The shareholders’ equity is presented before distribution of the divi-

dends for the financial year.

Net current result per share

Based on the current expectations and in the absence of major unfore-

seen events, the company has set an objective for its net current

result – Group share (excluding IAS 39 impact) of 6.19 EUR per share for

financial year 2016, a 4.2% decrease compared with financial year 2015

(6.46 EUR). The net current result (excluding IAS 39 impact) forecasted

for 2016 amounts to 129.8 million EUR, compared with the net current

result (excluding IAS 39 impact) of 2015 of 128.5 million EUR. The

decline in the net current result (excluding IAS 39 impact) per share is

explained mainly by the increase in the number of shares entitled to

share in the net result of the financial year (5.5%). Considering these

assumptions, the forecasted debt ratio at 31.12.2016 is maintained

below 50%.

Dividend

The Board of Directors intends to propose to the shareholders a gross

dividend per ordinary share of 5.50 EUR for financial year 2016, i.e. a

consolidated pay-out ratio of 88.9%. The proposed dividend level of

5.50 EUR for financial year 2016 corresponds to a gross yield of 5.53%

in relation to the average share price of the ordinary share during

financial year 2015, and a gross yield of 6.85% in relation to the net

asset value of the share at 31.12.2015 (in fair value). These yields remain

significantly higher than the average yield of European real estate

companies.

Unless the company has an obligation to distribute a dividend, this

proposal should comply with the requirement of Article 13 of the Royal

Decree of 13.07.2014 in that it exceeds the minimal requirement to

distribute 80% of the net income of Cofinimmo SA/NV (unconsolidated)

projected for 2016. This article foresees an absence of the obligation

to distribute a dividend in certain cases. However, Cofinimmo will use

the right to do so in these circumstances, when the net result and the

stipulation laid down in Article 617 of the Company Code allow it.

Caveat

The forecasted consolidated balance sheet and income statement are

projections, the achievement of which depends namely on trends in

the property and financial markets. They do not constitute a commit-

ment on the part of the company and have not been certified by the

company’s auditor.

Nevertheless, the Auditor, Deloitte Company Auditors SC s.f.d. SCRL/

BV o.v.v.e. CVBA, represented by Franck Verhaegen, has confirmed that

the forecasts have been drawn up properly on the indicated basis

and that the accounting basis used for the purposes of this forecast

are compliant with the accounting methods employed by Cofinimmo

in preparing its consolidated accounts using accounting methods in

accordance with IFRS standards as executed by the Belgian Royal

Decree of 13.07.2014.

