MANAGEMENT REPORT /

Forecasts 2015

following the restructuring of the financial hedging instruments in

2014. Considering these assumtions, the forecasted debt ratio at

31.12.2015 is below 50%.

Dividend

The Board of Directors plans to offer the shareholders a gross

dividend per ordinary share of €5.50 for the financial year 2015, i.e.

a consolidated pay-out ratio of 80.3%. The proposed dividend level

of €5.50 for the financial year 2015 corresponds to a gross yield of

6.12% against the average share price of the ordinary share during

the financial year 2014, and a gross yield of 6.41% against the net

asset value of the share at 31.12.2014 (in fair value). These yields

remain significantly higher than the average yield of European real

estate companies.

Unless the company is not obliged to distribute a dividend, this

proposal will be in line with the provisions of Article 13 of the Royal

Decree of 13.07.2014, in that it exceeds the minimal requirement to

distribute 80% of the net income of Cofinimmo SA/NV (unconsoli-

dated) forecasted for 2015.

Caveat

The forecast consolidated balance sheet and income statement are

projections, the achievement of which depends namely on trends

in the property and financial markets. They do not constitute a com-

mitment on the part of the company and have not been certified by

the company’s statutory auditor.

Nevertheless, the Auditor, Deloitte Company Auditors SC s.f.d. SCRL,

represented by Mr. Franck Verhaegen, has confirmed that the

forecasts have been drawn up properly on the indicated basis and

that the accounting basis used for the purposes of this forecast are

compliant with the accounting methods employed by Cofinimmo in

preparing its consolidated accounts using accounting methods in

accordance with IFRS standards as executed by the Belgian Royal

Decree of 13.07.2014.

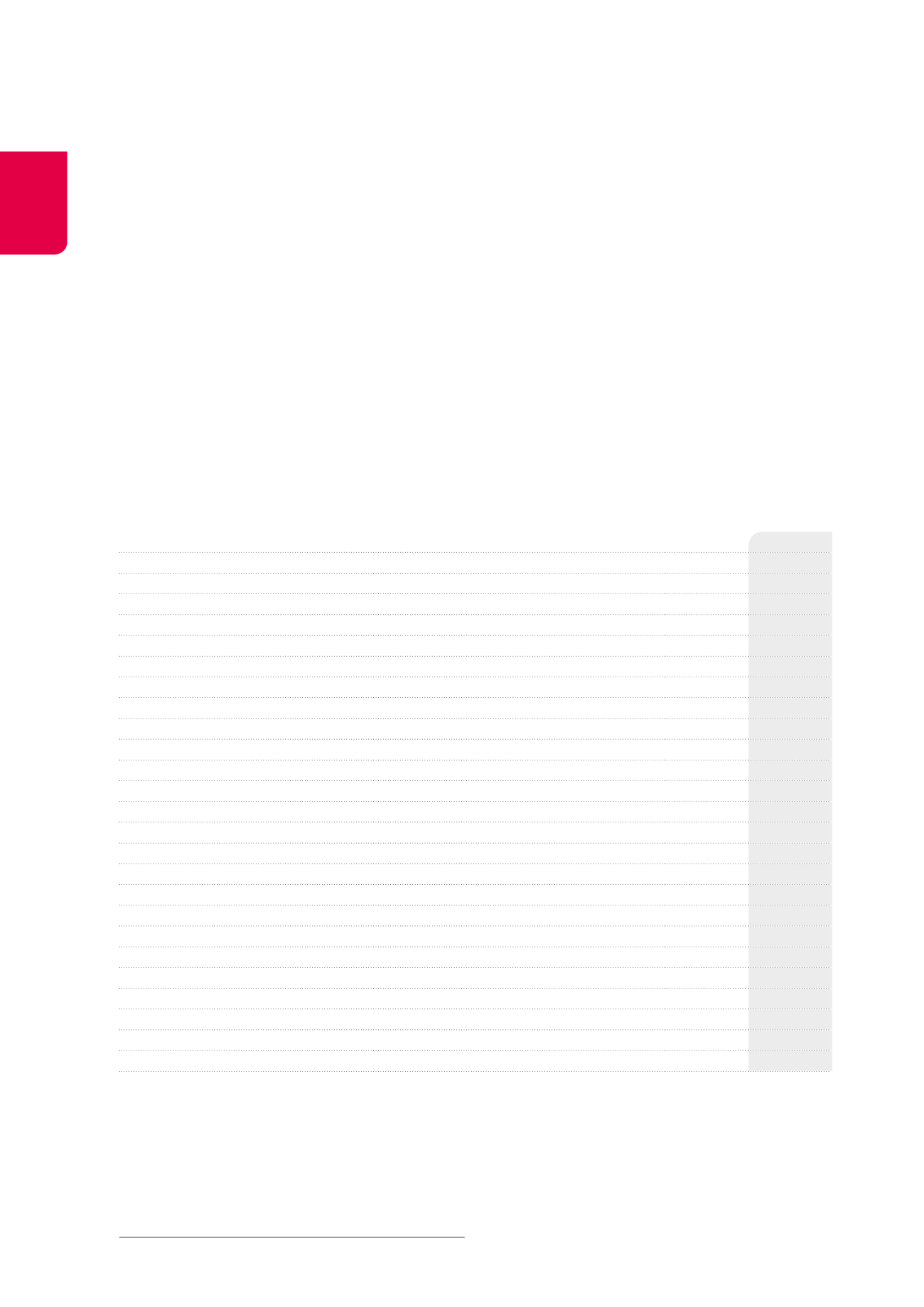

2015 Forecasted consolidated income statement – Analytical form

(x€1,000)

2014

2015

NET CURRENT RESULT

Rental income, net of rental-related expenses

195,827

199,605

Writeback of lease payments sold and discounted (non-cash)

15,931

10,214

Taxes and charges on rented properties not recovered

-2,756

-2,211

Redecoration costs, net of tenant compensation for damages

-928

-1,391

Property result

208,074

206,217

Technical costs

-3,802

-5,662

Commercial costs

-1,137

-904

Taxes and charges on unlet properties

-3,922

-6,082

Property result after direct property costs

199,213

193,570

Property management costs

-14,295

-15,937

Property operating result

184,918

177,632

Corporate management costs

-7,176

-6,771

Operating result (before result on the portfolio)

177,742

170,861

Financial income (IAS39 excluded)

5,577

5,436

Financial charges (IAS39 excluded)

-57,009

-43,311

Revaluation of derivative financial instruments (IAS39)

-136,143

Share in the result of associated companies and joint ventures

1,180

440

Taxes

-2,493

-3,644

Net current result

1

-11,146

129,782

Minority interests

-4,509

-4,357

Net current result - Group share

-15,655

125,425

Number of shares entitled to share in the result of the period

17,971,494 18,306,437

Net current result per share - Group share

-0.87

6.85

Net current result per share - Group share - excluding IAS39 impact

6.70

6.85

1

Net result excluding the result on disposal of investment properties, the changes

in fair value of investment properties and the exit tax.

40