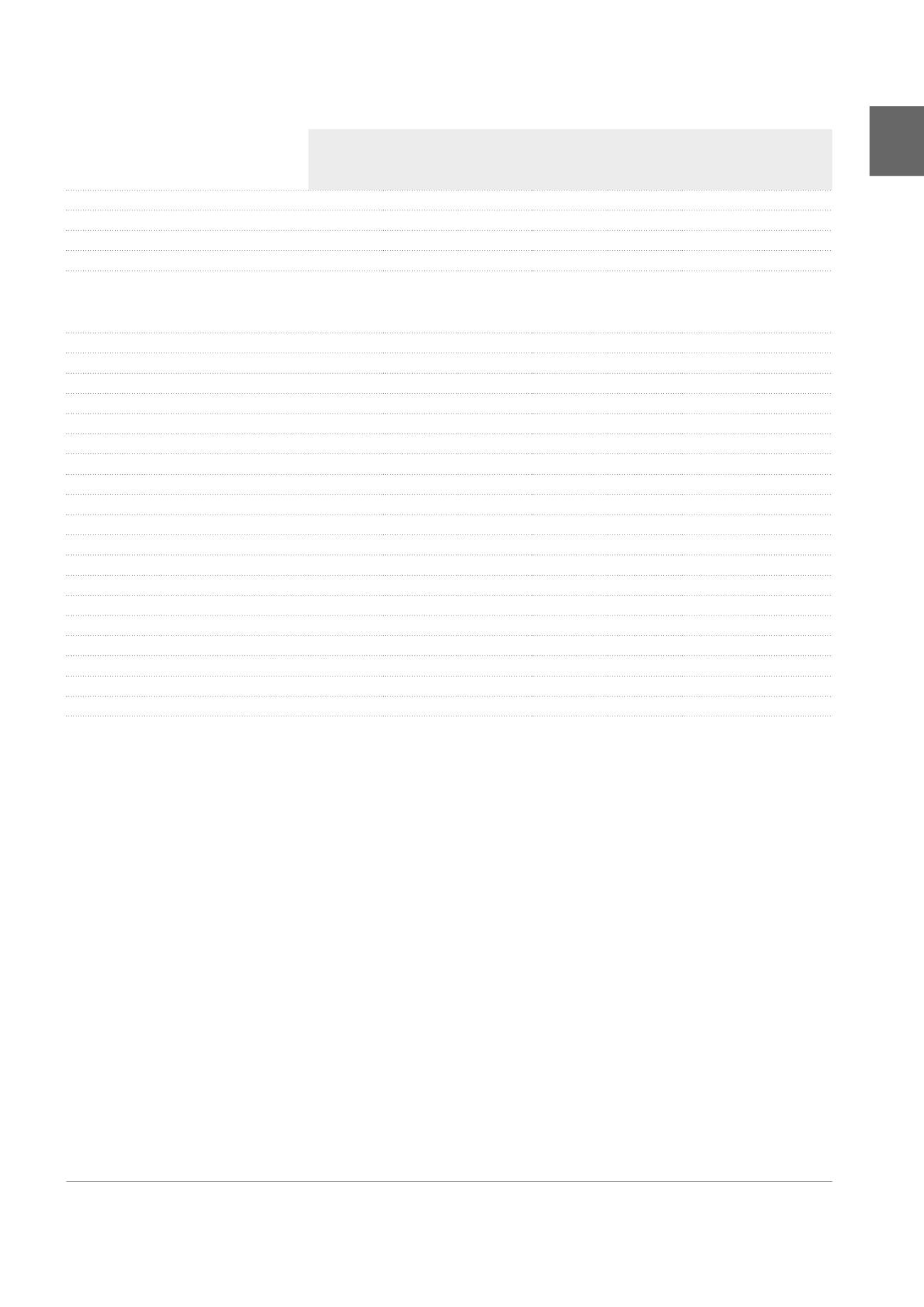

CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS’ EQUITY

(x 1,000 EUR)

Capital

Share

premium

account

Reserves

1

Net result

for the

financial

year

Equity –

Parent

company

Minority

interests

Share

holders’

equity

AT 01.01.2014

942,825

372,110 241,265

58,737 1,614,937

66,525 1,681,462

Appropriation of the 2013 net result

58,737

-58,737

Elements recognised in the global result

51,589

-52,671

-1,082

3,360

2,278

Cash flow hedging

2

51,799

51,799

51,799

Impact on fair value of estimated

transaction costs resulting from

hypothetical disposal of investment

properties

-210

-210

-18

-228

Result of the period

-52,671

-52,671

3,378

-49,293

Other

2,046

2,046

131

2,177

SUBTOTAL

942,825

372,110 353,637

-52,671

1,615,901

70,016 1,685,917

Issue of new shares

3

20,536

12,229

32,765

32,765

Acquisitions/disposals of own shares

-294

-326

89

-531

-531

Dividends/Coupons

-106,164

-106,164

-3,022

-109,186

AT 31.12.2014

963,067

384,013 247,562

-52,671

1,541,971

66,994 1,608,965

Appropriation of the 2014 net result

-52,671

52,671

Elements recognised in the global result

33,209

103,967

137,176

4,482

141,658

Cash flow hedging

2

33,209

33,209

33,209

Result of the period

103,967

103,967

4,482

108,449

Minority acquisitions

763

763

Minority disposals

-4,386

-4,386

Other

-621

-621

312

-309

SUBTOTAL

963,067

384,013 227,479 103,967 1,678,526

68,165 1,746,691

Issue of shares

3

160,997

120,059

281,056

281,056

Acquisitions/disposals of own shares

231

168

399

399

Dividends/Coupons

-99,882

-99,882

-3,649

-103,531

AT 31.12.2015

1,124,295 504,240

127,597

103,967 1,860,099

64,516 1,924,615

1

See Note 31.

2

Recycling on the income statement included.

3

Shares (capital + share premiums) issued in the context of intragroup mergers, without shares being awarded to third parties outside the Group, are directly eliminated during

consolidation. The issued shares listed here are related to the optional dividend.

155