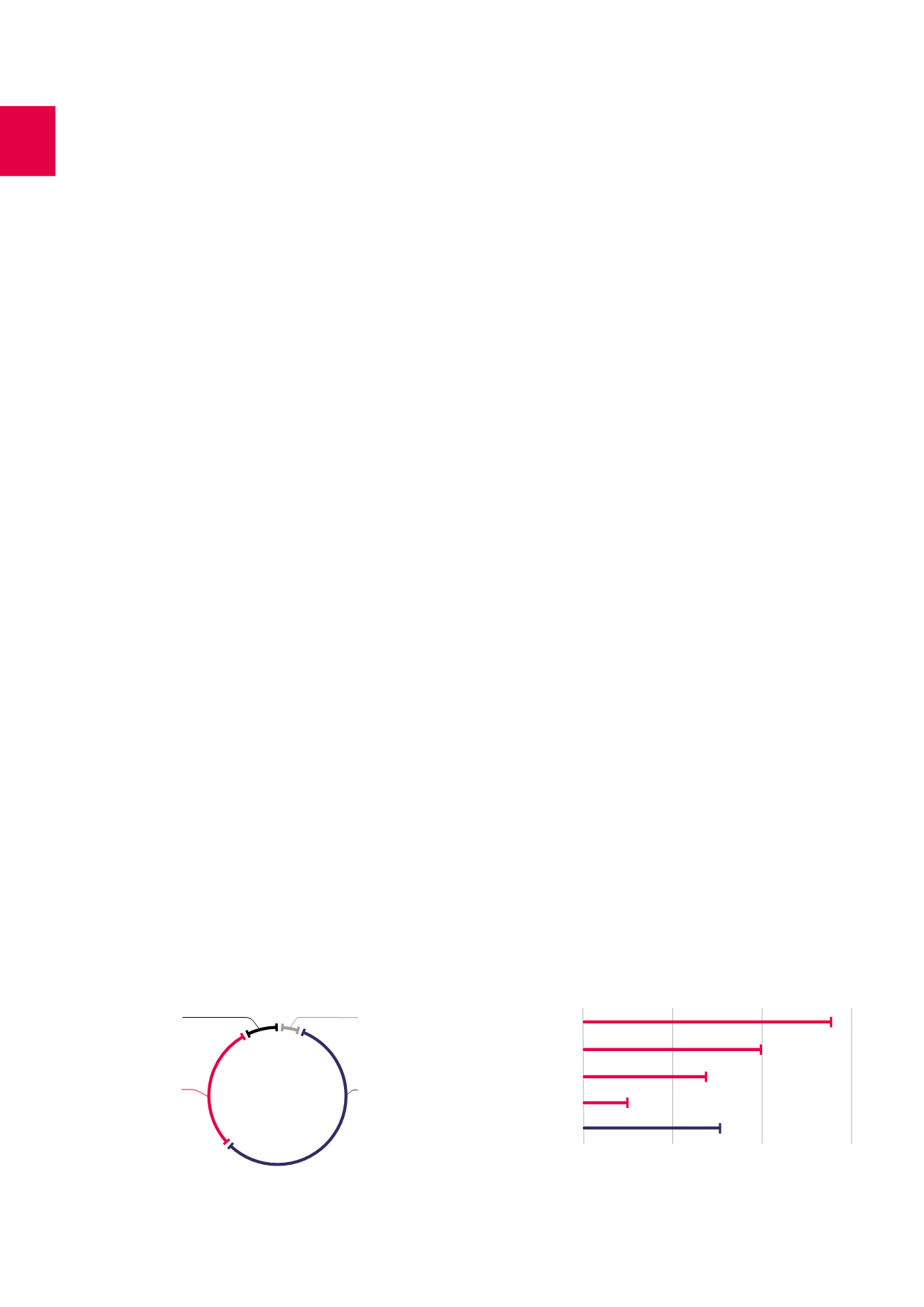

7.9%

28.9%

5.1%

58.1%

15.5

27.8

19.9

5.1

13.9

0

10

20

30

In 2015, Cofinimmo continued its growth in the healthcare real estate segment in line with its strategy

of diversification by country, by operator and by medical specialty. The company was also able to

take advantage of the interest for this type of asset to carry out asset arbitrage.

Favourable legal environment

The investment is based on real needs for growth triggered by the

demographic evolution and new lifestyles. Some care specialisations

are heavily regulated, both at the national and regional levels, which is

a significant obstacle to entry.

Long-term lease contracts with

operators

These lease contracts generally present an initial fixed term of

27 years in Belgium, 12 years in France, 15 years in the Netherlands

and 25 years in Germany. The rents, which are indexed annually, are

fixed and are not tied to resident occupancy rates. In addition, almost

all lease agreements provide an option to extend the lease for two

consecutive periods of nine years in Belgium, nine to 12 years in France

and 10 years in the Netherlands.

Strong growth potential

Faced with the ageing population and changing lifestyles, the require-

ments in terms of accommodations for dependent or sick elderly

people and healthcare are growing. Cofinimmo supports medical

facility operators in their growth and helps them renovate or enlarge

their property portfolio.

MAIN CHARACTERISTICS

OF THE SECTOR

During 2015, Cofinimmo invested 23.9 million EUR in the Netherlands in

new assets or construction projects. In this country, the company is

particularly interested in the growing segment of medium-sized pri-

vate clinics specialising in uncomplicated medical specialisations. The

company also expanded its portfolio in Germany through the purchase

of two sport and well-being centres in Hanover and Hamburg and a

rehabilitation clinic in Bonn for a total of 83.6 million EUR. Several nurs-

ing and care homes were also delivered to Belgium for an investment

of nearly 26 million EUR.

On certain more mature markets, such as France and Belgium,

Cofinimmo initiated a selective arbitrage policy, which consists in

selling non-strategic assets and reinvesting the collected funds in

other assets that correspond better to the Group’s vision. The criteria

taken into account in the decision to sell a healthcare asset concern

in particular its size, age, location, operational use and the remaining

term of the lease. In 2015, Cofinimmo sold therefore its 95% interest

in the Silverstone company, owner of 20 nursing and care homes in

Belgium, in a transition valorising the properties at 134.5 million EUR,

thus permitting a geographical rebalancing of its portfolio.

HEALTHCARE REAL ESTATE

Geographic breakdown – in fair value (in %)

Netherlands

France

Germany

Belgium

30.6%

Flemish region

18.7%

Brussels and

periphery

8.8%

Walloon region

Provincial towns

7.1%

Paris region

6.2%

Mediterranean coast

5.8%

Rural areas

5.1%

English Channel coast

3.2%

Major cities

1.5%

Average residual lease length by country

(in number of years)

Germany

Belgium

Netherlands

France

Total portfolio

50

Management report /

Healthcare real estate