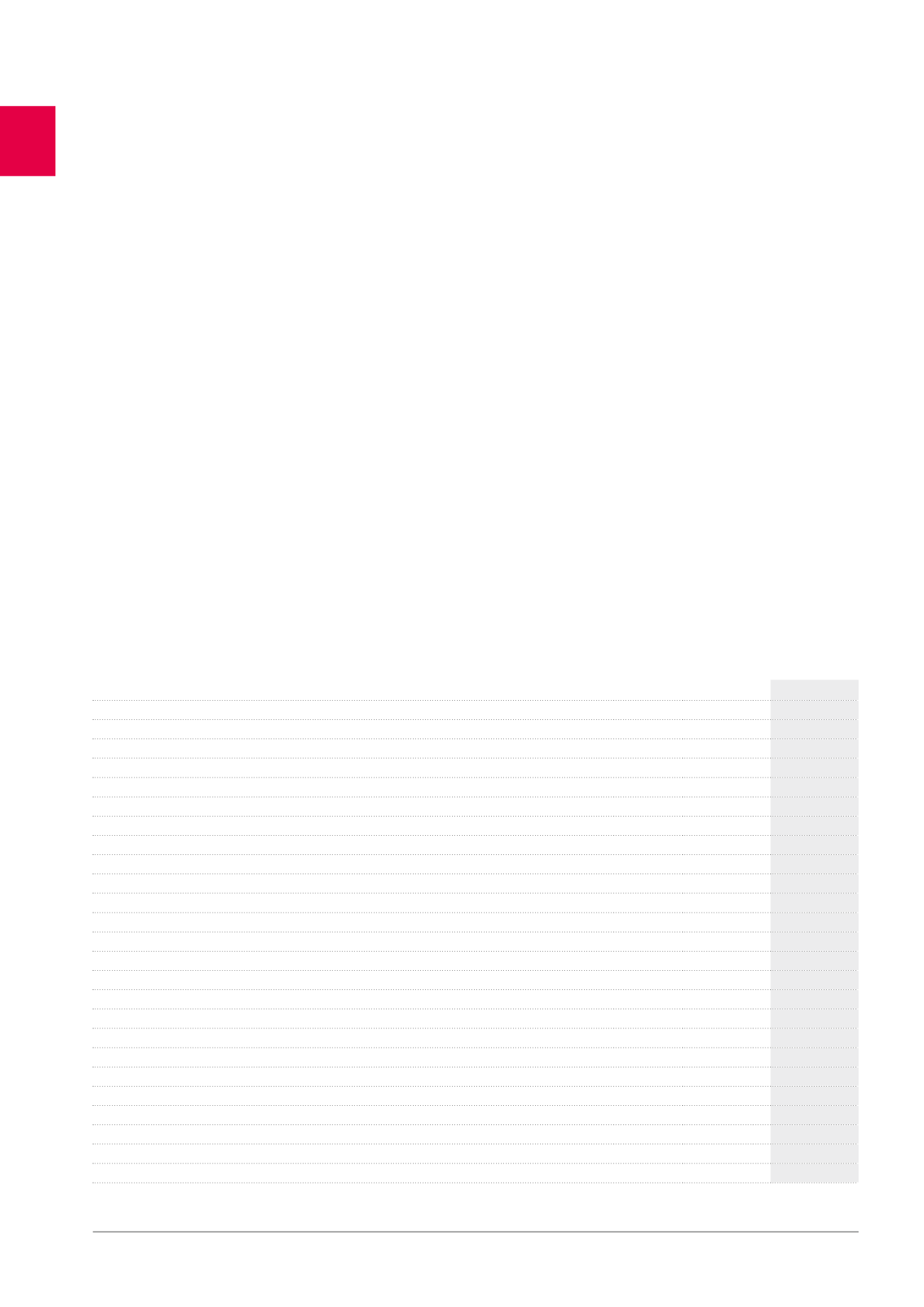

2016 projected consolidated income statement – Analytical form

(x 1,000 EUR)

31.12.2015

31.12.2016

NET CURRENT RESULT

Rental income, net of rental-related expenses

201,903

198,556

Writeback of lease payments sold and discounted (non-cash)

10,214

11,265

Taxes and charges on rented properties not recovered

-3,478

-2,170

Redecoration costs, net of tenant compensation for damages

-1,105

-2,213

Property result

207,534

205,438

Technical costs

-5,643

-7,266

Commercial costs

-950

-1,388

Taxes and charges on unlet properties

-3,451

-3,540

Property result after direct property costs

197,490

193,244

Property management costs

-15,343

-17,498

Property operating result

182,147

175,746

Corporate management costs

-7,806

-7,345

Operating result (before result on portfolio)

174,341

168,401

Financial income (IAS 39 excluded)

5,735

5,105

Financial charges (IAS 39 excluded)

-42,970

-35,862

Revaluation of derivative financial instruments (IAS 39)

-30,403

-5,950

Share in the result of associated companies and joint ventures

460

469

Taxes

-4,209

-3,875

Net current result

1

102,954

128,288

Minority interests

-5,248

-4,284

Net current result – Group share

97,706

124,004

Number of shares entitled to share in the result of the period

19,888,379

20,980,112

Net current result per share – Group share

4.91

5.91

Net current result per share – Group share – excluding IAS39 impact

6.46

6.19

1

Net income excluding gains or losses on disposals of investment properties, changes in fair value of investment properties and exit tax.

44

Management report /

2016 FORECAST