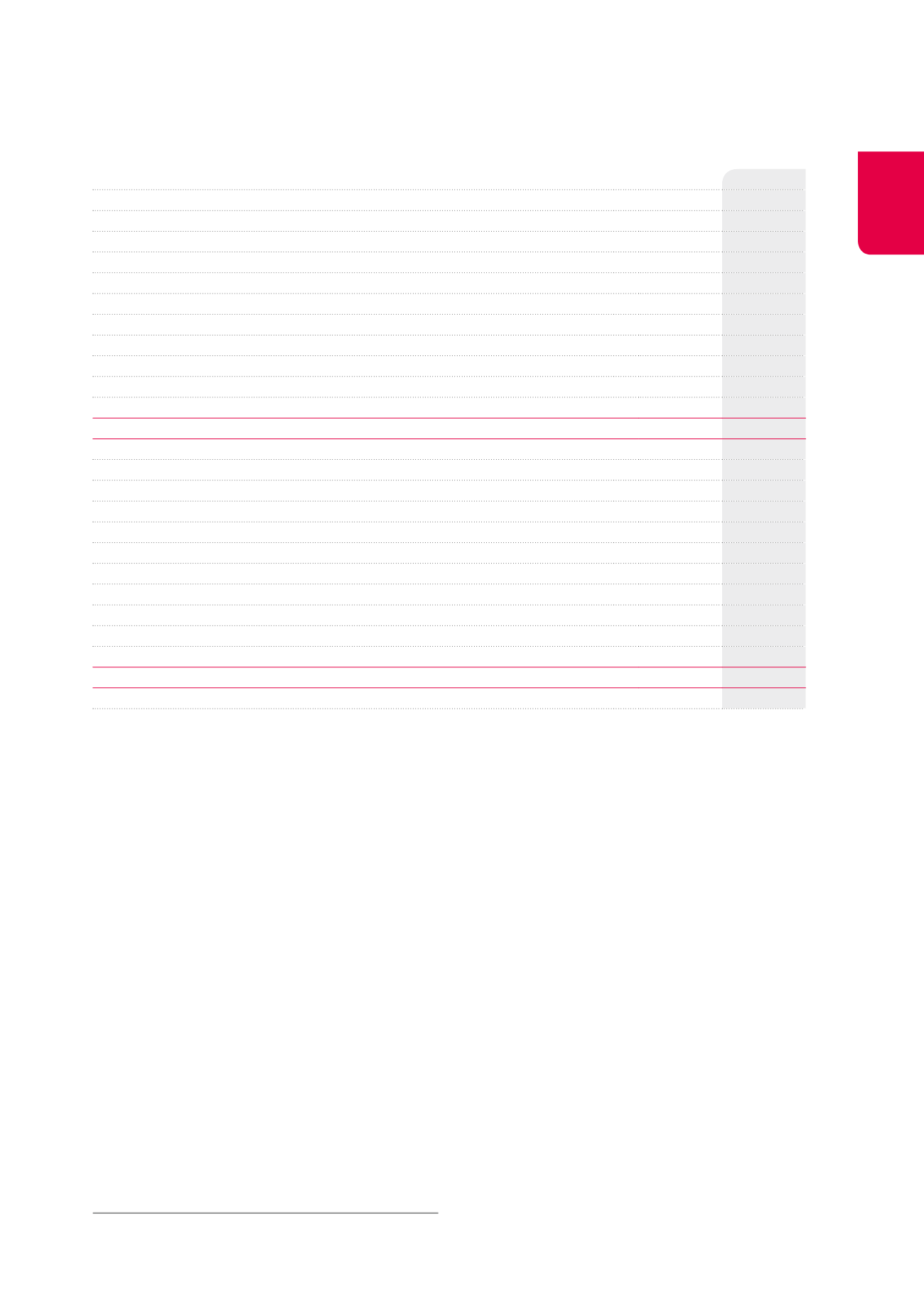

2015 Forecasted consolidated balance sheet

(x€1,000)

31.12.2014

31.12.2015

Non-current assets

3,410,050 3,438,404

Goodwill

118,356

118,356

Investment properties

3,195,773

3,224,270

Finance lease receivables

78,018

77,435

Trade receivables and other non-current assets

12,041

12,041

Participations in associated companies and joint ventures

5,862

6,302

Current assets

88,962

89,452

Assets held for sale

3,410

3,410

Finance lease receivables

1,618

1,618

Cash and cash equivalents

17,117

17,116

Other current assets

66,817

67,307

TOTAL ASSETS

3,499,012 3,527,856

Shareholders’ equity

1,608,965 1,622,363

Shareholders’ equity attributable to shareholders of parent company

1,541,971

1,553,991

Minority interests

66,994

68,372

Liabilities

1,890,047

1,905,493

Non-current liabilities

1,303,250 1,299,444

Non-current financial debts

1,148,023

1,161,717

Other non-current financial liabilities

155,227

137,727

Current liabilities

586,797

606,049

Current financial debts

473,499

494,254

Other current financial liabilities

113,297

111,795

TOTAL SHAREHOLDERS’ EQUITY AND LIABILITIES

3,499,012 3,527,856

Debt ratio

48.08%

48.61%

As the case may be, the company will comply with the provision of

Article 24 of the Royal Decree of 13.07.2014

1

(see also page 176).

1

This Article foresees the obligation to draw up a financial plan accompanied by

an execution schedule, detailing the measures taken to prevent the consolidated

debt ratio from exceeding 65% of the consolidated assets. This plan must be

submitted to the FSMA.

41