In 2014, the Cofinimmo Group strengthened its geographical diver-

sification in healthcare real estate by expanding its investments in

Germany. Cofinimmo is not only interested in rehabilitation clinics in

Germany but also in accommodation for the elderly.

The group has also strengthened its presence in the Netherlands

through the acquisition of a portfolio of 13 new or to-be-built health-

care facilities.

In some more mature markets, such as France for example,

Cofinimmo has initiated a selective arbitrage policy. This involves

selling non-strategic assets and reinvesting the funds generated in

other assets which are more in line with the Group’s vision, namely

new constructions. The criteria taken into account in the decision

to sell a healthcare asset relate in particular to its size, its age, its

location, its operation and the residual term of the lease

Portfolio at 31.12.2014

At 31.12.2014, Cofinimmo’s healthcare real estate portfolio accounted

for 40.3% of its total invested portfolio. It comprised 134 properties,

with a total above-ground floor area of 682,461m

2

and a fair value

of €1,289.1 million. It includes nursing and care homes, revalidation

clinics as well as psychiatric clinics.

The main characteristics of this sector are:

•

These investments benefit from a favourable legal

environment: they are based on real growth needs due to

demographic changes and they are highly regulated, both

at national and regional level, presenting a significant entry

barrier;

•

The leases concluded with operators are long-term. They have

an initial fixed term of 27years in Belgium, 12years in France,

15years in the Netherlands and 25years in Germany;

•

The rents, which are indexed annually, are fixed and are not

tied to resident occupancy rates. In addition, almost all lease

agreements provide an extension option for two consecutive

periods of nine years in Belgium, nine to 12years in France and

ten years in the Netherlands.

Healthcare operators

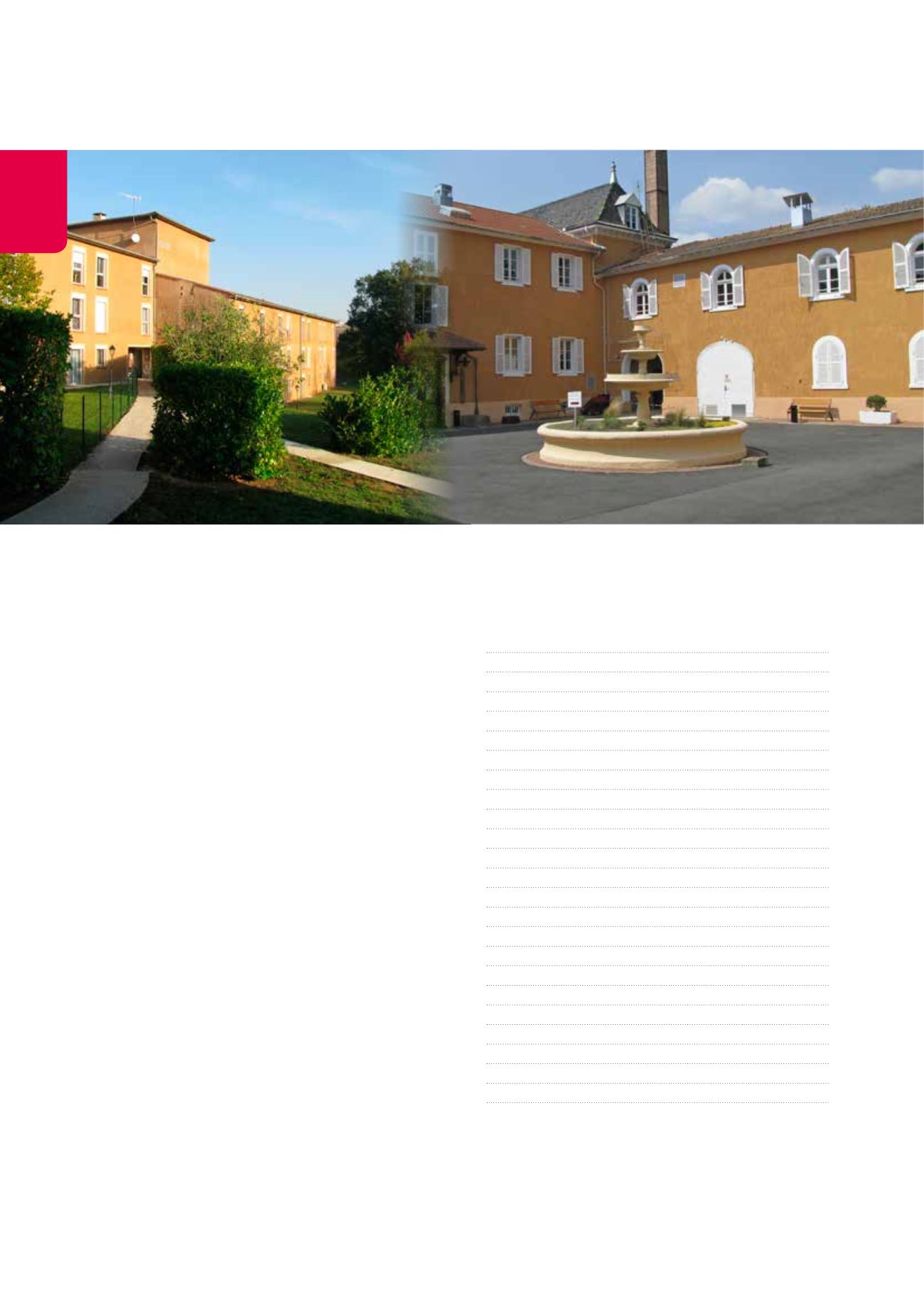

Bruyères, Letra (FR)

Automne, Villars les Dombes (FR)

Breakdown by operator – in contractual rent (in %)

Belgium

61.9%

Armonea

25.2%

Senior Living Group

19.9%

Senior Assist

9.6%

ORPEA Belgium

4.1%

Other Belgium

3.1%

France

30.3%

Korian/Medica

20.8%

ORPEA

7.0%

Inicéa

2.3%

Other France

0.2%

Germany

1.0%

Celenus

1.0%

Netherlands

6.8%

Bergman Clinics

1.7%

Domus Magnus

1.2%

European Care Residences

1.2%

Stichting Elisabeth

0.8%

Stichting Zorggroep Noordwest-Veluwe

0.7%

Stichting Sozorg & Martha Flora

0.6%

Stichting ASVZ

0.2%

Stichting JP van den Bent

0.2%

Stichting Leger des Heils

0.2%

MANAGEMENT REPORT / PROPERTY PORTFOLIO /

Healthcare real estate

54