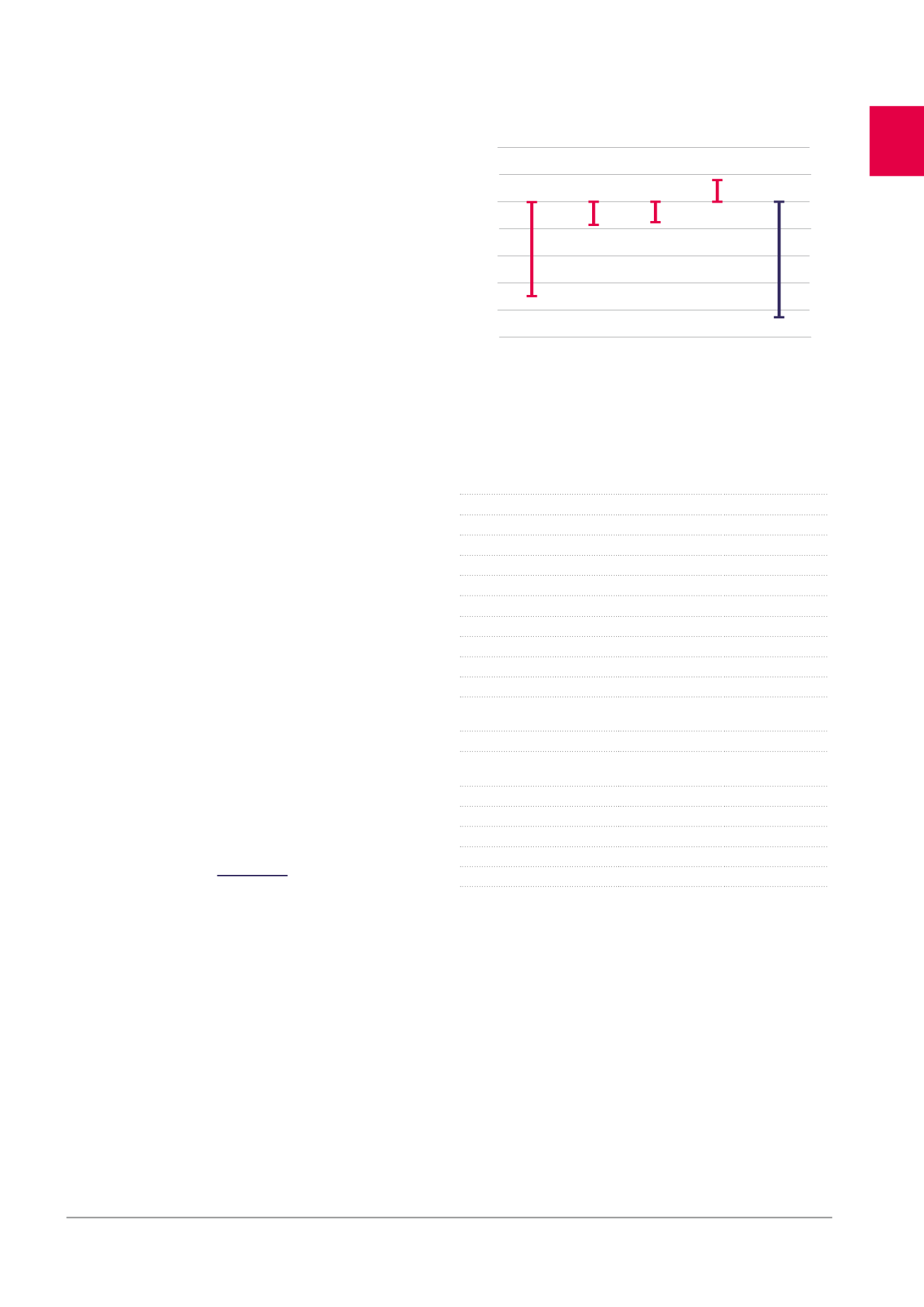

-4

2

1

0

-2

-6

-8

-10

Q1

Q2

Q3

Q4

Total 2015

-6.99 -1.76 -1.55

1.67

-8.62

Changes in the fair value of the

portfolio

The Cofinimmo portfolio, standing at 3,134.4 million EUR

1

at fair value on

31.12.2015, posted a decrease in fair value of -0.27% over the 12 months

of 2015, which corresponds to -8.6 million EUR.

This depreciation is made up as follows:

•

the “Office” segment posted a negative change in fair value of

-30.9 million EUR;

•

the “Healthcare real estate”, “Property of distribution networks“

and “Other” segments posted a positive change in fair value of

20.2 million EUR, 1.4 million EUR and 0.7 million EUR respectively.

The depreciation of the office portfolio comes from buildings under

renovation or requiring a significant renovation in the short term. This

is the case for the Souverain 23-25, Bourget 40 and Arts 19H buildings.

At the global portfolio level, this depreciation is partially offset by:

•

the indexation of the leases;

•

a high occupancy rate: 94.9% at 31.12.2015;

•

an average residual lease length which has increased from 6.7 years

at the end of 2004 to 8.4 years at the end of 2006, and then to

10.52 years at the end of 2015, an outstanding figure among the

European real estate companies.

“A PORTFOLIO’S

VALUATION HAS

BEEN OFFSET BY

A DIVERSIFICATION.”

Segment

Change in the

fair value at

1 year

Geographic

distribution by

sector

HEALTHCARE REAL ESTATE

1.5%

42.4%

Belgium

1.4%

24.8%

France

0.9%

12.2%

Germany

3.4%

2.1%

Netherlands

4.1%

3.3%

OFFICES

-2.4%

39.6%

Antwerp

0.9%

2.1%

Brussels Centre/Nord

1.5%

3.7%

Brussels Decentralised

-6.0%

16.9%

Brussels Leopold/Louise

1.1%

8.8%

Brussels Periphery &

Satellites

-2.0%

4.4%

Other

0.5%

3.7%

PROPERTY OF DISTRIBUTION

NETWORKS

0.3%

17.2%

Pubstone Belgium

-0.1%

8.8%

Pubstone Netherlands

-1.9%

4.7%

Cofinimur I - France

4.1%

3.7%

Other

2.6%

0.8%

TOTAL

-0.3%

100%

1

Including the impact of the investment expenditures capitalised during the year.

2

For the office portfolio alone, it stands at 4.3 year at the end of 2015.

Changes in fair value of investment properties in 2015

(x 1,000,000 EUR)

35