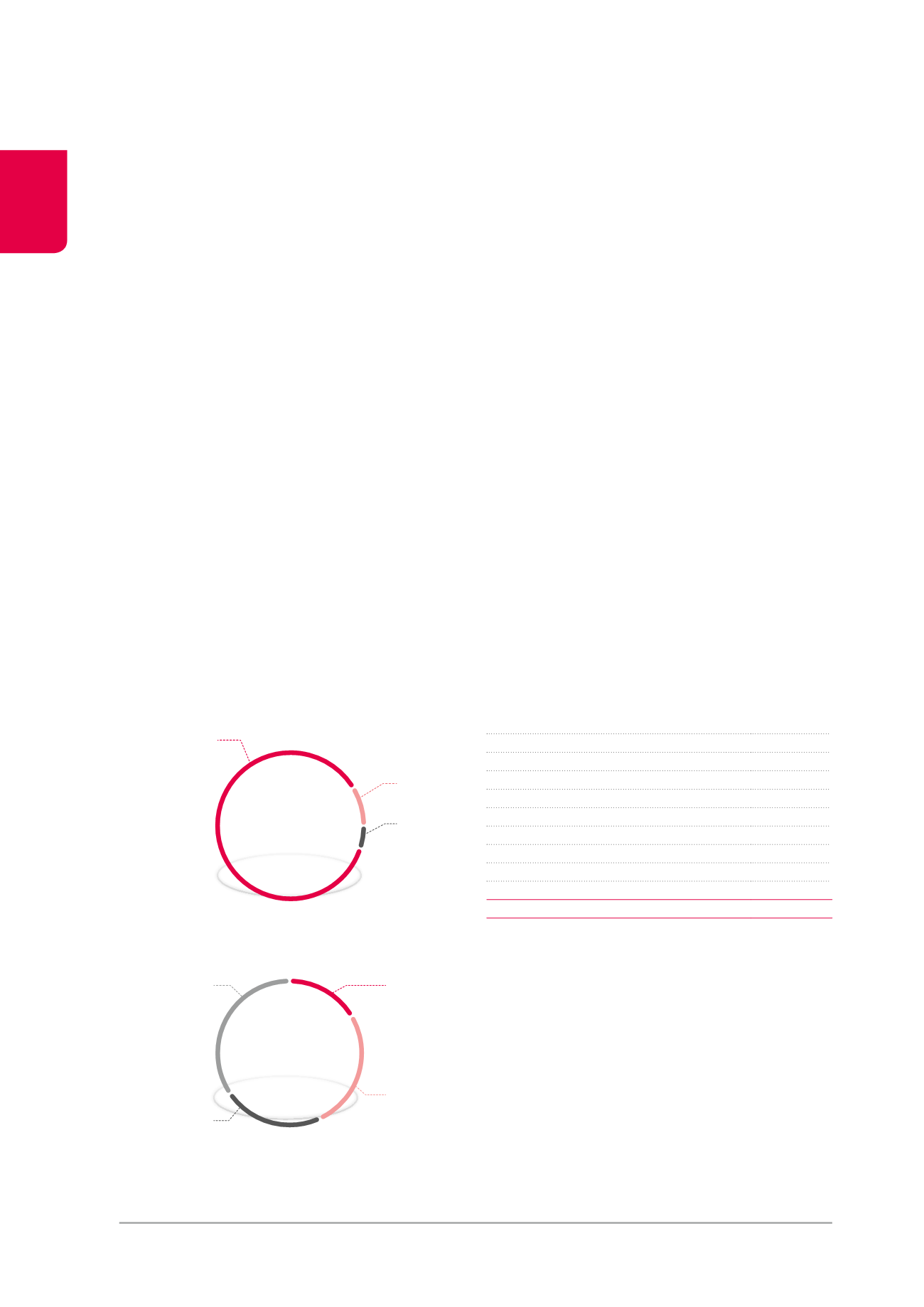

Geographic breakdown – in fair value (in %)

8.6

%

Other

regions

5.0

%

Antwerp

Central Business

District

8.5%

Decentralised

43.0%

Leopold/Louise

District

24.0%

Periphery &

Satellites

10.9%

Brussels

86.4

%

> 15 years

34.4

%

16.5

%

0-5 years

Average age of buildings

3

(in %)

26.7

%

6-10

years

11-15 years

22.4

%

Breakdown by activity sector of tenants – in con-

tractual rent (in %)

Belgian public sector

12.1%

Information technology

9.7%

Insurance

18.9%

International public sector

11.3%

Other

27.3%

Chemicals, Oil & Pharmaceuticals

5.4%

Retail

2.3%

Sollicitors & Consulting

10.7%

Telecommunications

2.3%

TOTAL

100.0%

MANAGEMENT REPORT / PROPERTY PORTFOLIO /

Offices

46