Letting activity

The marketing and Property Management teams are constantly working with a view to

improve the occupancy rate, the rental conditions and the lease term of the portfolio.

Rental situation by destination

In collected rents, offices represent 41.4% of the portfolio, health-

care real estate 38.8%, property of distribution networks 17.7%

and the other business sectors 2.1%. The difference between the

Properties

Super

structure

(in m²)

Contractual

rents

(x €1,000)

Contractual

rents

(in %)

Occupancy

rate

Rents + ERV

1

on unlet

(x €1,000)

ERV

1

(x €1,000)

Total offices & offices which receivables

have been sold

618,579

87,797

41.4%

90.35%

97,170

94,115

Healthcare real estate

682,461

82,233

38.8%

99.13%

82,953

83,327

Pubstone

360,887

29,854

14.1%

98.97%

30,166

27,406

Cofinimur I

59,867

7,731

3.6%

96.28%

8,030

8,311

Other

23,026

4,301

2.0% 99.84%

4,308

4,100

Total investment properties &

properties which receivables have been

sold

1,744,821

211,916

99.9%

95.19% 222,627

217,259

Projects and renovations

35,536

-

-

-

-

-

Land reserve

-

149

0.1%

-

149

176

GLOBAL PORTFOLIO

1,780,357

212,065

100%

95.19% 222,776

217,435

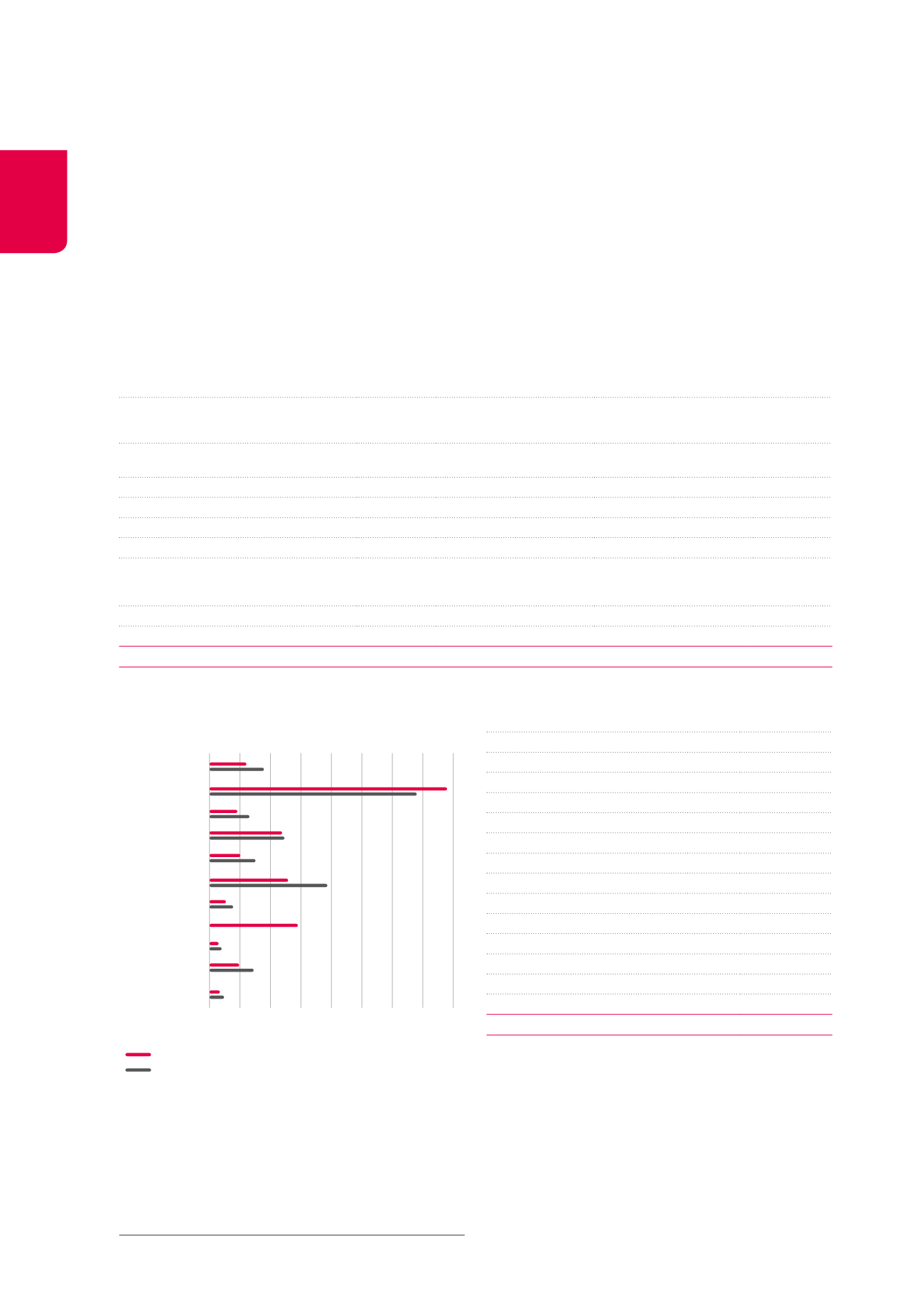

Breakdown by activity of the tenants – in consolidated

contractual rents and in contractual rents of the public RREC

(in %)

Main clients - in contractual rents (in %)

Korian/Medica Group

15.8%

AB InBev Group

14.1%

Armonea

9.8%

Buildings Agency (Belgian State)

5.6%

AXA Group

5.5%

Top 5 tenants

50.8%

International public sector

4.6%

ORPEA

4.3%

Senior Assist

3.7%

MAAF

3.6%

IBM Belgium

2.2%

Top 10 tenants

69.2%

Top 20 tenants

78.3%

Other tenants

21.7%

TOTAL

100%

1

ERV = Estimated Rental Value.

2

The contractual rents of the public RREC are related to Cofinimmo SA/NV.

MANAGEMENT REPORT /

Transactions and performances in 2014

rents actually collected and the contractual rents results from the

rent-free periods granted at the beginning of certain leases and the

prorata temporis vacancy of properties during the past 12 months.

0 5 10 15 20 25 30 35 40

Belgian public

sector

Healthcare

Information

technology

Insurance

International

public sector

Other

Chemicals, oil &

pharmaceuticals

Pubstone

Retail

Sollicitors &

consulting

Tele

communications

Consolidated contractual rents

Contractual rents of the RREC

2

Since the merger of both entities in March 2014, the Korian/Medica

Group has become the largest tenant of the portfolio. AB InBev,

which rents the entire Pubstone portfolio, comes second.

The public sector, both Belgian and international, represents 10.2%

of the tenants.

The other tenants in the segment of healthcare real estate are also

well represented, with Armonea, first nursing home operator in

Belgium, and ORPEA, one of the foremost European players in the

care market.

32