8.0%

16.0%

2.1%

73.9%

0.8%

17.2%

39.6%

42.4%

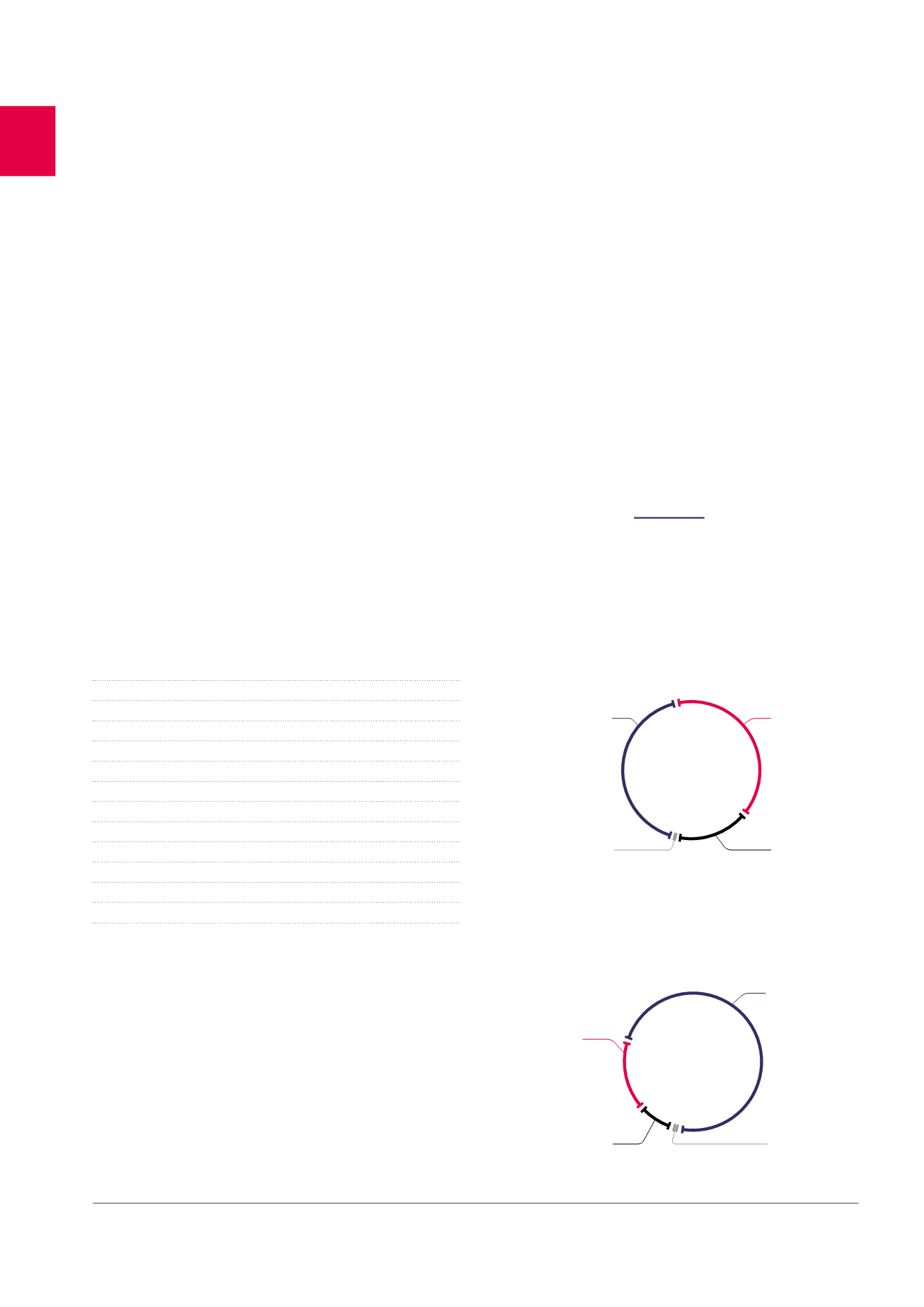

Breakdown of the portfolio

Healthcare real estate represents 42.4%of the portfolio, and offices

represent 39.6%. Property of distribution networks, including the

Pubstone portfolio (pubs/restaurants let to AB InBev) and the

Cofinimur I portfolio (insurance agencies let to MAAF) account for 17.2%

of the portfolio. The other business sectors (0.8%) are not significant

1

.

The vast majority of the portfolio is located within the Belgian territory

(73.9%).

The buildings located abroad are:

•

in France (16.0%): healthcare real estate and the network of

insurance branches;

•

in the Netherlands (8.0%): the Dutch Pubstone portfolio and

healthcare real estate;

•

in Germany (2.1%): healthcare real estate.

One of the main characteristics of Regulated Real Estate Companies

(RREC) lies in the diversification of risk. Cofinimmo’s portfolio offers a

balanced distribution. The largest building represents only 2.7% of the

consolidated portfolio in value.

“WITH A PORTFOLIO OF

1,328.3 MILLION EUR

AT 31.12.2015,

HEALTHCARE REAL

ESTATE HAS BECOME

THE NUMBER 1

SEGMENT OF THE

GROUP’S PORTFOLIO.”

Relative importance of the main buildings - in fair value (in%)

SOUVERAIN 23-25

2.7%

EGMONT I

2.6%

BOURGET 42

1.6%

GEORGIN 2

1.5%

ALBERT I

er

4 - CHARLEROI

1.4%

THE GRADIENT (formerly Tervuren 270-272)

1.3%

DAMIAAN - TREMELO

1.2%

SOMBRE 56 - BRUXELLES

1.2%

SERENITAS

1.2%

COCKX 8-10

1.1%

Other

84.2%

TOTAL

100%

1

The breakdown of the portfolio is expressed in fair value.

2

For the company Cofinimmo SA/NV alone, the breakdown is: Offices 59.0%, Healthcare real estate 39.7%, and Other 1.3%.

3

For the company Cofinimmo SA/NV alone, the breakdown is: Belgium 95.3% and France 4.7%.

Breakdown by purpose in fair value

2

(in %)

Geographic breakdown in fair value

3

(in %)

Netherlands

France

Germany

Belgium

43.7%

Brussels and

periphery

23.1%

Flemish region

7.1%

Walloon region

Other

Property of

distribution

networks

Offices

Healthcare

real estate

34

Management report /

TOTAL PORTFOLIO