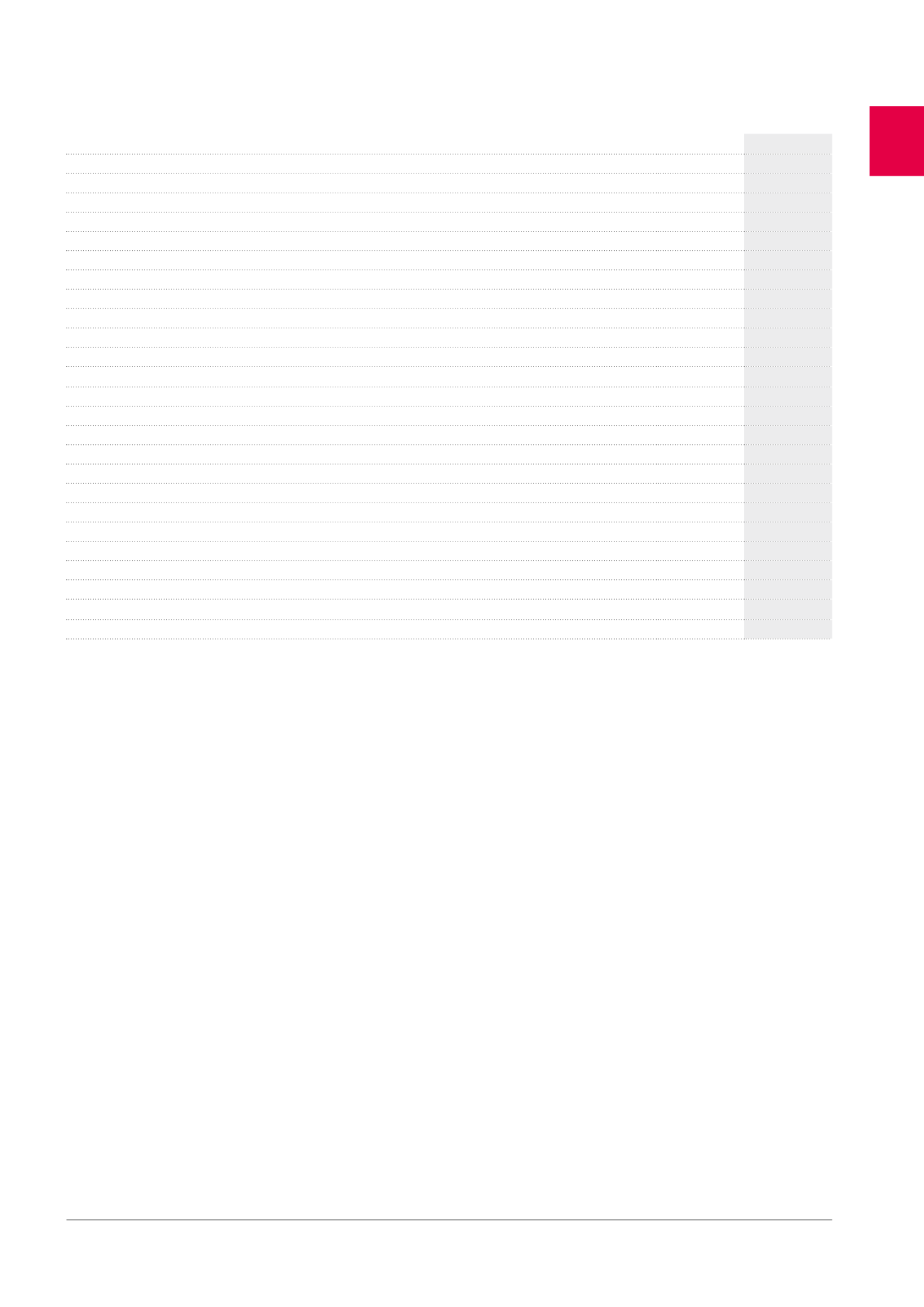

2016 forecast consolidated balance sheet

(x 1,000 EUR)

31.12.2015

31.12.2016

Non-current assets

3,325,414

3,407,447

Goodwill

111,256

111,256

Investment property

3,131,483

3,213,799

Finance lease receivables

75,652

74,900

Trade receivables and other non-current assets

990

990

Participations in associated companies and joint ventures

6,033

6,502

Current assets

87,066

87,321

Assets held for sale

2,870

2,870

Finance lease receivables

1,656

1,656

Cash and cash equivalents

22,040

22,040

Other current assets

60,500

60,755

TOTAL ASSETS

3,412,480 3,494,768

Shareholders’ equity

1,924,615

1,903,960

Shareholders’ equity attributable to shareholders of parent company

1,860,099

1,838,716

Minority interests

64,516

65,244

Liabilities

1,487,865

1,590,808

Non-current liabilities

926,891

1,193,590

Non-current financial debts

809,313

1,076,013

Other non-current financial liabilities

117,578

117,577

Current liabilities

560,974

397,218

Current financial debts

445,676

282,712

Other current financial liabilities

115,298

114,506

TOTAL SHAREHOLDERS’ EQUITY AND LIABILITIES

3,412,480 3,494,768

Debt ratio

38.62%

40.65%

Where relevant, the company shall comply with the provisions of Article 24 of the Royal Decree of 13.07.2014

1

(see also page 90).

1

This Article stipulates the obligation to draw up a financial plan accompanied by an execution schedule, detailing the measures taken to prevent the consolidated debt ratio from

exceeding 65% of the consolidated assets. This plan must be submitted to the FSMA.

45