12

14

10

8

6

4

2

0

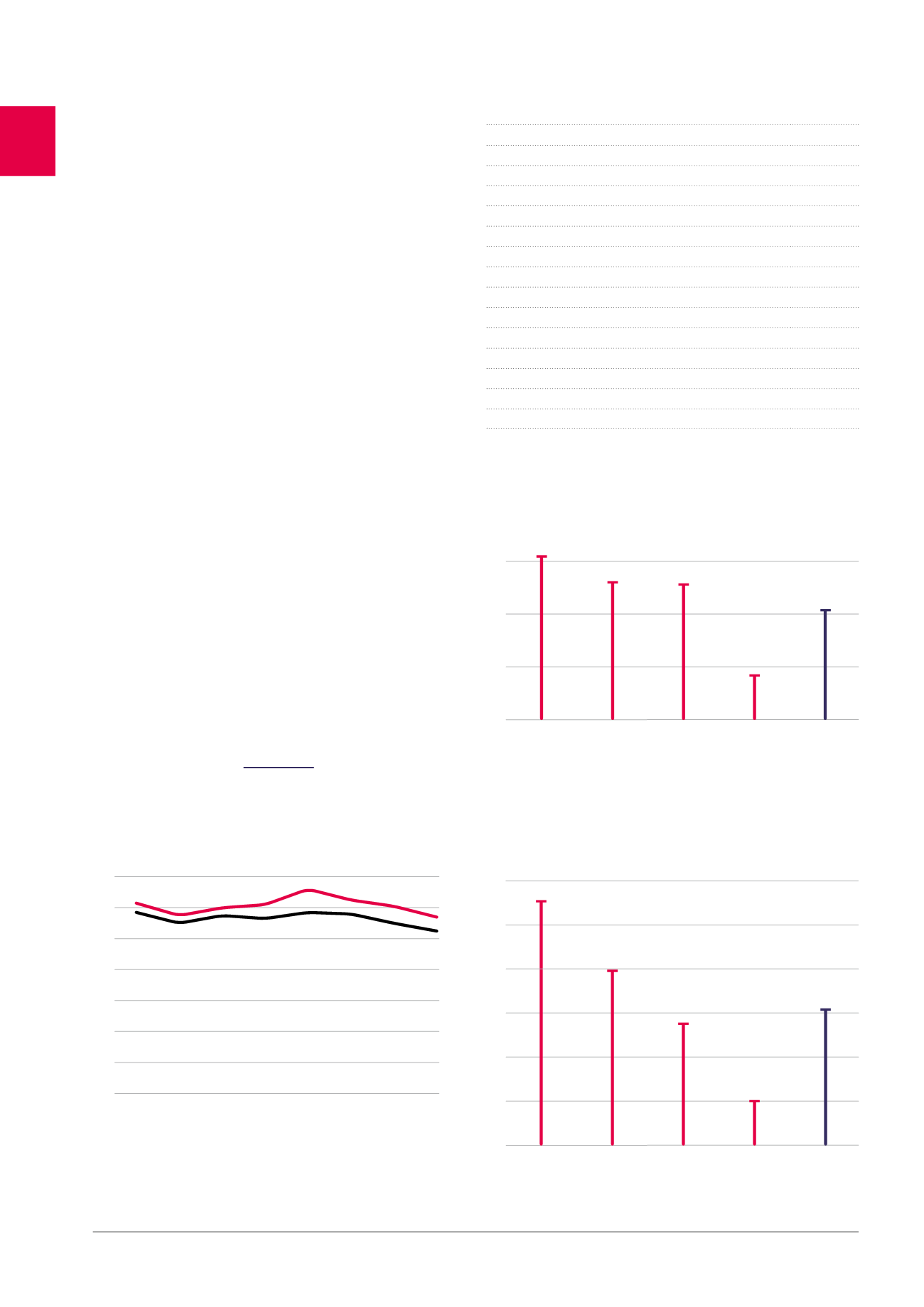

2008 2009 2010 2011

2012 2013 2014 2015

10.5

11.4

15.5

13.1

12.9

4.3

10.5

15

10

5

0

30

25

20

15

10

5

0

19.9

5.1

27.8

13.9

15.5

Maturity of leases (in %)

LEASES > 9 YEARS

47.4%

Healthcare real estate

28.2%

Properties of distribution networks - Pubstone

14.2%

Offices (public sector)

3.8%

Other

0.8%

Offices (private sector)

0.4%

LEASES 6-9 YEARS

10.6%

Offices

5.9%

Healthcare real estate

2.6%

Property of distribution networks - Cofinimur I

2.1%

LEASES < 6 YEARS

42.0%

Offices

30.8%

Healthcare real estate

9.6%

Property of distribution networks - Cofinimur I

1.5%

Other

0.1%

Maturity of leases

The average remaining term of all leases in effect on 31.12.2015 is

10.5 years, if every tenant were to exercise their first break option.

This number increases to 11.4 years in case no break option were to be

exercised and all tenants were to remain in their rented space until the

contractual end of the leases.

Almost 47.4% of the leases of the global portfolio have a term longer

than nine years, of which 28.2% of healthcare real estate alone.

1

Until the first possible break option.

“THE MATURITY

OF LEASES IN

THE PORTFOLIO

IS 10.5 YEARS,

AN EXCEPTIONAL

LEVEL AMONG

EUROPEAN REAL

ESTATE COMPANIES.”

Evolution of the weighted residual lease length

(in number of years)

1

Weighted residual lease length by segment

(in number of years)

1

Weighted residual lease length by country for

healthcare real estate (in number of years)

1

Healthcare

real estate

Belgium

Healthcare

real estate

France

Healthcare

real estate

Germany

Healthcare

real estate

Netherlands

Healthcare

real estate

Until the first possible break option

Until the end of the leases

Total

portfolio

Healthcare

real estate

Property of

distribution

networks

Other

Offices

38

Management report /

RENTAL MANAGEMENT