1

The fair value is obtained by deducting an appropriate rate of transaction costs

(mainly transfer taxes) from the investment value.

2

The investment value, which is established by independent real estate experts,

is the most likely value that could reasonably be obtained in normal sales

conditions between willing and well-informed parties, before deduction of

transaction costs.

3

Investments include renovations, extensions and redevelopments.

4

Investment value.

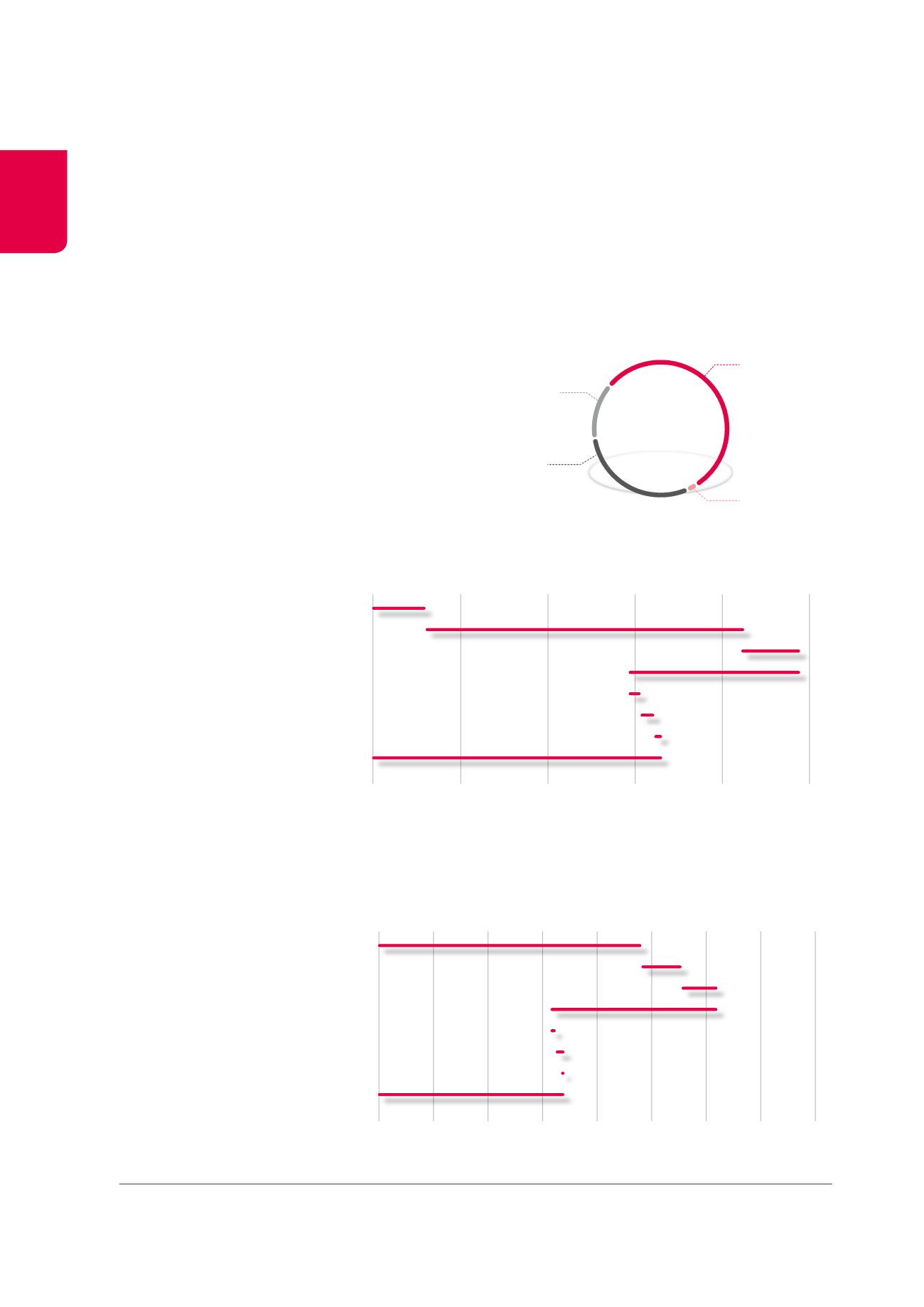

Total portfolio

At 31.12.2014, the consolidated property portfolio reaches €3,199.2million in fair value

1

and €3,329.2million in investment value

2

.

3,000

Portfolio at 01.01.2014

Net disposal value

Acquisitions

Realised gains and losses compared to the last

annual estimated value

Change in the investment value of the portfolio

Constructions and renovations

Writeback of lease payments sold - value

reconstitution

Portfolio at 31.12.2014

3,478.9

65.1

-303.5

2.0

15.9

-2.2

3,329.2

73.0

3,200

3,400

3,600

3,800

Evolution of the consolidated portfolio 1996-2014

4

(x €1,000,000)

0

Portfolio at 01.01.1996

Net disposal value

Acquisitions

Realised gains and losses compared to the last annual

estimated value

Change in the investment value of the portfolio

Constructions and renovations

Writeback of lease payments sold - value

reconstitution

Portfolio at 31.12.2014

608.6

669.0

-1,959.0

145.5

156.8

89.0

3,329.2

3,619.3

1,000

2,000

3,000

4,000

5,000

Acquisition prices and investments 1996-2014

3

(x €1,000,000)

Property of

distribution

networks

Offices

Healthcare real

estate

Other

Evolution of the portfolio since 1996

Since 1996 (date of approval as a Sicafi/Bevak), the Cofinimmo

Group realised investments amounting to €4,288.3 million. It also

divested for €1,813.5 million, realising (before deduction of interme-

diaries’ remuneration and other various costs) an average net gain

of +9.3% compared to the last annual valuations (in investment

value) preceding these disposals. During the year 2014 alone, this

average stood at +0.6%. This amount does not include the sale of

the shares of the company Galaxy Properties SA/NV, owner of the

North Galaxy building. This sale resulted in a realised accounting

loss of €24 million, booked under the gains and losses on disposals

of securities.

566.7

1,289.3

45.6

2,386.7

MANAGEMENT REPORT /

Transactions and performances in 2014

Evolution of the consolidated portfolio in 2014

4

(x €1,000,000)

Evolution of the portfolio in 2014

28