0

5

10

15

20

25

30

35

40

45

RENTAL MANAGEMENT

Rental situation by purpose

Properties

Superstruc-

ture (in m²)

Contractual

rents

(x 1,000 EUR)

Contractual

rents (in%)

Occupancy

rate (in %)

Rents + ERV

1

on

unlet premises

(x 1,000 EUR)

ERV

1

(x 1,000 EUR)

Healthcare real estate

660,316

84,728

40.3%

99.2%

85,448

87,202

Offices and writeback of lease payments sold

and discounted

607,150

85,922

40.9%

89.7%

95,816

92,826

Pubstone

357,510

29,850

14.2%

98.3%

30,358

27,317

Cofinimur I

59,601

7,766

3.7%

96.8%

8,026

8,303

Other

15,830

1,802

0.9%

100%

1,802

1,636

TOTAL INVESTMENT PROPERTIES & WRITEBACK

OF LEASE PAYMENTS SOLD AND DISCOUNTED

1,700,407

210,068

99.9%

94.9%

221,450 217,284

Projects & renovations

28,637

-

-

-

Land reserve

-

152

0.1%

152

176

PORTFOLIO GRAND TOTAL

1,729,044

210,220

100%

94.9%

221,602

217,460

Main clients - in contractual rents (in %)

Korian-Medica Group

16.1%

AB InBev

14.2%

Armonea

11.1%

Buildings agency (Belgian Federal

State)

6.0%

Axa Belgium

5.6%

TOP 5 TENANTS

53.0%

ORPEA

4.4%

MAAF

3.7%

International public sector

3.6%

Aspria

3.0%

IBM Belgium

2.0%

TOP 10 TENANTS

69.7%

TOP 20 TENANTS

78.4%

Other tenants

21.6%

TOTAL

100%

The commercial and property management teams are constantly working with a view to improve the

occupancy rate, the rental conditions and the lease term of the portfolio.

Rental situation by purpose

In collected rents, healthcare real estate represents 40.3%, offices

40.9%, property of distribution networks 17.9% and other 0.9%. The dif-

ference between the rents actually collected and the contractual rents

results from the rent-free periods granted at the beginning of certain

leases and the prorata temporis vacancy of properties during the past

12 months.

Since the merger of both entities in March 2014, the Korian-Medica Group

has become the main tenant of the portfolio. AB InBev, which rents the

entire Pubstone portfolio, comes second.

The public sector, both Belgian and international, represents 9.6% of the

tenants.

The other tenants in the segment of healthcare real estate are also

well-represented, with Armonea, first nursing home operator in Belgium,

and ORPEA, one of the foremost European players in the care market.

1

ERV = Estimates Rental Value.

2

The contractual rents of the public Regulated Real Estate Company pertain to Cofinimmo SA/NV.

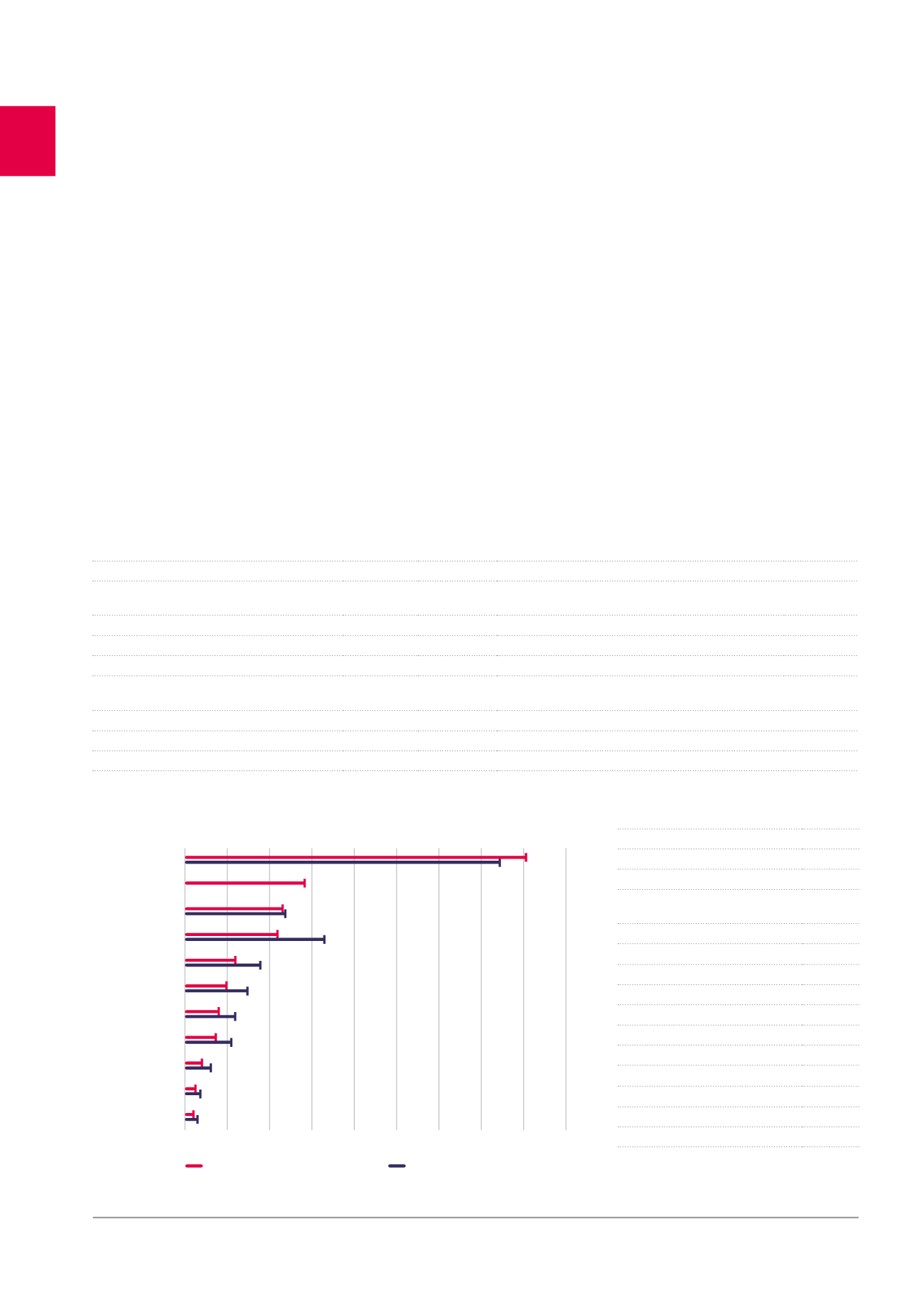

Breakdown by activity of the tenants – in consolidated contractual rents and contractual

rents of the public RREC

2

(in %)

Consolidated contractual rents

Contractual rents of the public RREC

Healthcare

Pubstone

Banks, insurance

Other

Belgian public

sectors

Sollicitors &

consulting

Information

technology

International

public sector

Chemicals, oil and

pharmaceuticals

Tele

communications

Retail

36

Management report /

RENTAL MANAGEMENT