Rental yield

The diversification of the property portfolio guarantees the stability of the rental yields

over the years.

MANAGEMENT REPORT /

Transactions and performances in 2014

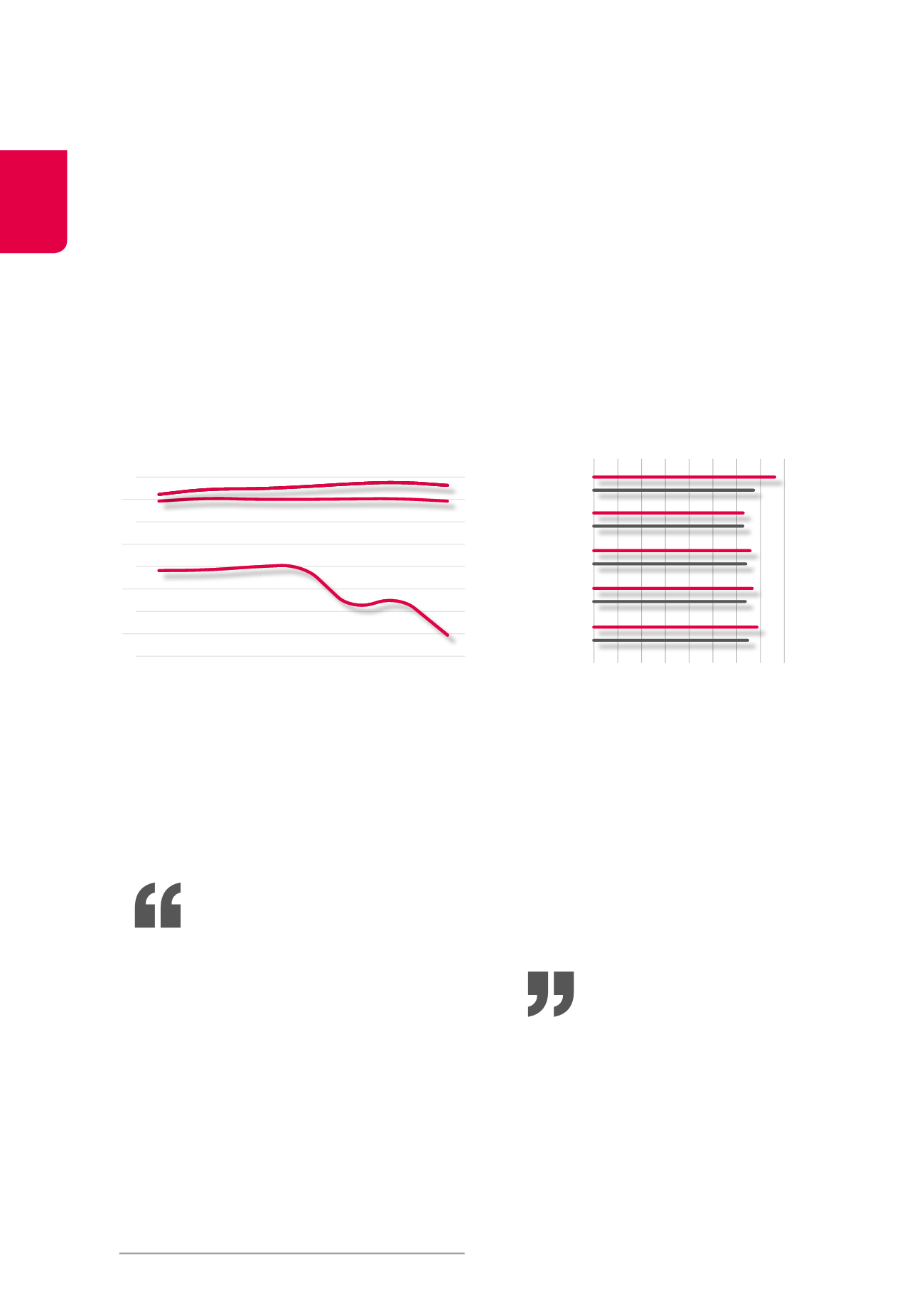

Capitalisation rates applied on the Cofinimmo portfolio and

yield of the Belgian government bonds (in %)

2008 2009 2010

2011

2012

2013

2014

Gross/net rental yields per sector

1

(in %)

7.61%

6.73%

6.30%

6.29%

6.59%

6.41%

6.68%

6.39%

6.88

%

6.49

%

Offices

Healthcare

real estate

Property of

distribution

networks

Other

Global

portfolio

Gross

Net

Gross

Net

Gross

Net

Gross

Net

Gross

Net

The gross rental yield of the portfolio decreased to 6.88% in 2014

(7.03% in 2013). This represents a 5.97% premium compared to the

yield of the Belgian government bonds (OLO) over ten years.

The difference between the gross and net rental yields comes from

the direct costs. These are mainly comprised of technical and com-

mercial costs, as well as rental costs and taxes on unlet buildings.

In the sector of healthcare real estate, the leases are mainly “triple

net”, which means that the insurances, taxes and maintenance

costs are borne by the tenant. Therefore, in this sector, gross and

net yields are almost identical.

0

2

4

6

8

In the healthcare real estate sector, the charges, taxes

and insurances being borne by the tenants, gross and

net yields are almost identical.

7.61%

6.88%

0.91%

Cofinimmo

Office portfolio

Cofinimmo

Global portfolio

10-year Belgian govern-

ment bond

8

6

4

2

0

1

If the portfolio is 100% rented.

36