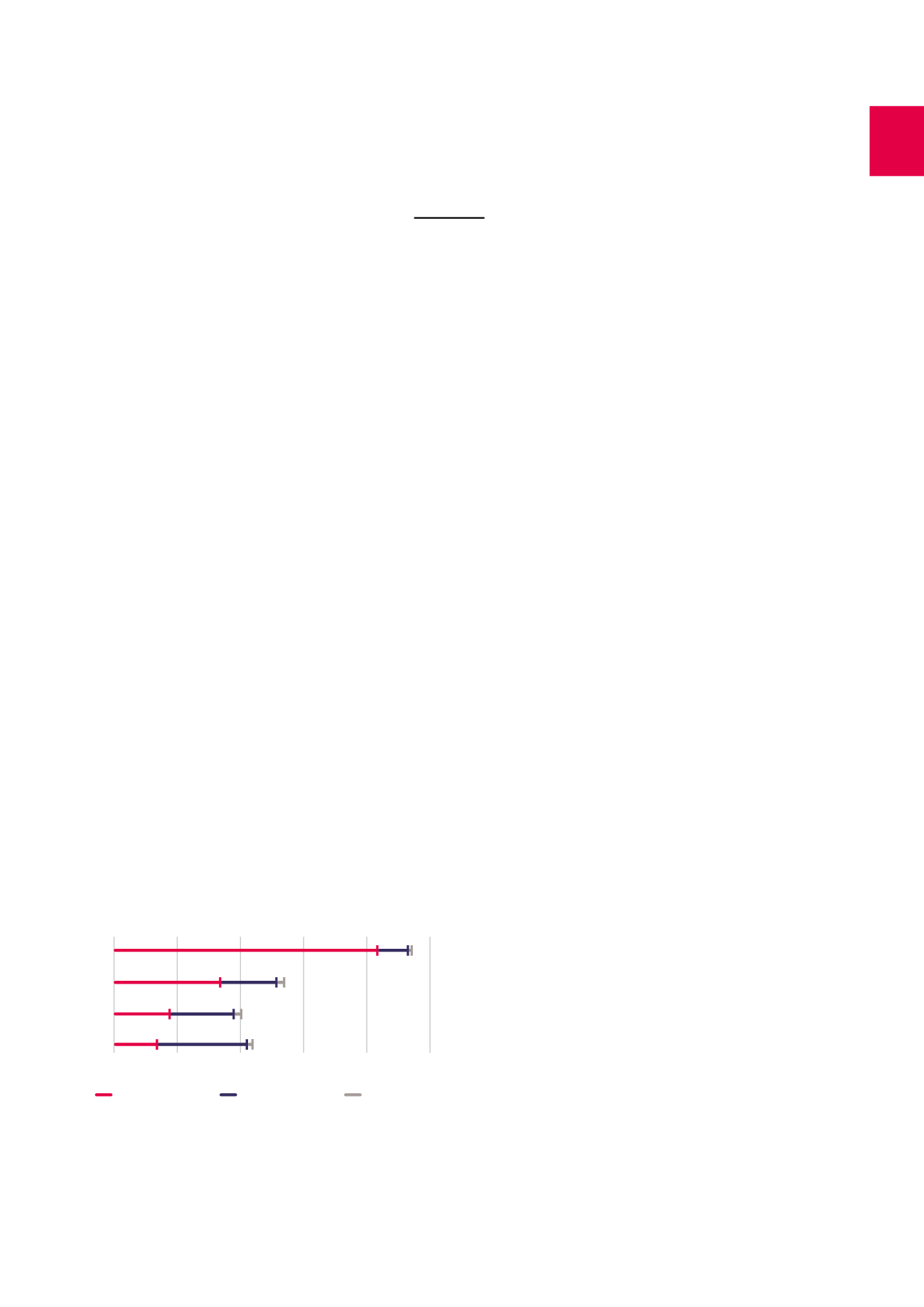

ASSUMPTIONS

2016 FORECAST

Q1 2016

Q2 2016

Q3 2016

Q4 2016

Healthcare real

estate

Offices

Property of

distribution

networks

14.3

1.8

1.2

1.2

8.9

10.2

41.7

4.8 0.6

17.0

6.9

8.8

0

10

20

30

40

50

Valuation of assets

The fair value, i.e. the investment value of the properties net of transac-

tion costs, is included on the consolidated balance sheet. For the 2016

provisional balance sheet, this valuation is entered as an overall figure

for the entire portfolio, increased by major renovation expenses.

Maintenance and repairs -

Major renovation works

The forecasts, produced by building, include the maintenance and

repair expenses, which are entered under operating expenses. They

also include the large-scale renovation costs, which are capitalised

and met from self-financing or borrowing. The large-scale renovation

expenses taken into account in the forecast amount respectively

to 38.1 million EUR for the office buildings and 4.8 million EUR for the

pubs/restaurants.

Investments and divestments

The forecast takes into account the following investment and divest-

ment projects:

•

the purchase of healthcare real estate in Belgium, France, the

Netherlands and Germany for 74.4 million EUR, resulting from the

delivery of new units or extensions of existing units for which

Cofinimmo is legally committed;

•

sale of Pubstone pubs/restaurants for 4.7 million EUR.

Rents

The rent forecast takes into account assumptions for each lease

as to tenant departures, analysed on a case-by-case basis. The

forecast also includes redecoration costs, a rental vacancy period,

rental charges and taxes on unoccupied spaces as well as agency

commissions at the time of the relocation that apply if the tenant

leaves. Letting forecasts refer to the current market situation, without

anticipating either a possible upturn or deterioration in the market.

The property result also incorporates the writeback of lease payments

sold and discounted relating to the gradual reconstitution of the full

value of buildings of which the leases have been sold to a third party.

A 1.00% positive or negative change in the occupancy rate on the office

portfolio leads to a cumulative increase or reduction in the net current

result per share and per year of 0.04 EUR. The ongoing contracts are

indexed.

Inflation

The inflation rate used for the evolution of rents ranges from 1.00%

to 1.30%, depending on the countries, for the leases being indexed in

2016. The sensitivity of the forecast to changes in the inflation rate is

low over the considered period. An expected inflation change of 50

basis points, positive or negative, leads to a cumulative increase or

reduction in the net current result per share and per year of 0.05 EUR.

Financial charges

The calculation of the financial charges is based on the assumption

that interest rates will evolve as anticipated by the future rates curve,

and on the current bank and bond borrowings. Considering the hedg-

ing instruments in place, the estimated cost of debt in 2016 should be

less than 3.00% (margins included). No assumption of changes in the

value of financial instruments due to the evolution of rates is taken into

account in the 2016 forecasts, both on the balance sheet and on the

income statement.

Consolidated income statement

Given the uncertainty of a forward projection of the future market

values of the properties, no reliable assessed forecast can be provided

for the unrealised result on the portfolio.

This result will depend on trends in the rental market, changes in

their capitalisation rates as well as anticipated renovation costs of

buildings.

Changes in shareholders’ equity will depend on the current result, the

result on the portfolio and the dividend distribution.

2016 Investissement programme (x 1, 000 ,000 EUR)

43