Occupancy rate and rental vacancy

The rental vacancy risk faced by Cofinimmo each year represents

on average 5% of its overall portfolio and 10% to 15% of its office

portfolio alone. The letting team pays special attention to the clients

whose leases are considered at risk. The treatment of the rental

vacancy risk in 2014 shows that 67% was secured through renego-

tiations, unexercised breaks and lease renewals. This percentage

of tenant retention reaches 72% if the new leases that were signed

and took effect during the year are also taken into account. Hence,

of the 5% of the total portfolio that were at risk in 2014, 3.6% have

been secured.

During the financial year 2014, Cofinimmo signed leases for over

54,400m² of office space, representing contractually guaranteed

revenues, net of rent-free periods, of €58.4 million

1

. The most impor-

tant transactions are related to the Livingstone II, Arts/Kunsten

47-49, Woluwe 102, Leuvensesteenweg 325, Souverain/Vorst 36 and

Bourget 44 buildings.

On a like-for-like basis, the rental revenues increased by 1.02% in

2014.

Three elements help to maintain a positive reversion:

•

the office occupancy rate

3

, which is still relatively high

(90.35%);

•

the tenant rotation rate over the entire portfolio, which remains

limited at 2%;

•

healthcare real estate and property of distribution networks

have leases which are indexed positively and rents which are

protected by their long duration.

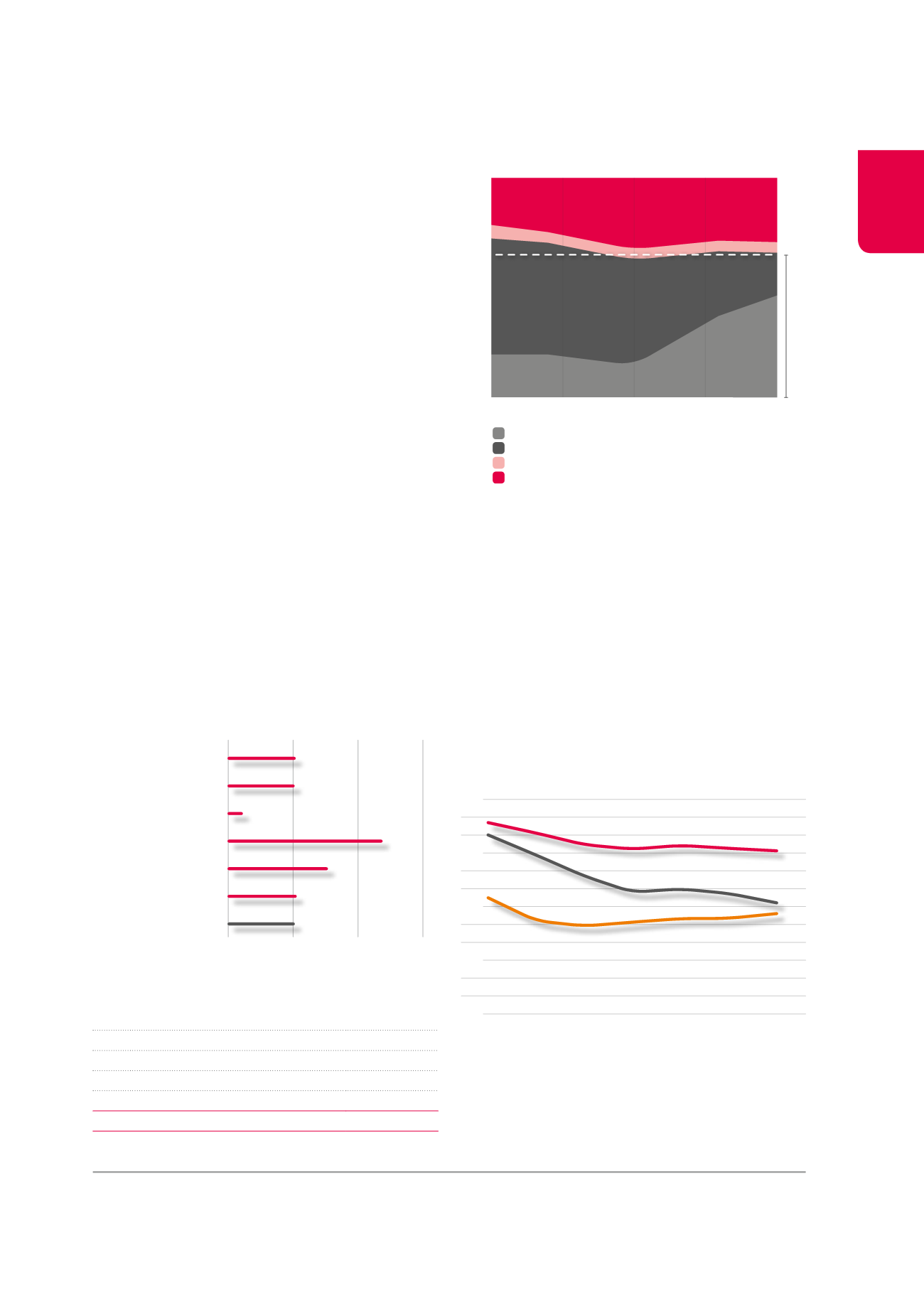

Vacancy risk handling (in %)

2010

2011

2012

2013

2014

100

90

80

70

60

50

40

30

20

10

0

67%

5%

28%

15%

52%

Evolution of rental revenues on a like-for-like basis 2014 vs.

2013 (in %)

0

1

2

3

1.0%

0.2%

2.4%

1.6%

1.1%

1.0

%

1.0%

Offices

Healthcare real estate

Belgium

Healthcare real estate

France

Healthcare real estate

Netherlands

Property of distribution

networks

Other

Global portfolio

1

Spread over the fixed length of the new or renegotiated lease agreements.

2

The renegociations of lease contracts were made at less favourable conditions

than the previous contracts for the same premises.

3

The occupancy rate is calculated by dividing the contractual rents of the current

leases (indexed) by the sum of these contractual rents and the estimated rental

values of the vacant premises, the latter being calculated on the basis of the

prevailing market rents.

4

Source: CBRE.

The occupancy rate of the office portfolio (90.35%) is still above

the market average which stands at 89.37%

4

. This is the result

of the letting strategy based on the relationship of trust with the

clients, leading to a favourable evolution of the operating margin.

Furthermore, the diversification in the healthcare real estate sector

and the Pubstone and Cofinimur I portfolios, where the occu-

pancy rate is close to 100%, has a positive impact on the overall

occupancy rate, which stands at 95.19%, and improves the risk

distribution.

Unexercised breaks

Renegociations

2

New lettings

Effective departures

100

95

90

85

80

2008

2009

2010

2011

2012

2013

2014

Cofinimmo

Global portfolio

95.19%

Cofinimmo

Offices

90.35%

Brussels office

market

89.37%

Evolution of the occupancy rate of the Cofinimmo portfolio vs.

the Cofinimmo office portfolio vs. the Brussels office market

(in %)

Occupancy rate of the portfolio (in %)

Offices

90.35%

Healthcare real estate

99.13%

Property of distribution networks

98.40%

Other

99.82%

GLOBAL PORTFOLIO

95.19%

33