Assumptions

Valuation of assets

The fair value, i.e. the investment value of the properties of which

transaction costs are deducted, is included in the consolidated bal-

ance sheet. For the 2015 provisional balance sheet, this valuation

is entered as an overall figure for the entire portfolio, increased by

major renovation expenses.

Maintenance and repairs – major renovation works

The forecasts by building include both the repair and maintenance

costs, which are entered under operating expenses, and the major

renovation costs, which are capitalised and met from self-financ-

ing or borrowing. The large-scale renovation expenses taken into

account in the forecast amount respectively to €30.33 million for

the office buildings and €2.88 million for the cafés/restaurants.

Investments and divestments

The forecast takes into account the following investment and

divestment projects, provided that Cofinimmo is legally bound:

•

The acquisition of nursing homes in Belgium, France and the

Netherlands for a total amount of €37.94 million resulting from

the delivery of new units or the extension of existing units;

•

The disposal of MAAF insurance branches for €0.44 million,

corresponding to firm commitments. Moreover, assumptions

were made with regard to the disposal of the apartments of the

Livingstone I and Woluwe 34 buildings.

Forecasts 2015

Rents

Rent forecasts include assumptions for each lease as to tenant

departures, analysed on a case-by-case basis, and, in the event of

tenant departure, redecoration costs, a period of rental vacancy,

rental charges and taxes on unlet space plus agency commissions

when the space is relet. Letting forecasts are based on the current

market situation, without assuming either a possible upturn or

deterioration in the market.

The property result also incorporates the writeback of lease pay-

ments sold and discounted relating to the gradual reconstitution

of the full value of buildings which leases have been sold to a third

party.

A 1% variation either way in the occupancy rate leads to a cumula-

tive increase or reduction in the net current result per share and per

year of €0.04. The ongoing contracts are indexed.

Inflation

The inflation rate used for the evolution of rents amounts to 1.20%

for the leases being indexed in 2015. The sensitivity of the forecast

to changes in the inflation rate is low over the considered period. A

0.5% variation either way from the predicted inflation rate leads to a

cumulative increase or reduction in the net current result per share

and per year of €0.05.

Financial charges

The calculation of financial charges is based on the assumption

that interest rates will evolve as anticipated by the future rates

curve, and on the current bank and bond borrowings. Considering

the hedging instruments in place, the estimated cost of debt in

2015 should be below 3.00% (margins included). No assumptions

were made as to changes in the value of the financial instruments

due to the evolution of interest rates, either on the balance sheet or

under the income statement.

Consolidated income statement

Given the uncertainty of a forward projection of the future market

values of the properties, no reliable assessed forecast can be

provided for the unrealised result on the portfolio.

This result will depend on trends in the rental market, capitalisation

rates as well as anticipated renovation costs of buildings.

Changes in shareholders’ equity will depend on the current result,

the result on the portfolio and the dividend distribution.

Shareholders’ equity is presented before distribution of the divi-

dends for the financial year.

Net current result per share

Based on the current expectations and in the absence of major

unforeseen events, the Group has set an objective for its net

current result – Group share (excluding IAS 39 impact) of €6.85 per

share for the financial year 2015, a 2.24% increase compared to the

financial year 2014 (€6.70). The net current result (excluding IAS 39

impact) forecasted for 2015 amounts to €125.4 million, against a

net current result (excluding IAS 39 impact) of 2014 of €120.5 mil-

lion. The higher net current result (excluding IAS 39 impact) per

share is mainly the result of the decrease of the financial charges

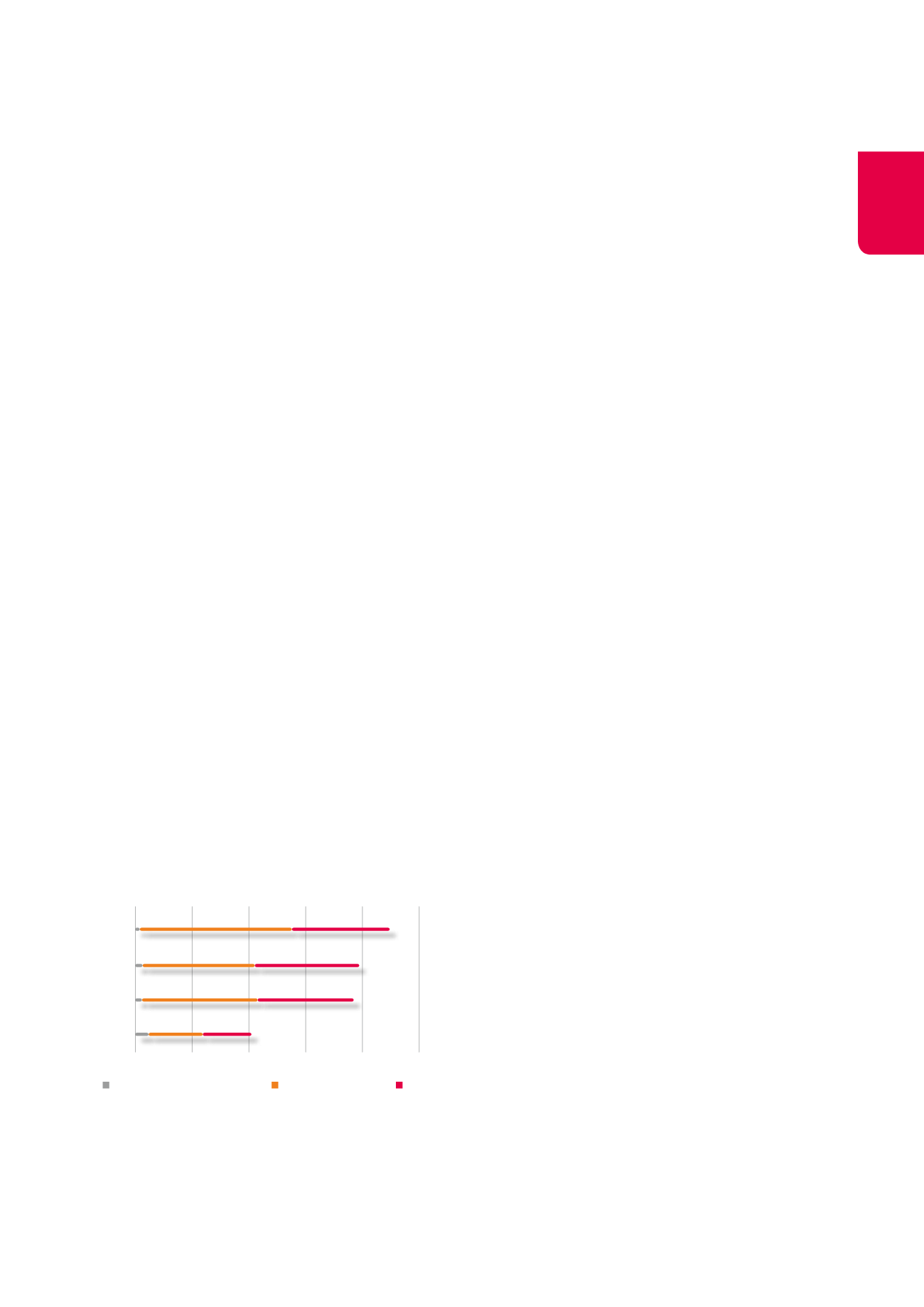

2015 Investment programme (x €1,000,000)

0

5

10

15

25

20

13.3

9.8

10.1

4.7

8.5

9.1

8.4

4.3

Property of distribution networks

Healthcare real estate

Offices

0.7

0.1

1.2

Q1 2015

Q2 2015

Q3 2015

Q4 2015

0.4

39